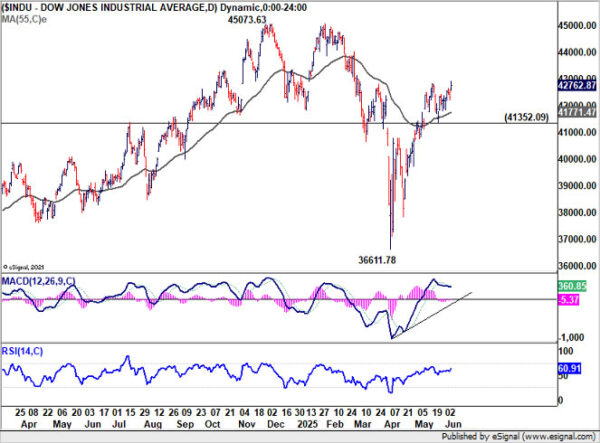

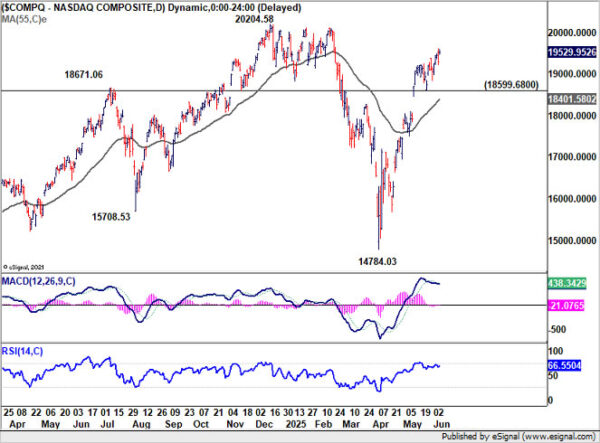

Risk aversion dominates global markets today as geopolitical tensions in the Middle East intensify, though the broader equity selloff has remained contained so far. The trigger came early Friday when Israel launched a series of airstrikes deep into Iranian territory, targeting key military and nuclear infrastructure. In response, Iran retaliated with a wave of drone attacks aimed at Israel—estimated at around 100 drones. The development marked a sharp escalation in hostilities that took markets by surprise. While the US has so far distanced itself from the conflict, analysts have warned that any Iranian attack on American bases could pull Washington into the war, an outcome that would significantly raise the stakes for global markets.

