Yen is under intense selling pressure today, dragged down by a sharp plunge in super-long JGB yields. The 30-year yield closed at 2.836%, down significantly from 3.165% just days ago. This abrupt move followed a Reuters report suggesting that the Ministry of Finance may reduce super-long bond issuance as part of a potential tweak to its bond program. Discussions with market participants are expected to conclude by mid- to late-June, after which the MOF will formalize its decision.

The reported consideration comes in response to a surge in super-long yields to multi-decade highs, which had mirrored global trends, particularly a selloff in US long bonds. A reduction in supply could help stabilize Japan’s long-end, which has come under additional pressure amid political calls for fiscal stimulus ahead of July’s upper house elections. Prime Minister Shigeru Ishiba faces growing demands for tax cuts and expansive spending measures, both of which could further exacerbate Japan’s already heavy debt load and add pressure on government financing costs.

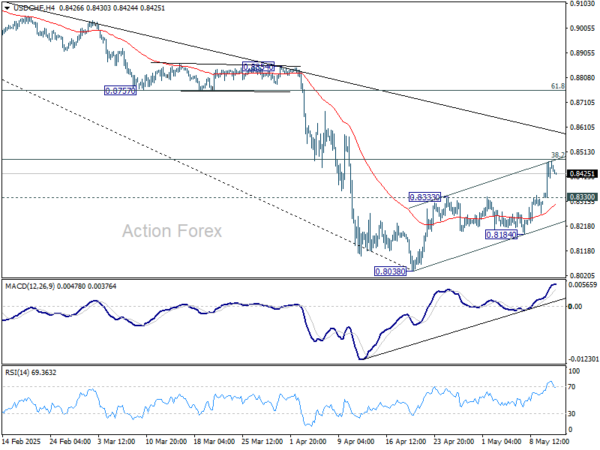

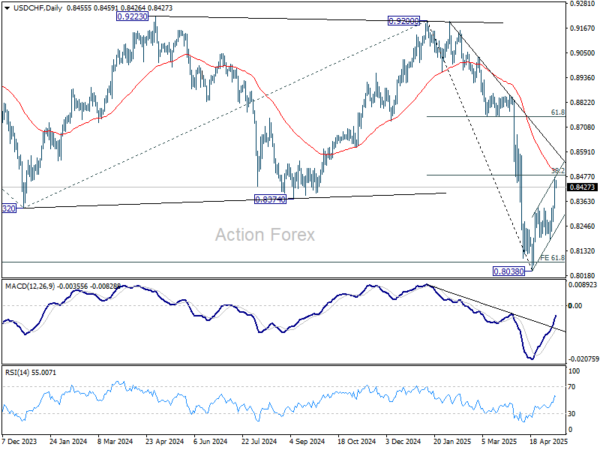

This bond market adjustment has compounded Yen weakness, particularly as global risk appetite revives. European equities are rallying, with DAX hitting a fresh record high, and US equity futures are pointing higher as well. This upswing in sentiment is fueling a rebound in Dollar, while Euro and Sterling are also firming against most peers. In contrast, the Swiss franc is underperforming, second only to Yen on the downside today. However, commodity currencies like Aussie, Kiwi and Loonie are showing muted reactions, failing to capitalize on the improved mood.

