Market activity remains subdued ahead of the weekend, with major currency pairs and crosses locked within yesterday’s tight ranges. Earlier in the day, New Zealand Dollar received a brief lift from rise in inflation expectations, but the move lacked conviction and quickly faded. Similarly, Japan’s weaker-than-expected Q1 GDP figures failed to trigger much reaction, as traders largely shrugged off domestic data and remained directionless.

Broader risk sentiment is offering little help, with global equity markets also confined to narrow ranges. Investors are awaiting fresh cues, with some attention turning to the upcoming US University of Michigan Consumer Sentiment survey. While a bounce in sentiment is possible following the 90-day reciprocal tariff truce, lingering policy uncertainty may cap any gains. Of particular interest will be the inflation expectations component, as a notable uptick could reinforce concerns that tariffs are beginning to feed into price pressures.

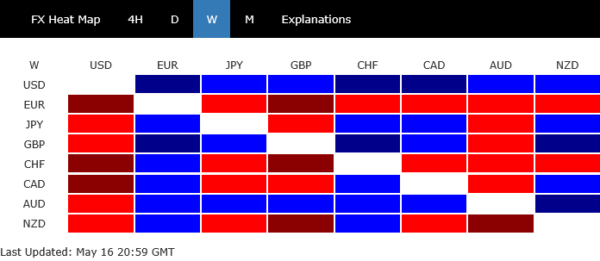

For the week, Aussie is leading the pack, followed by Dollar and Sterling. On the weaker side, Swiss Franc is underperforming, trailed by Euro and Kiwi. Yen and Canadian Dollar are trading more neutrally.

In Europe, at the time of writing, FTSE is up 0.40%. DAX is up 0.45%. CAC is up 0.37%. UK 10-year yield is down -0.038 at 4.623. Germany 10-year yield is down -0.047 at 2.575. Earlier in Asia, Nikkei closed flat. Hong Kong HSI fell -0.46%. China Shanghai SSE fell -0.40%. Singapore Strait Times rose 0.15%. Japan 10-year JGB yield fell -0.024 at 1.455.

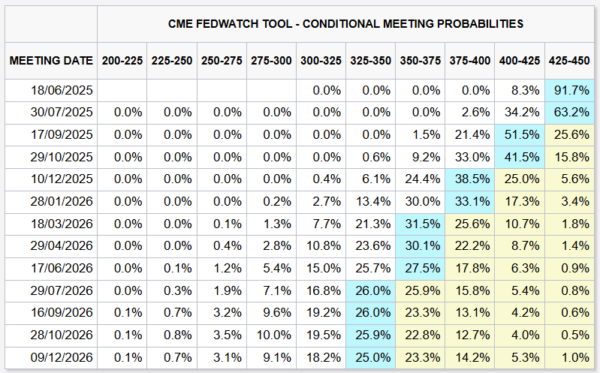

Fed’s Bostic sees only one rate cut in 2025, as uncertainty unlikely to resolve quickly

Atlanta Fed President Raphael Bostic reiterated his expectation for just one interest rate cut this year, citing persistent uncertainty surrounding global trade policy “is unlikely to resolve itself quickly.”

Speaking on Bloomberg’s Odd Lots podcast, Bostic pointed to the 90-day delay of reciprocal tariffs and the tentative nature of the recent US-China de-escalation, warning that the final outcomes of trade negotiations remain unclear.

Bostic emphasized that tariffs are expected to exert upward pressure on inflation, a view supported by the Atlanta Fed’s own analysis and echoed by many economists.

As a result, monetary policy may need to lean against those inflationary forces, limiting how far the Fed can ease. “Our policy is going to have to anticipate — and to some extent — potentially push against those inflationary forces,” he said.

EU exports jump 15.% yoy in March on strong US shipments

Eurozone trade data showed a strong performance in March, with exports rising 13.7% yoy to EUR 279.8B and imports up 8.8% yoy to EUR 243.0B, resulting in a solid trade surplus of EUR 36.8B. Intra-eurozone trade also rose 1.7% yoy to EUR 226.0B, indicating modest growth in internal demand.

For the broader European Union, the trade picture was similarly positive. Exports jumped 15.2% yoy to EUR 254.8B, while imports increased by 10.4% yoy to EUR 219.5B, yielding a EUR 35.3B surplus.