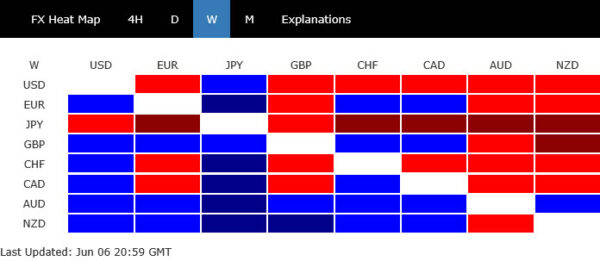

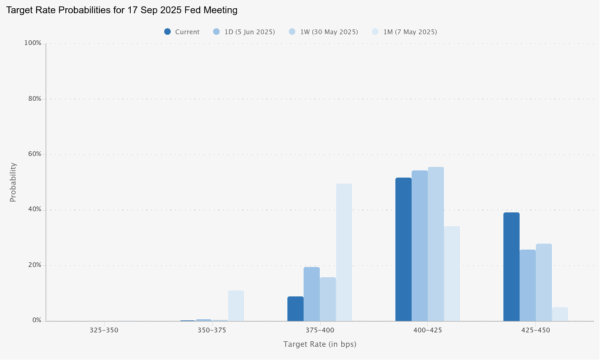

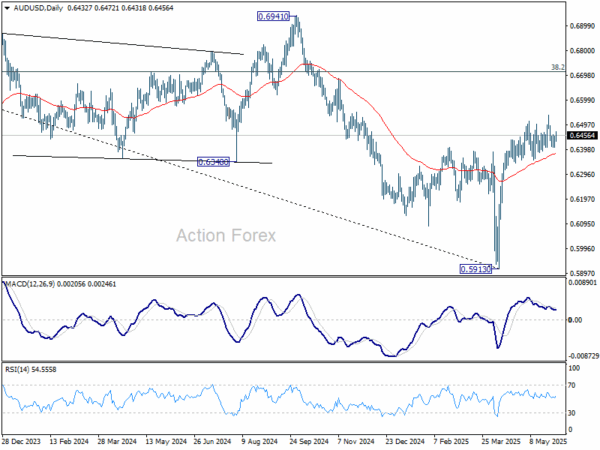

In currency markets, risk-sensitive assets are bearing the brunt of the shift in sentiment. Aussie and Kiwi have fallen to the bottom of the weekly performance board, weighed down by geopolitical fear and, in the Kiwi’s case, a sharp deterioration in domestic manufacturing activity too. Dollar has managed to rebound modestly today, but remains the third worst-performing major for the week. Earlier inflation data, both CPI and PPI, came in softer than expected, reinforcing expectations for a Fed rate cut in September and limiting the Dollar’s momentum.

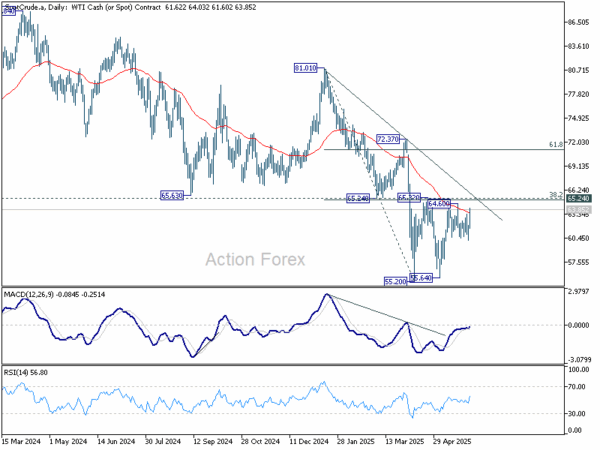

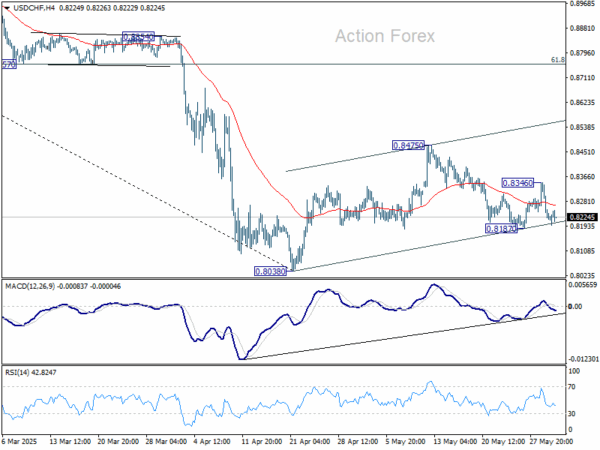

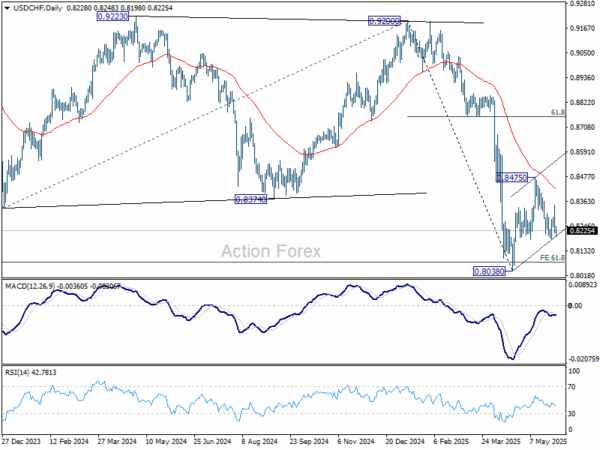

Swiss Franc stands out as the strongest performer for the week, benefiting from traditional safe-haven demand amid heightened geopolitical uncertainty. Euro has also held firm, underpinned by a steady flow of ECB commentary indicating that the easing cycle is nearing its end. Loonie ranks third, supported by surging oil prices. Yen and Sterling are trading in the middle of the pack. The Yen, despite an early jump, has given back gains as safe-haven flows rotate toward the Franc.