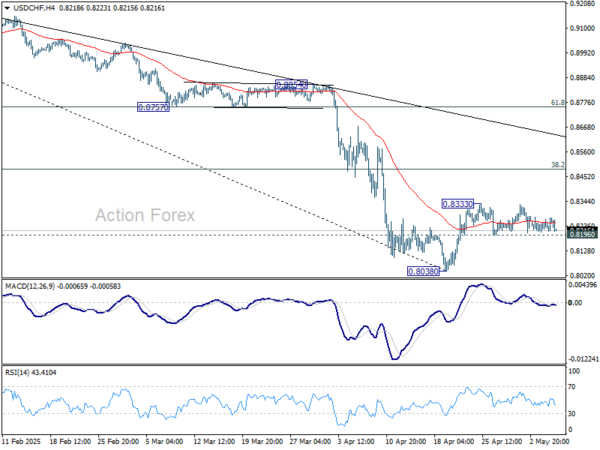

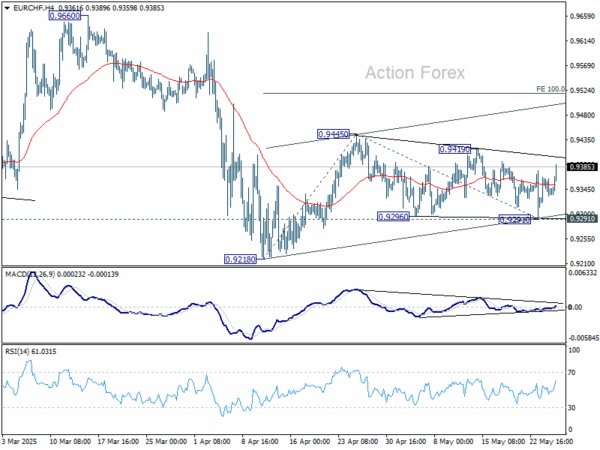

Technically, one focus now is whether EUR/CHF’s rebound from 0.9291 could extend through 0.9419 resistance. In this case, that would signal resumption of rise from 0.9218. Next near term target will be 100% projection of 0.9218 to 0.9445 from 0.9291 at 0.9518.

In Europe, at the time of writing, FTSE is up 0.72%. DAX is up 0.70%. CAC is up 0.09%. UK 10-year yield is down -0.005 at 4.678. Germany 10-year yield is down -0.018 at 2.544. Earlier in Asia, Nikkei rose 0.51%. Hong Kong HSI rose 0.43%. China Shanghai SSE fell -0.18%. Singapore Strait Times rose 0.53%. Japan 10-year JGB yield fell -0.03 to 1.466.

US durable goods orders fall -6.3% mom, but core shows resilience

US durable goods orders fell sharply by -6.3% mom in April to USD 296.3B, driven primarily by a steep -17.1% mom drop in transportation equipment. The headline decline, while severe, was less than the expected -8.0%.

Orders excluding defense also posted a significant decline of -7.5% mom to USD 279.3B.

However, the underlying picture was somewhat more stable. Orders excluding the often-volatile transportation component rose by 0.2% mom to USD 197.5B, beating expectations of a flat reading.

This suggests that while large-ticket and defense-related items dragged the headline figure lower, private sector investment in capital goods is holding up better than feared.

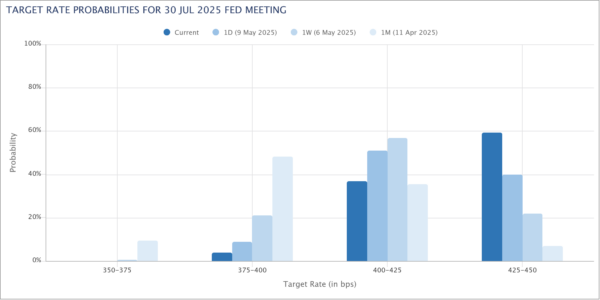

Fed’s Kashkari leans cautious on tariff shock, favors holding rates to anchor inflation expectations

Speaking at the IMES conference in Japan, Minneapolis Fed President Neel Kashkari addressed the growing internal debate within Fed over how to respond to the inflationary effects of new US tariffs.

He noted that some policymakers advocate “looking through” these price shocks, viewing them as “transitory”, akin to a one-time upward shift in the price level rather than persistent inflation. That approach would favor cutting interest rates to support economic activity during the adjustment period.

However, Kashkari expressed skepticism toward this lenient view. He emphasized that trade negotiations are “unlikely to be resolved quickly”., warning of a prolonged period of elevated uncertainty and the risk of retaliatory measures.

Tariffs on intermediate goods could lead to delayed but persistent inflationary pressure as cost increases pass through to final goods over time.

Given these risks, Kashkari said he finds the case for holding rates steady more persuasive, especially in light of the need on “defending long-run inflation expectations”.

While current policy is likely “only modestly restrictive”, he argued that caution is warranted until the full effects of tariffs become clearer.

ECB’s Holzmann: Should pause rate cut until at least September

Austrian ECB Governing Council member Robert Holzmann cautioned against further rate cuts in the near term, citing heightened uncertainty from the US-EU trade conflict and a belief that monetary policy is no longer the main drag on economic activity.

Arguing that “moving further south would be more risky than staying where we are,” Holzmann said there is no justification for easing in June or July and suggested waiting until at least September before reassessing the need for further action.

Holzmann also pointed to a notable rise in estimates of the neutral interest rate since early 2022, stating that ECB’s current policy stance is already “at least at the neutral level.”

In his view, lower rates would provide little economic benefit, as lingering uncertainty, not borrowing costs, is the key factor suppressing growth.

ECB’s Villeroy and Simuks Signal June rate cut

Comments from ECB Governing Council members today reinforced expectations for a rate cut in June, as inflation continues to moderate across the Eurozone.