The standout development came from transatlantic trade: EU exports to the United States surged 59.5% yoy to EUR 71.4B, far outpacing the 15.8% yoy rise in imports from the U.S.

Meanwhile, trade with the UK also showed moderate growth, with exports rising 4.8% yoy and imports increasing 5.4% yoy. In contrast, trade with China as a weak spot. EU exports to China fell sharply by -10.1% yoy to EUR 17.9B, while imports surged 15.8% yoy to EUR 48.6B.

ECB’s Kazaks: Interest rates near terminal level of easing cycle

Latvian ECB Governing Council member Martins Kazaks indicated market pricing of a 25bps cut at the June 5 meeting is “relatively appropriate”.

Nevertheless, speaking to CNBC, Kazaks added that inflation developments are “by and large within the baseline scenario”. Thus, ECB is “relatively close to the terminal rate” of its easing cycle.

Kazaks’ comments argue that ECB may enter a phase of pause after the June rate cut.

Meanwhile, French Governing Council member Francois Villeroy de Galhau, in an interview with a regional French newspapers, acknowledged the risk of a trade war but dismissed the notion that central banks are currently engaged in a currency war.

Villeroy defined a currency war as using interest rates competitively to gain economic advantage. Instead, he said recent currency movements are more reflective of “revisions to economic forecasts.”

BoJ’s Nakamura urges caution on rate hikes as economy faces mounting downward pressure

BoJ board member Toyoaki Nakamura, known for his dovish stance, warned that Japan’s economy is under “mounting downward pressure” and cautioned against “rushing” to interest rate hikes.

Speaking today, Nakamura highlighted the risks of tightening policy while growth slows, noting that higher rates could “curb consumption and investment with a lag”.

Nakamura also pointed to growing uncertainty stemming from US tariff policy, which he said is already causing Japanese firms to delay or scale back capital spending plans.

He warned that escalating trade tensions could spark a “vicious cycle of lower demand and prices,” undermining both growth and inflation.

Japan’s GDP contracts -0.2% qoq in Q1, export drag offsets capex gains

Japan’s economy shrank by -0.2% qoq in Q1, marking its first contraction in a year and falling short of the -0.1% qoq consensus. On an annualized basis, GDP contracted by -0.7%, a sharp disappointment compared to expectations for -0.2%.

The weakness was largely driven by external demand, which subtracted -0.8 percentage points from growth as exports declined -0.6% qoq while imports jumped 2.9% qoq.

Domestically, the picture was mixed. Private consumption, comprising more than half of Japan’s output, was flat on the quarter. However, capital expenditure provided some support, rising by a solid 1.4% qoq.

Meanwhile, inflation pressures showed no sign of easing, with the GDP deflator accelerating from 2.9% yoy to 3.3% yoy, above expectations of 3.2% yoy.