In Europe, at the time of writing, FTSE is down -0.02%. DAX is down -1.08%. CAC is down -0.78%. UK 10-year yield is up 0.042 at 4.524. Germany 10-year yield is up 0.016 at 2.500. Earlier in Asia, Nikkei fell -0.89%. Hong Kong HSI fell -0.59%. China Shanghai SSE fell -0.75%. Singapore Strait Times fell -0.27%. Japan 10-year JGB yield fell -0.058 to 1.402.

Eurozone industrial production down -2.4% mom in April, broad-based weakness

Eurozone industrial production dropped sharply by -2.4% mom in April, significantly below expectations of a -1.6% decline. Output fell in all major categories, with non-durable consumer goods posting the steepest drop at -3.0%. Capital goods, energy (-1.1%), and intermediate goods (-0.7%) also contracted. Durable consumer goods saw a modest -0.2% fall, offering little relief in an otherwise dismal report.

At the EU level, industrial output slipped -1.8% mom, driven by steep declines in Ireland (-15.2%), Malta (-6.2%), and Lithuania (-3.0%). While a few economies such as Denmark (+3.5%) and Luxembourg (+3.2%) managed modest gains, the regional picture remains weak.

EU exports drop -1.9% yoy in April as shipments to China plunge -15.9% yoy

Eurozone trade data for April showed signs of weakening external demand, with goods exports falling -1.4% yoy to EUR 243.0B, while imports edged up 0.1% yoy to EUR 233.1B. Despite the drop in exports, the region maintained a trade surplus of EUR 9.9B, helped by subdued import growth. Intra-Eurozone trade also declined, down -2.0% yoy to EUR 217.3B.

Across the broader European Union, the trade picture reflected similar pressures. EU exports dropped -1.9% yoy to EUR 218.2B, while imports increased 0.5% yoy to EUR 210.7B, yielding a surplus of EUR 7.4B. Intra-EU trade fell -1.7% yoy to EUR 341.9B.

While exports to the US remained a bright spot, rising 3.8% yoy, exports to China plunged -15.9% yoy. On the import side, EU purchases from China rose 8.4% yoy. Imports from the U.S. rose modestly by 2.4% yoy.

NZ BNZ manufacturing fall to 47.5, slumps back into contraction

New Zealand’s manufacturing sector slipped sharply back into contraction in May, with the BusinessNZ Performance of Manufacturing Index plunging from 53.3 to 47.5. The reading not only marks a decisive reversal from April’s expansion but also sits well below the historical average of 52.5.

Key components of the index showed broad-based weakness: production dropped from 53.0 to 48.7, employment tumbled from 54.6 to 45.7, and new orders fell sharply from 50.8 to 45.3—all signaling deteriorating activity across the sector.

The sharp decline was echoed in business sentiment, with 64.5% of survey respondents offering negative comments—up from 58% in April. The commentary reflects a growing sense of pessimism as manufacturers grapple with falling demand, weak forward orders, and subdued consumer spending. Rising input costs, ongoing economic uncertainty, and stalled investment plans are compounding pressures.

BNZ’s Senior Economist Doug Steel said that “the New Zealand economy can claw its way forward over the course of 2025, but the PMI is yet another indicator that suggests an increased risk that the bounce in GDP reported for Q4, 2024 and Q1, 2025 could come to a grinding halt”.