French central bank chief François Villeroy de Galhau noted that policy normalization is “probably not complete,” and hinted that the upcoming ECB meeting is likely to deliver further action. He pointed to France’s May inflation reading of just 0.6% as a “very encouraging sign of disinflation in action”

Separately, Lithuania’s Gediminas Šimkus struck a dovish tone, stating that the balance of inflation risks has shifted to the downside, citing trade frictions with the US and a stronger Euro as deflationary forces. He added that current borrowing costs sit at the upper bound of the neutral range, leaving room for more rate reductions.

German Gfk consumer sentiment edges higher to -19.9, mood remains extremely low

Germany’s GfK Consumer Sentiment rose for the third straight month, reaching -19.9 in June, its highest reading since November 2024, but slightly below expectations of -19.7. In May, income expectations surged 6.1 pts to 10.4, the best since October last year. Economic expectations climbed 2.9 pts to 13.1, their highest since April 2023.

According to Rolf Bürkl of the NIM, the mood remains “extremely low,” with uncertainty still elevated due to global trade tensions, stock market volatility, and persistent fears of another year of economic “stagnation”. These concerns are encouraging households to prioritize saving over spending.

BoJ’s Ueda highlights persistent food inflation and trade uncertainty

In his remarks at the BoJ-IMES Conference, BoJ Governor Kazuo Ueda highlighted a fresh wave of price pressures, particularly from food, has emerged in Japan recently. Rice prices nearly doubling year-on-year and broader non-fresh food categories climbing 7%.

While BoJ expects the latest food-driven inflation spike to be transitory, Ueda acknowledged that underlying inflation now hovers closer to the 2% mark than in previous years, warranting heightened vigilance.

BoJ retains its baseline scenario that underlying inflation will gradually return to the 2% target over time. However, given the evolving backdrop of supply-driven shocks and heightened global uncertainty, Ueda reiterated that any adjustment in the degree of monetary easing will hinge on incoming data.

“Considering the extremely high uncertainties, it is important for us to judge whether the outlook will be realized, without any preconceptions,” Ueda emphasized.