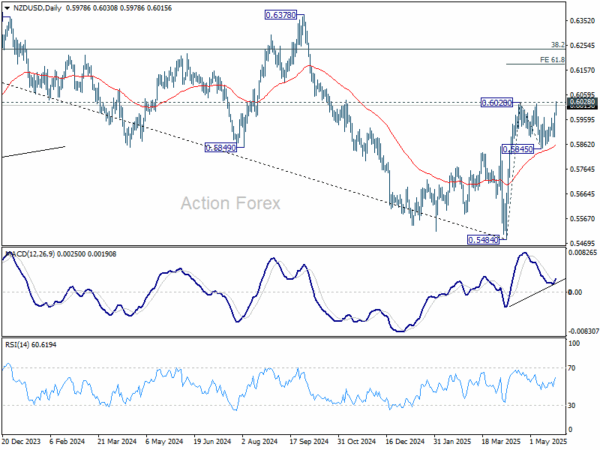

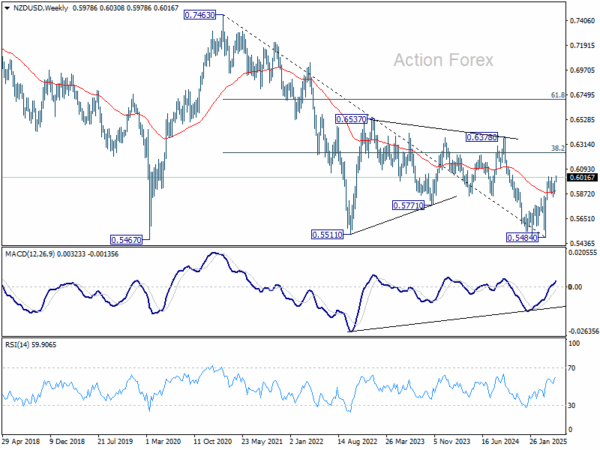

RBNZ inflation expectations rise to 2.41%, further easing seen ahead

RBNZ’s latest Survey of Expectations for May revealed a notable uptick in inflation forecasts across all time horizons.

One-year-ahead inflation expectations climbed from 2.15% to 2.41%, while two-year expectations rose from 2.06% to 2.29%. Even long-term projections edged higher, with five- and ten-year-ahead expectations increasing to 2.18% and 2.15% respectively.

Despite the upward revisions in inflation outlook, expectations for monetary policy point clearly toward easing.

With the Official Cash Rate currently at 3.50%, most respondents anticipate a 25 bps cut by the end of Q2. Looking further ahead, the one-year-ahead OCR expectation also declined from 3.23% to 2.91%.

NZ BNZ manufacturing rises to 53.9, recovery gains ground

New Zealand’s BusinessNZ Performance of Manufacturing Index edged up from 53.2 to 53.9 in April. The gain was driven by improvements in employment and new orders, up to 55.0 and 51.4 respectively, with employment reaching its highest level since July 2021. However, production eased slightly to 53.8.

BNZ Senior Economist Doug Steel noted that while the sector isn’t booming, the recovery is clear, with the PMI rebounding sharply from a low of 41.4 last June.

Still, he cautioned, “there remain questions around how sustainable it is given uncertainty stemming from offshore”.