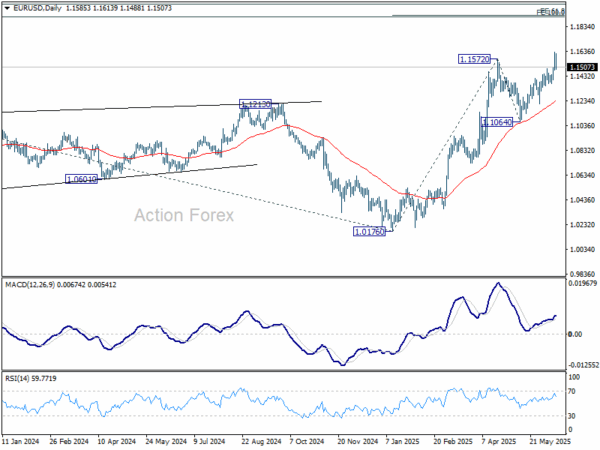

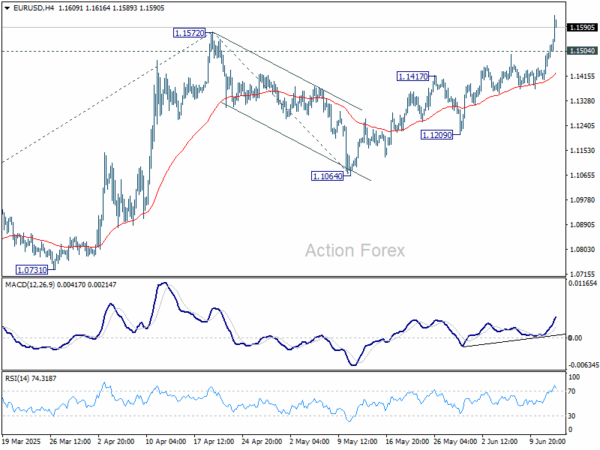

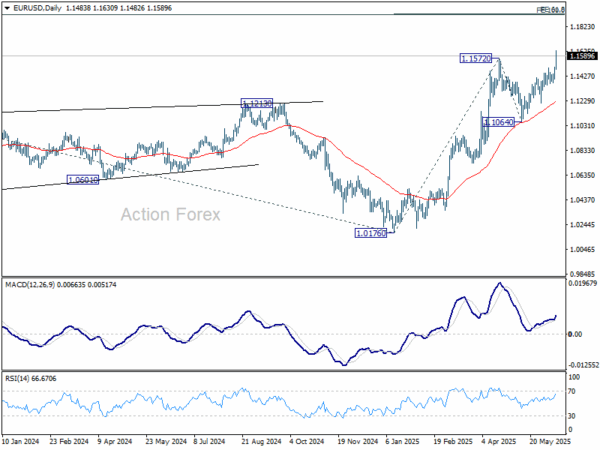

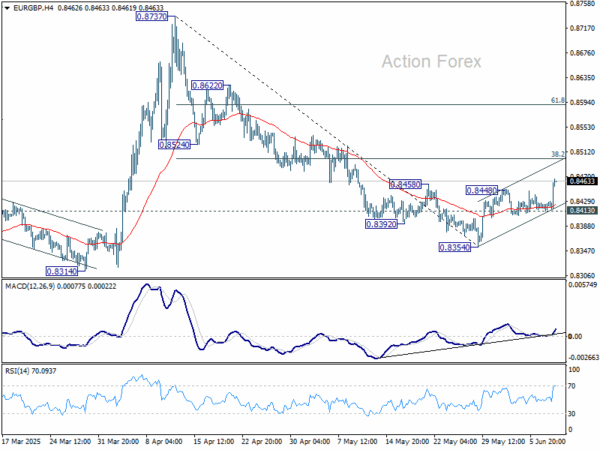

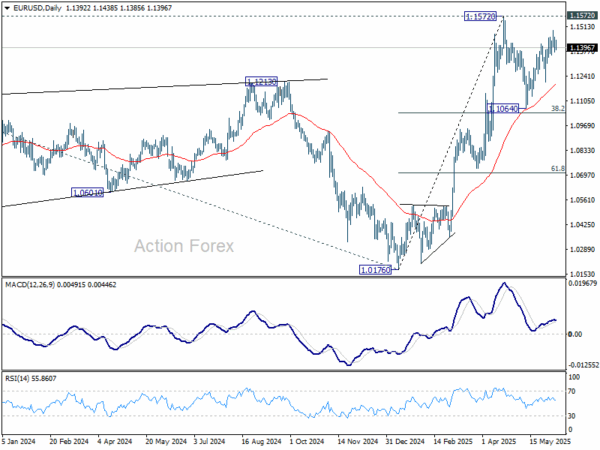

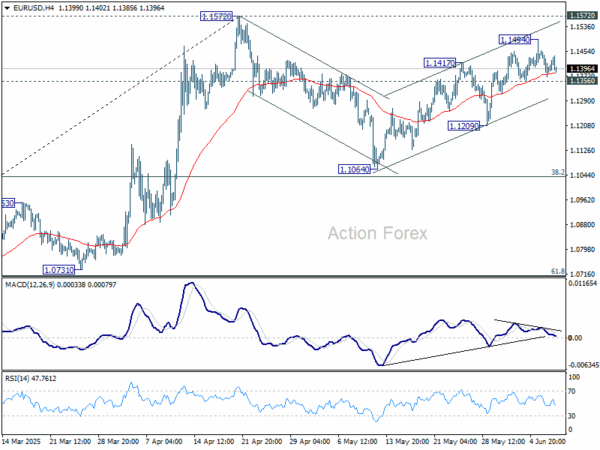

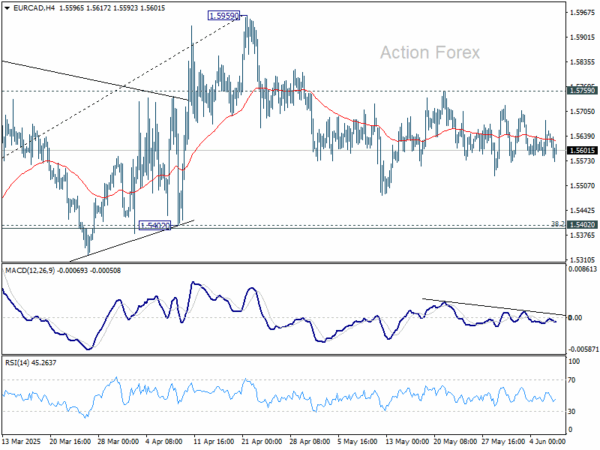

