When two tech titans with a combined market cap of over $4 trillion prepare to reveal their Q1 earnings, the stakes stretch far beyond Wall Street. This isn’t just another earnings season – it’s a reality check on how big tech plans to handle the rising costs of AI, shifting alliances, and new threats from competitors and regulators.

Alphabet and Microsoft aren’t just reporting numbers. They’re setting the tone for where tech investing is headed next – and whether AI’s billion-dollar promises are still on track.

What if the next chapter of tech Investing Isn’t about who leads in AI – but who survives It?

This week, Alphabet and Microsoft will reveal more than quarterly earnings. They’ll show us how two of the world’s most influential companies are navigating a high-stakes landscape of artificial intelligence, platform battles, and economic uncertainty.

Forget the hype. What’s coming could decide who dominates – and who drifts – through the rest of 2025.

Alphabet: AI expansion amid ad pressures and trade fears

Alphabet reports earnings on April 24, and the stakes couldn’t be higher. Backed by a hefty $9 billion vote of confidence from Goldman Sachs, the Google parent is betting on AI – but it’s also juggling increasing headwinds.

The recent $32 billion acquisition of cybersecurity firm Wiz hints at Alphabet’s ambitions to become indispensable across the cloud and security spectrum. Wiz’s cross-platform capabilities make Alphabet a more serious contender in the multi-cloud arena, where compatibility is king.

Yet Alphabet’s journey is far from smooth. The ad business – its traditional powerhouse – is facing stiff competition. Amazon’s creative tie-ups with platforms like Pinterest and Snapchat threaten to siphon off young, ad-savvy audiences. In addition to the pressure from rising antitrust heat and fears of new tariffs under a potential Trump administration, the picture becomes more complicated.

Analysts are still backing Alphabet to deliver forecasting:

Still, not everyone’s bullish. Citi recently pulled back its price target to $195, citing risks in the ad sector that could dent Alphabet’s near-term upside.

Microsoft: Riding quantum dreams but watching its AI ally

Microsoft’s turn comes on April 30 – and the mood is cautious. The company’s long-standing alliance with OpenAI was once its ace card. Now, it’s a wildcard.

OpenAI’s surprise $3 billion buyout of Windsurf, an elite AI coding platform, has rattled markets. Once seen as Microsoft’s AI extension, OpenAI now seems more independent – and potentially competitive. With $40 billion in fresh capital, OpenAI could go its way, prompting concerns over how Microsoft’s AI pipeline might be affected.

Despite the AI shake-up, Microsoft remains a Wall Street darling. Azure continues to perform like a recession-proof machine, and Microsoft 365 remains a reliable revenue anchor. Mizuho’s Gregg Moskowitz keeps a $475 target on the stock, citing Microsoft’s scale and cloud infrastructure as key strengths.

But the real buzz? Quantum computing. Microsoft recently unveiled the Majorana 1 chip – a leap in quantum tech enabled by a breakthrough “top conductor” material. While still in the early stages, the quantum computing market is forecast to balloon to $90–$170 billion by 2040, with strong government and private sector backing.

That puts Microsoft in a prime spot. Its investment in future-proof technologies, from AI to quantum, could pay massive dividends – if it stays ahead of the curve.

Quantum spending has also been growing steadily and is expected to stay on that trajectory in the foreseeable future. Fifty to 60 percent of the spending is expected to come from the public sector, 35 to 50 percent from the corporate sector, and the rest from supply chain spending.

Source: Hyperion Research

Technical outlook: The bottom line

The upcoming earnings calls from Alphabet and Microsoft will be pivotal. They will clarify AI strategies, quantum computing potential, and how each company plans to tackle economic uncertainties. Investors now face a crucial decision: jump in early, banking on potential upside, or await further clarity from executive insights.

Whichever approach investors choose, one thing is clear: Tech earnings season is shaping up to be exciting – and potentially lucrative – for those paying close attention.