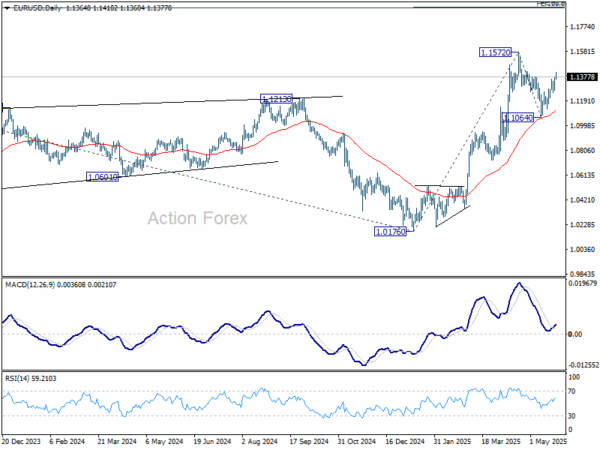

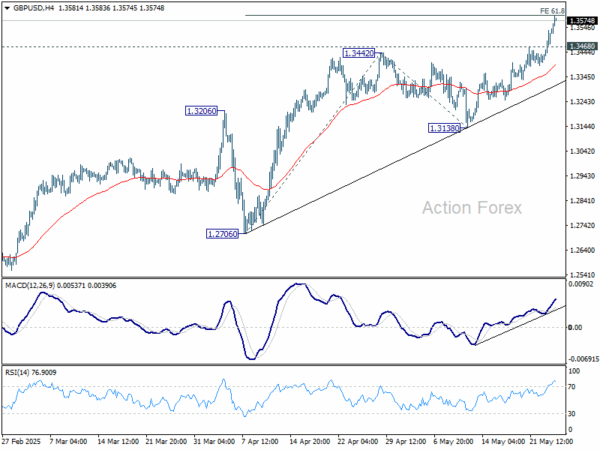

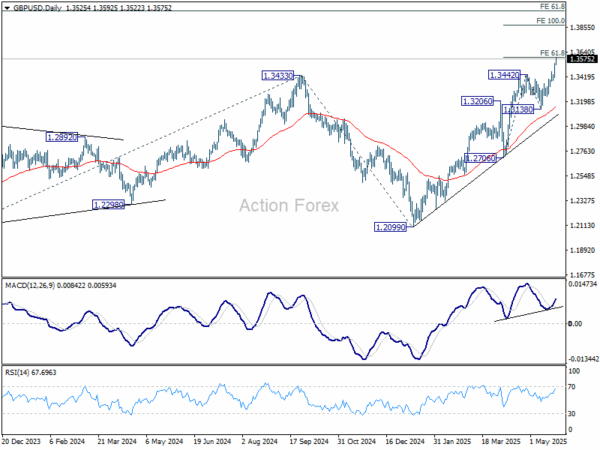

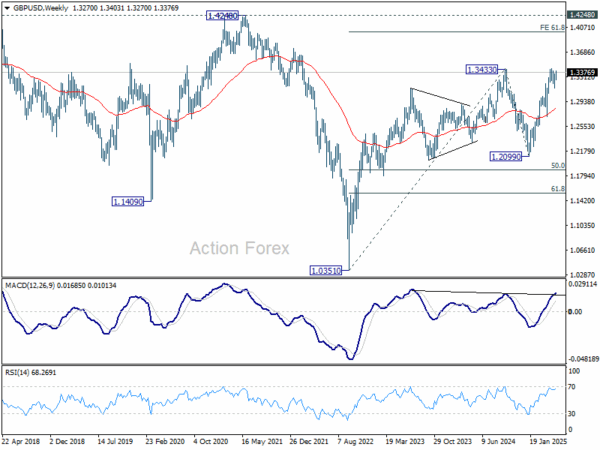

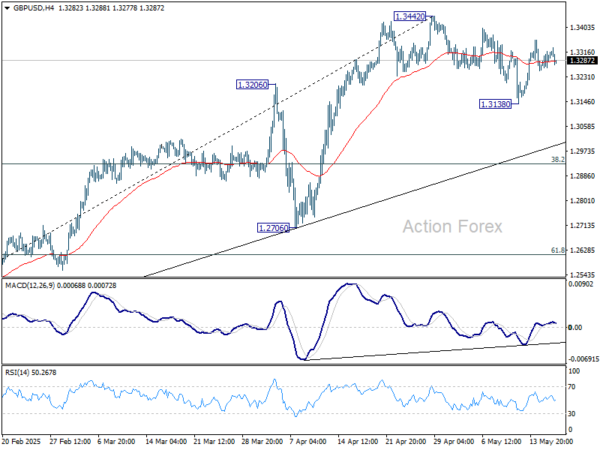

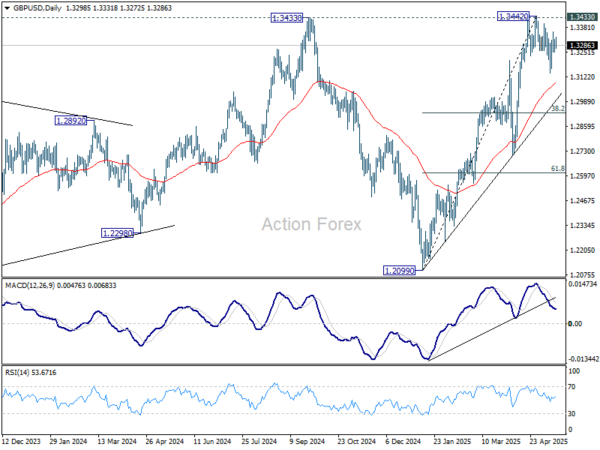

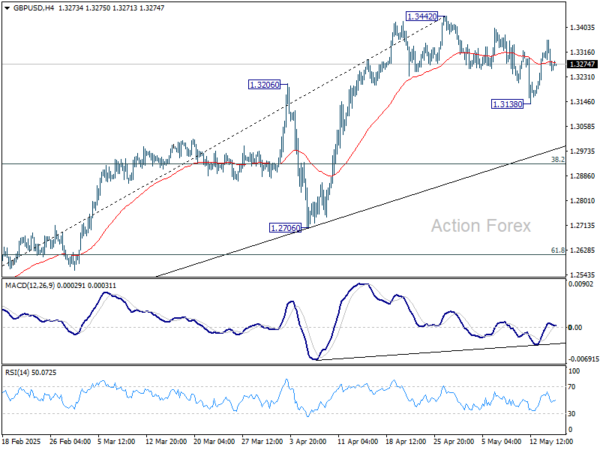

GBP/USD Mid-Day Outlook

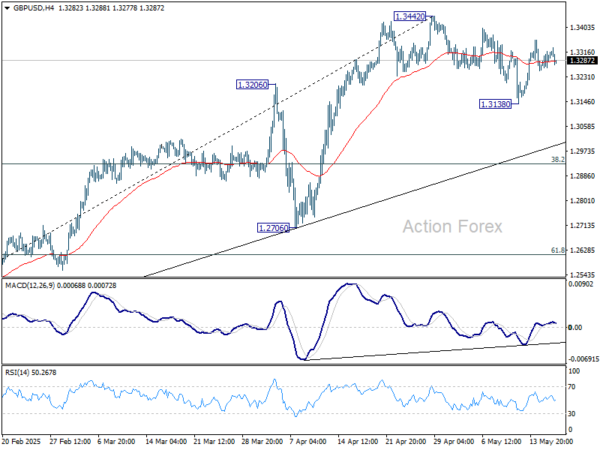

Daily Pivots: (S1) 1.3263; (P) 1.3292; (R1) 1.3331; More…

Intraday bias in GBP/USD remains neutral as range trading continues. On the upside, decisive break of 1.3433/42 key resistance zone will confirm larger up trend resumption. Nevertheless, below 1.3138 will resume the correction from 1.3442. But downside should be contained by 38.2% retracement of 1.2099 to 1.3442 at 1.2929 to bring rebound.

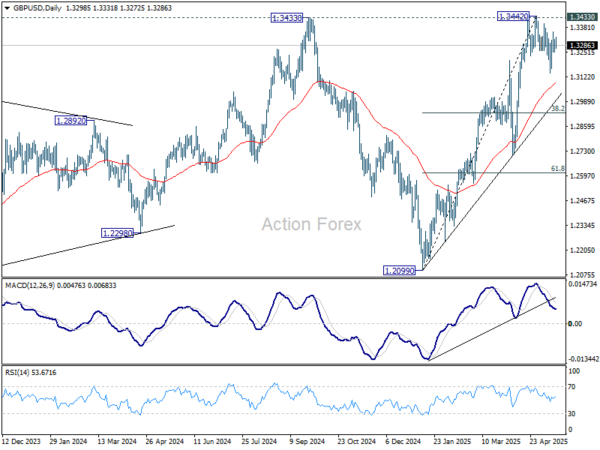

In the bigger picture, price actions from 1.3433 are seen as a corrective pattern to the up trend from 1.3051 (2022 low). Rise from 1.2099 could either be resuming the up trend, or the second leg of a consolidation pattern. Overall, GBP/USD should target 1.4248 key resistance (2021 high) on decisive break of 1.3433 at a later stage.