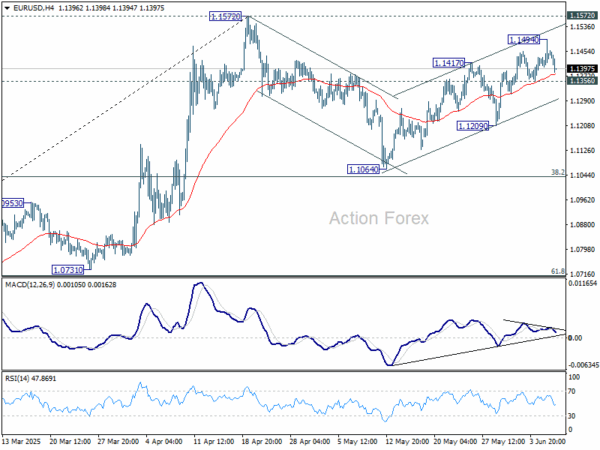

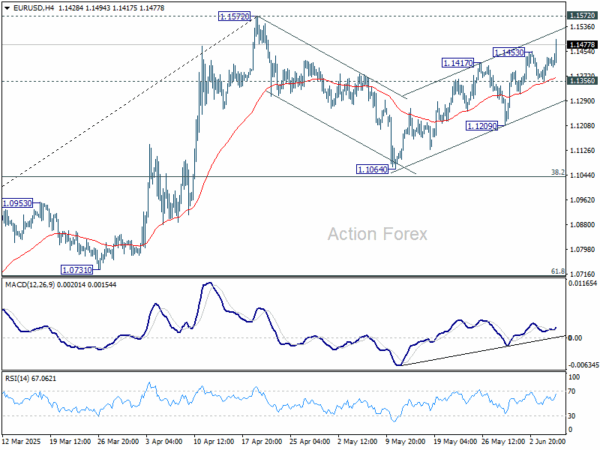

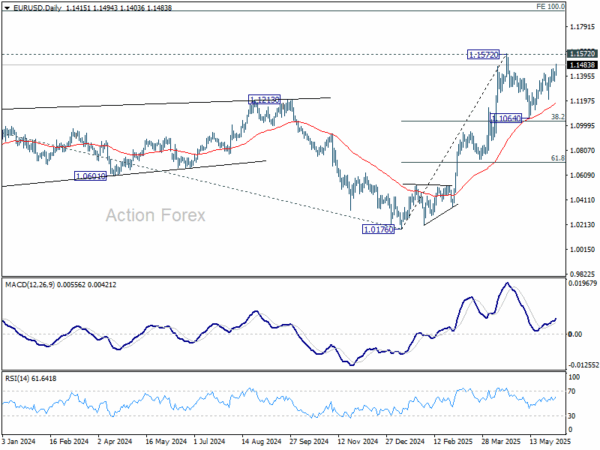

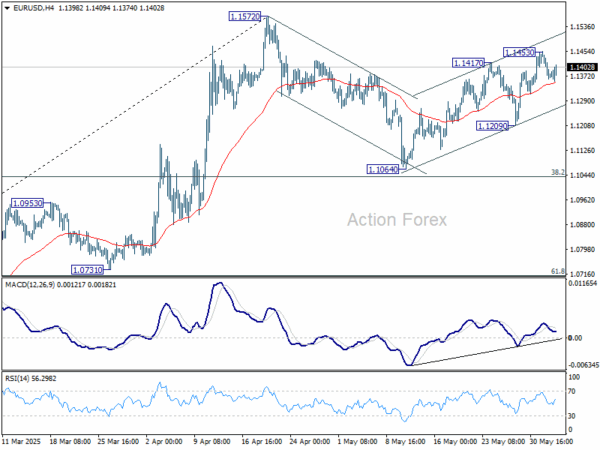

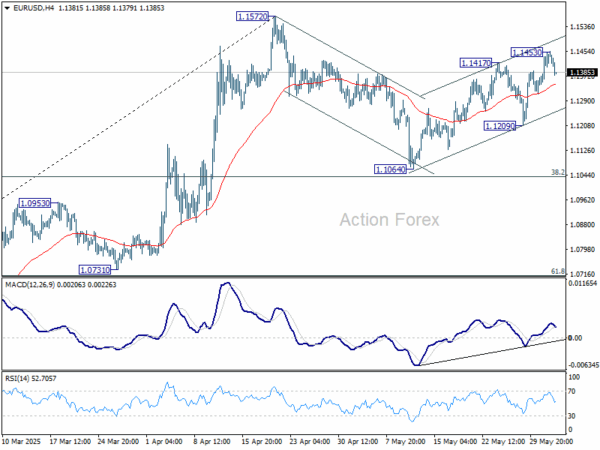

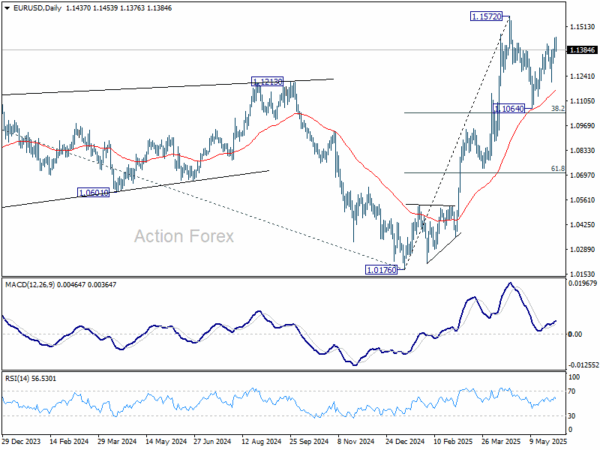

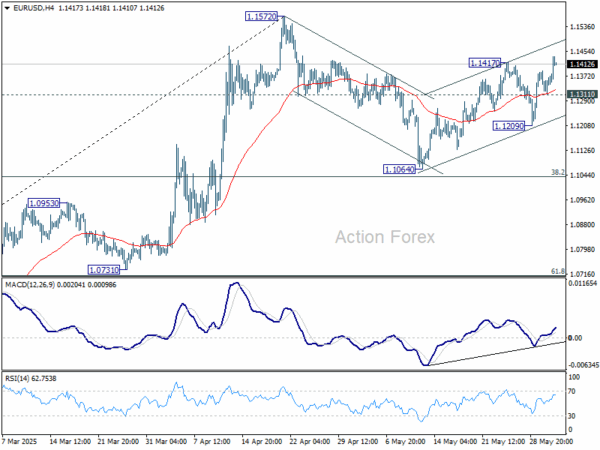