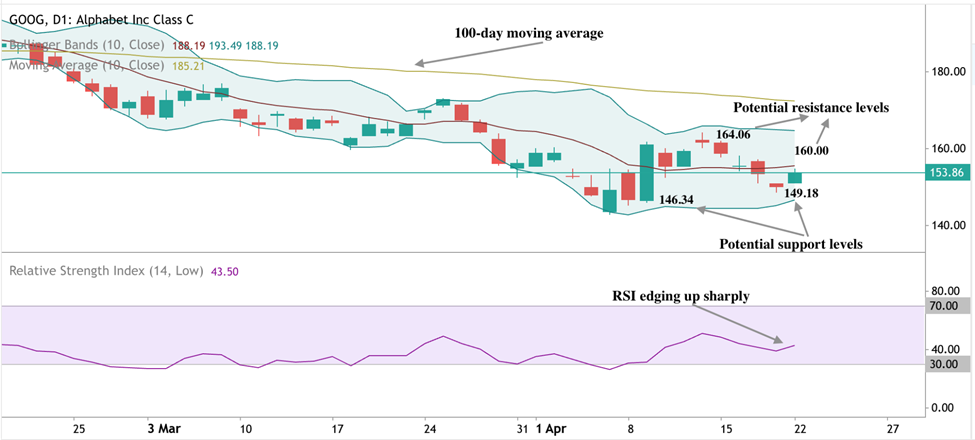

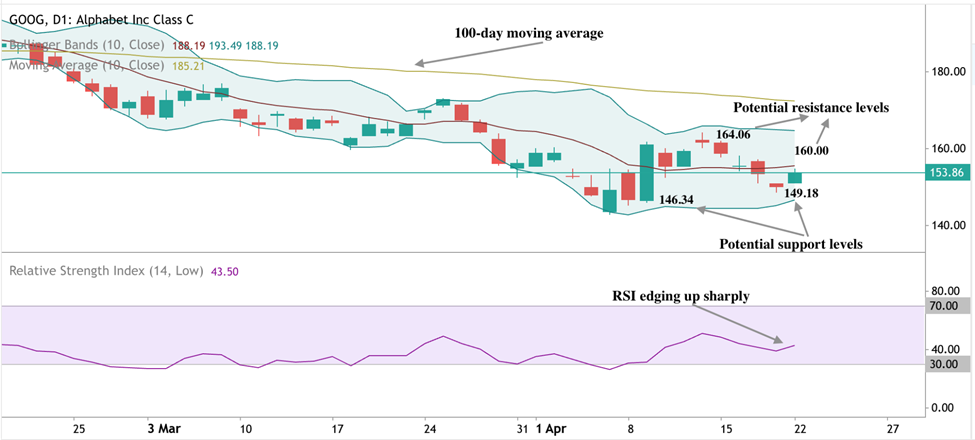

At the time of writing, Google stock is hovering around the $153.86 mark. Prices remain below the moving average, indicating that the trend is still downwards. However, RSI rising steadily indicates that some upside pressure is building. Should the downward trend continue, prices could find support around the $149.18 and $146.34 support levels.

Source: Deriv MT5

Microsoft stock has also seen some downward movement over the past few days. The RSI pointing up suggests that some upward pressure is building. However, we recently saw a “death cross,” a tell-tale sign of a bearish trend. This is when the 200 SMA crosses over the 50 SMA.

If the slump continues, prices could find a support floor at the $356.53 support level. Prices could find resistance barriers at the $380.00 and $395.00 resistance levels if we see a significant bounce.

Source: Deriv MT5

![GBP/USD soars above 1.3400 [Video] GBP/USD soars above 1.3400 [Video]](https://i0.wp.com/editorial.fxsstatic.com/images/i/GBPUSD_Large.png?w=1200&resize=1200,0&ssl=1)

![NEE Elliott Wave technical analysis [Video] NEE Elliott Wave technical analysis [Video]](https://i0.wp.com/editorial.fxsstatic.com/images/i/General-Stocks_2_Large.png?w=1200&resize=1200,0&ssl=1)

![VanEck Rare Earth & Strategic Metals ETF (REMX) Elliott Wave technical analysis [Video] VanEck Rare Earth & Strategic Metals ETF (REMX) Elliott Wave technical analysis [Video]](https://i3.wp.com/editorial.fxsstatic.com/images/i/stock-02_Large.jpg?w=1200&resize=1200,0&ssl=1)