Economic Indicators Update

| GMT |

CCY |

EVENTS |

ACT |

F/C |

PP |

REV |

| 22:30 |

NZD |

Business NZ PMI Apr |

53.9 |

|

53.2 |

|

| 23:50 |

JPY |

GDP Q/Q Q1 P |

-0.20% |

-0.10% |

0.70% |

|

| 23:50 |

JPY |

GDP Deflator Y/Y Q1 P |

3.30% |

3.20% |

2.90% |

|

| 03:00 |

NZD |

RBNZ Inflation Expectations Q2 |

2.29% |

|

2.06% |

|

| 04:30 |

JPY |

Industrial Production M/M Mar F |

0.20% |

-1.10% |

-1.10% |

|

| 09:00 |

EUR |

Eurozone Trade Balance (EUR) Mar |

27.9B |

17.5B |

21.0B |

22.7B |

| 12:30 |

USD |

Housing Starts Apr |

1.36M |

1.37M |

1.32M |

1.34M |

| 12:30 |

USD |

Building Permits Apr |

1.41M |

1.45M |

1.48M |

|

| 12:30 |

USD |

Import Price Index M/M Apr |

0.10% |

-0.40% |

-0.10% |

-0.40% |

| 14:00 |

USD |

UoM Consumer Sentiment May P |

|

53 |

52.2 |

|

| 14:00 |

USD |

UoM Inflation Expectations May P |

|

|

6.50% |

|