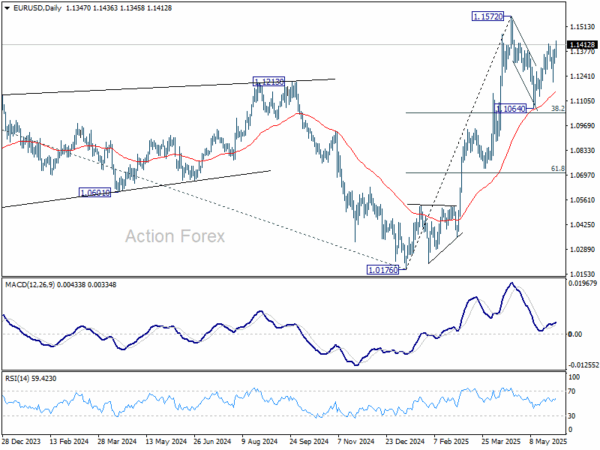

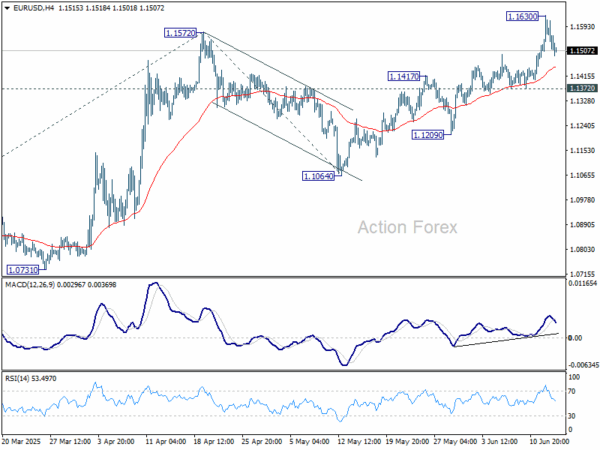

EUR/USD Mid-Day Outlook

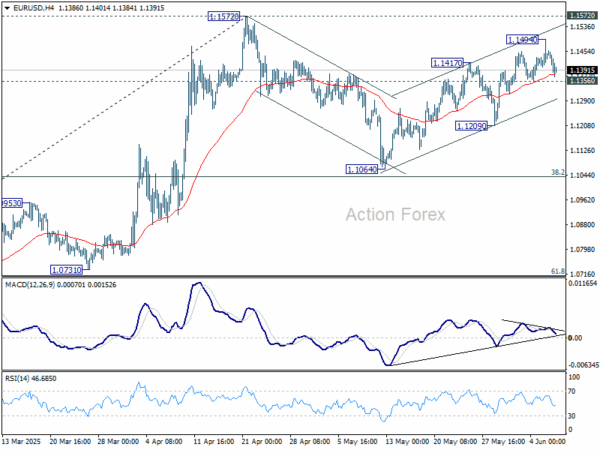

Daily Pivots: (S1) 1.1503; (P) 1.1567; (R1) 1.1649; More…

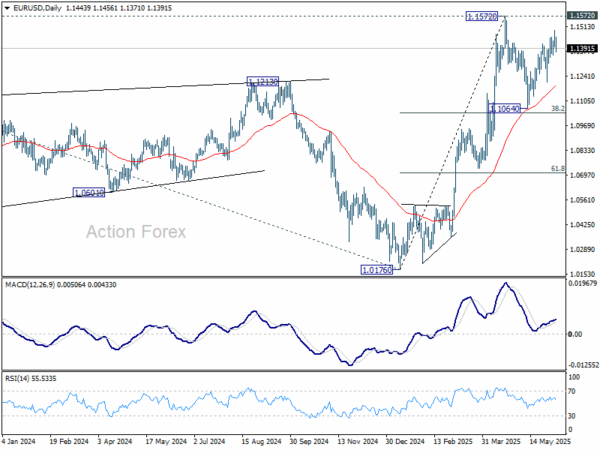

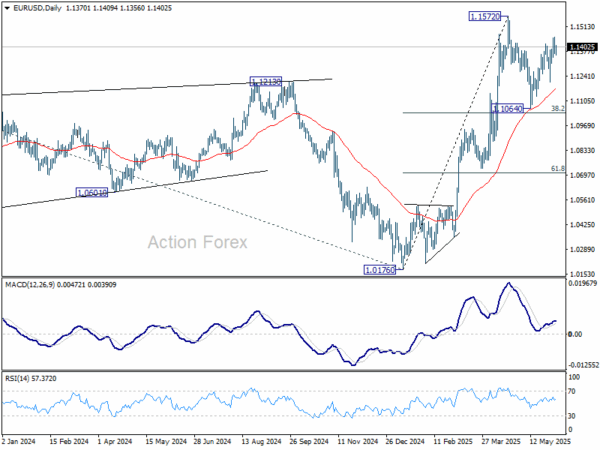

