The US markets last week were shaped by two dominant themes: uncertainty surrounding trade policies of the incoming US administration and the impact of robust US economic data. Initial market confusion, driven by ambiguous signals regarding tariffs, created significant volatility. However, this indecisiveness gave way to clarity as strong US data reaffirmed the resilience of the economy, casting doubt on the likelihood of more Fed rate cuts in 2025.

US Treasury yields surged as markets recalibrated their expectations for Fed policy, while equities faced notable selling pressure. This dual development provided a substantial boost to Dollar, which ended the week broadly higher. While some traders remain cautious, wary of surprises tied to US political developments, the Dollar’s upward momentum appears poised to persist, supported by the hawkish shift in Fed expectations and strong macroeconomic fundamentals.

Across the Atlantic, Sterling faced intense pressure, falling sharply as concerns over fiscal de-anchoring took center stage. Rising UK gilt yields, coupled with a weakening Pound, highlighted fears of a negative spiral for the UK’s fiscal health. Investors are increasingly concerned that higher borrowing costs could exacerbate fiscal imbalances, particularly in an environment of tepid growth and stagflationary risks. Sterling’s underperformance made it the worst performer among major currencies.

Elsewhere, Canadian Dollar emerged as the strongest currency of the week, but only for consolidating recent losses. Yen followed Dollar as the third strongest, benefiting from a late-week risk-off environment. On the other hand, Aussie and Kiwi, reflecting their risk-sensitive nature, were among the weakest performers. Euro and Swiss Franc ended in middle positions.

Fed Pause to Extend, Rate Cuts in 2025 Less Certain, Hike Risks Emerge?

Dollar and US Treasury yields soared last week, while equities took a hit, as a new idea gained traction: Fed might refrain from any rate cuts in 2025. This shift in market sentiment emerged after several catalysts converged, including robust employment data, jump in inflation expectations, and public remarks from key Fed officials. Traders are now rethinking their scenarios for the months ahead, pricing in the possibility that the central bank will remain on hold longer than previously thought.

Driving the narrative is the unexpectedly strong December non-farm payroll report. Employers added 256k new jobs, surpassing consensus forecasts of 150k and even outpacing the monthly average of 186k for 2024. Unemployment rate dipped back to 4.1%, reinforcing the view that the labor market is in solid shape.

These data points suggest not only a healthy labor market but also reacceleration in hiring after last year’s elections, bolstered by expectations of pro-business policies under the incoming Trump administration. If these dynamics persist, the labor market could tighten further, reigniting inflationary pressures. The timing of these numbers matters greatly too, as they have arrived just as the market was anticipating a more tempered economy heading into 2025.

Another factor reshaping investor expectations is the January University of Michigan survey, which revealed a marked rise in inflation expectations. One-year inflation forecasts jumped from 2.8% to 3.3%, the highest since May, while long-run expectations climbed to 3.3%, not seen since June 2008. These developments highlight a growing concern that inflation could move beyond Fed’s comfort zone, especially with additional fiscal and trade policies fueling price pressures ahead.

In parallel, the incoming Trump administration’s policy stance, in particular on trade, adds more complexity. While the president-elect denied reports of a shift to sector-specific tariffs out of concerns over political backslash, subsequent speculation about declaring a national economic emergency to justify tariffs has left markets unsettled.

It should be emphasized that these scenarios are not mutually exclusive. Trump could still use emergency powers to target specific sectors or countries. This uncertainty is likely to persist at least until his inauguration on January 20.

Looking at Fed, three key takeaways have taken form. First, a pause in January appears virtually locked in, with robust data and upbeat official commentary reinforcing the case for no immediate move. Second, markets are now leaning toward the next cut being postponed until May, representing a prolonged window of inactivity. Third, there is a growing notion that Fed could deliver just one cut in 2025 or potentially none at all, should inflation remain elevated and growth hold steady.

Meanwhile, central bank communication has echoed these changing expectations. Former rate-cut proponents at Fed have begun to indicate growing consensus that policy easing may be nearing an end. However, it should be clarified that Fed Governor Michelle Bowman described December’s cut as the “final step” in the “recalibration” process only. She stopped short of declaring an outright end to the cycle. Still, Bowman’s words imply that a higher threshold for further reductions is now in play.

Adding to the hawkish tilt, analysts from Bank of America have raised the possibility of a Fed rate hike rather than additional cuts. Such a scenario isn’t the baseline, given that policies are still restrictive, despite being close to neutral. Fed appears content to let existing policy restrictions work their way through the economy for now.

However, significant acceleration in core inflation—particularly if it exceeds 3%—could force Fed policymakers to reconsider their stance. But then the bar for a hike is also high.

DOW Correction Deepens, 10-Year Yield and Dollar Index Power Up

Technically, DOW’s correction started to take sharp as the decline from 45703.63 resumed last week. Two near term bearish signal emerged recently, rejection by 55 D EMA and break of rising channel support.