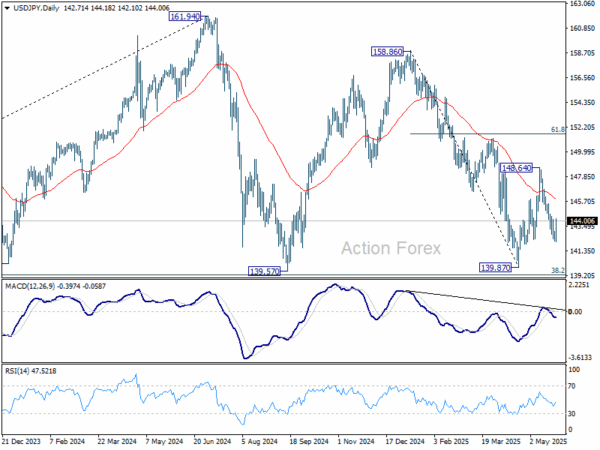

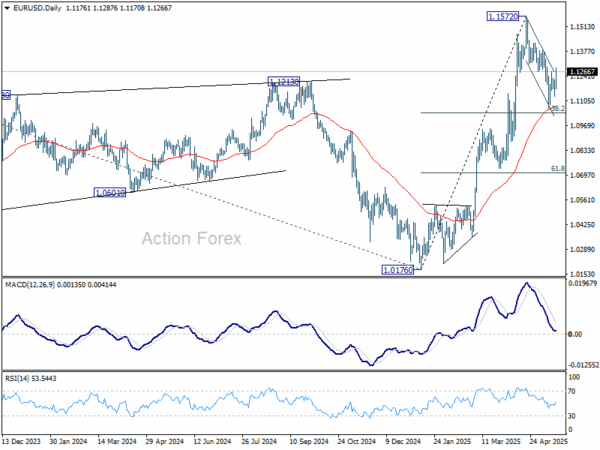

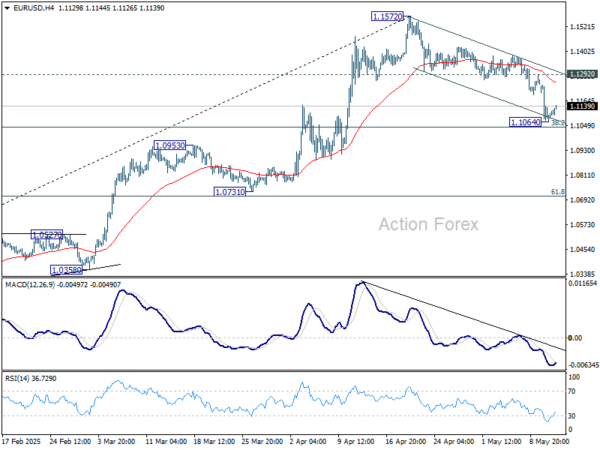

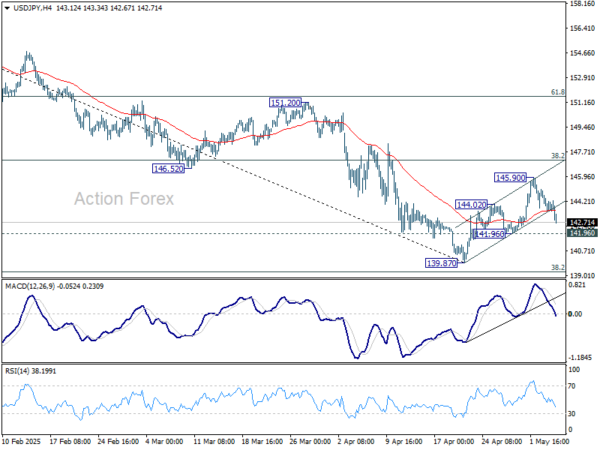

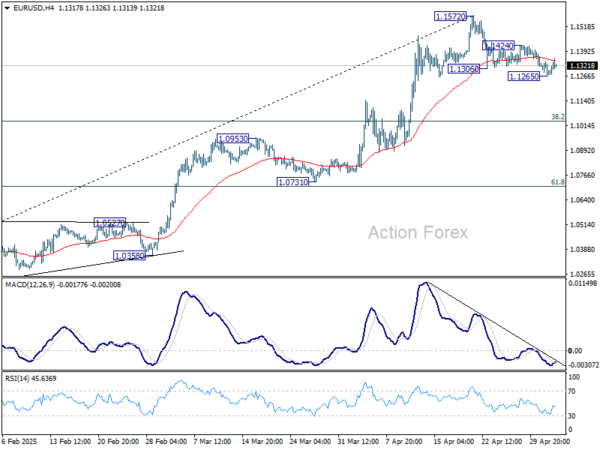

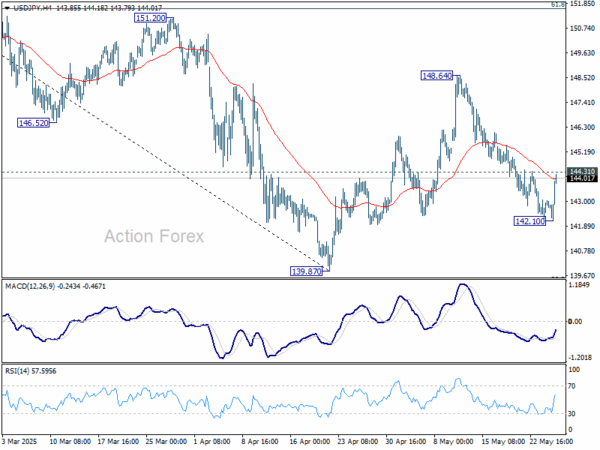

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 142.35; (P) 142.72; (R1) 143.20; More…

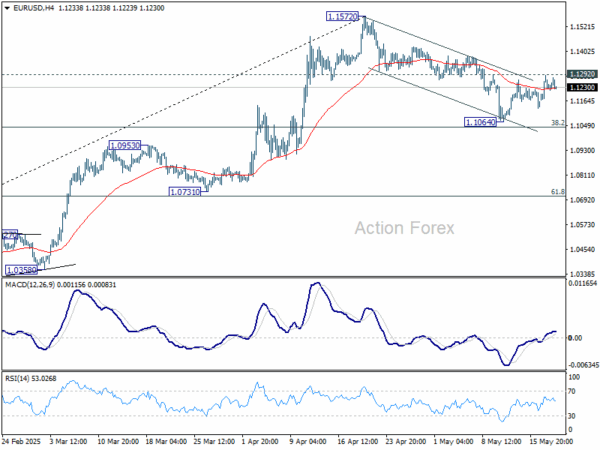

USD/JPY recovered notably today but stays below 144.31 minor resistance. Intraday bias remains neutral first. On the upside, firm break of 144.31 will argue that fall from 148.64 has completed as a corrective pullback. Intraday bias will be turned back to the upside for 148.64 resistance next. Nevertheless, rejection by 144.31 will keep risks on the downside. Below 142.10 will target a retest on low.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low), with fall from 158.86 as the third leg. Strong support should be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.