Intraday bias in EUR/USD remains neutral and more consolidations could be seen below 1.1630 temporary top. . Further rally is expected as long as 1.1372 support holds. Above 1.1630 will resume the rally from 1.0176 to 61.8% projection of 1.0176 to 1.1572 from 1.1064 at 1.1927. However, break of 1.1372 support will indicate short term topping, and turn bias to the downside for deeper pullback.

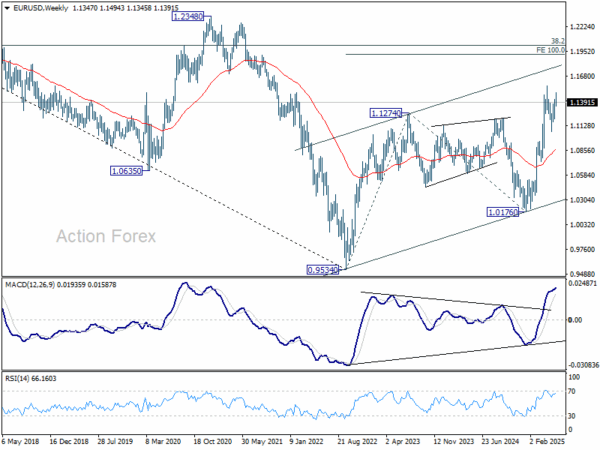

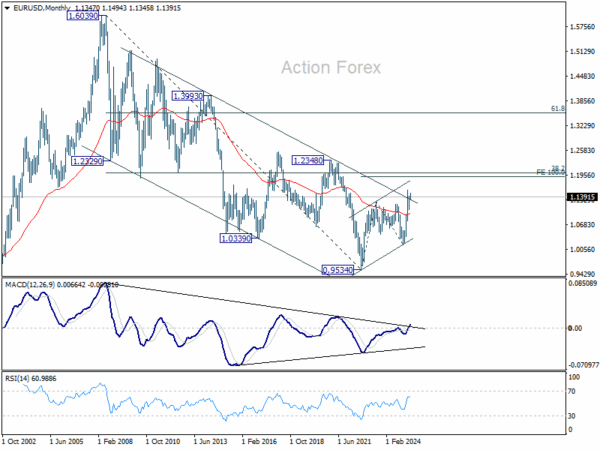

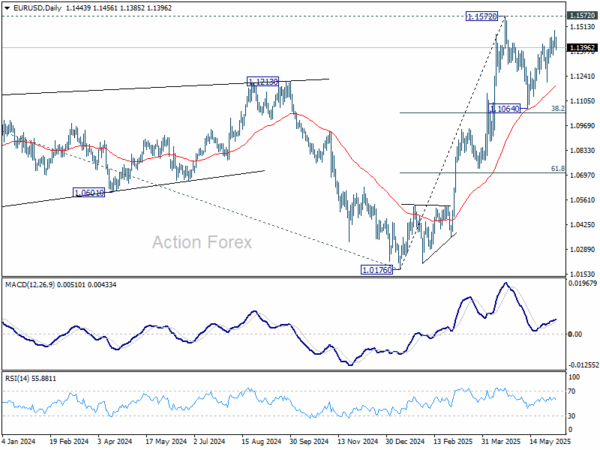

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 1.1604 support holds.