Further fall is expected as long as 55 D EMA (now at 43504.46) holds, targeting 38.2% retracement of 32327.20 to 45073.63 at 40204.49. Nevertheless, this decline is seen as correcting the rise from 32327.20 only. Hence strong support should be seen from 40204.49 which is close to 40k psychological level, to contain downside.

Also, the broader US equity markets remain relatively resilient, with S&P 500 and NASDAQ hold well above support levels at 5669.67 and 18671.06, respectively. These two levels will need to be decisively broken to confirm broader medium-term corrections. Without such breaks, the overall market appears to be in a sideways consolidation phase, with DOW underperforming.

10-year yield’s rally from 3.603 reaccelerated last week and powered through 61.8% projection of 3.603 to 4.505 from 4.126 at 4.683. Further rally is now expected in the near term to 4.997 high. And possibly further to 100% projection at 5.028. In any case, near term outlook will remain bullish as long as 4.517 support holds during any pullbacks.

The bigger picture in 10-year yield still suggests that up trend from 0.398 (2020 low) is ready to resume. Consolidations from 4.997 (2023 high) should have completed at 3.603 already.

It may still be a bit early, but this bullish medium term scenario is getting closer. Firm break of 4.997 will target 38.2% projection of 0.398 to 4.997 from 3.603 at 5.359.

Dollar Index’s rally from 100.15 continued last week and remains on track to 61.8% projection of 100.15 to 108.87 from 105.42 near term target. Decisive break there will target 100% projection at 113.34. In any case, near term outlook will stay bullish as long as 107.73 support holds.

In the bigger picture, Dollar index now looks on track to retest 114.77 key resistance (2022 high). But more importantly, considering the strong support from rising 55 M EMA, it might also be ready to resume the long term up trend from 70.69 (2008 low), with its sight on 61.8% projection of 89.20 to 114.77 from 100.15 at 115.95.

Fiscal De-anchoring Fears Send UK Bond Yields Soaring, Pound Plunging

The UK also found itself at the center of market attention last week, with 10-year Gilt yield surging to its highest level since 2008. At the same time, Sterling sank to a more-than-one-year low against Dollar.

The simultaneous rise in bond yields and depreciation of the currency has raised alarm bells, as some analysts interpret it as a sign of fiscal de-anchoring. In this scenario, higher yields push up borrowing costs, compounding fiscal worries and creating a negative feedback loop.

Investors have increasingly voiced concern about stagflationary environment in the UK, marked by both subdued economic growth and rising inflationary pressures. The Autumn Budget, with its array of tax and fiscal measures—including an increase in employers’ national insurance contributions—appears to have hindered economic activity to a greater extent than initially expected.

Comparisons to the “Truss Crisis” of 2022 have naturally emerged. Back then, the mini-budget proposed by Prime Minister Liz Truss and Chancellor Kwasi Kwarteng triggered a dramatic collapse in Sterling from 1.16 to 1.05 against Dollar, alongside a sudden spike in Gilt yields. Those moves, however, were entirely reversed within a few weeks once both the Chancellor and Truss resigned, paving the way for a change in policy direction.

The scope of last week’s market shifts is notably smaller by comparison, providing a measure of reassurance that the current situation may not descend into a repeat of that crisis. Nonetheless, market sentiment appears less likely to stabilize quickly this time, as there is no indication of immediate change in key government positions.

Prime Minister Keir Starmer and Chancellor of the Exchequer Rachel Reeves are expected to remain in office despite the current headwinds, which differs markedly from the abrupt reshuffling seen in 2022. Without a rapid pivot in fiscal policy, the overhang of higher borrowing costs and fragile investor confidence could persist, prolonging downward pressure on Sterling and upward pressure on bond yields.

The confluence of looming stagflation, renewed fiscal anxieties, and limited policy flexibility casts a shadow over Sterling’s outlook. Where the pound plummeted sharply during the Truss episode—only to bounce back swiftly—the new environment suggests a more gradual but persistent decline.

Technically, with last week’s strong rally, EUR/GBP’s is now back on 0.8446 resistance, which is close to 55 W EMA (now at 0.8444). Decisive break there will firstly confirm medium term bottoming at 0.8221, after drawing support from 0.8201 (2022 low). Further rally should be seen to 0.8624 cluster resistance ( 38.2% retracement of 0.9267 to 0.8221 at 0.8621), even as a correction. Reactions from there would then decide whether the whole down trend from 0.9267 (2022 high) has reversed.

As for GBP/CHF, it has clearly struggled to sustain above flat 55 W EMA, which kept outlook neutral at best. Break of 1.1106 support will indicate that rebound from 1.0741 has completed, and deeper fall should be seen back to this support. More importantly, downside acceleration below 1.1106 will raise the chance that fall from 1.1675 is resuming the long term down trend, which could send GBP/CHF through 1.0741 to retest 1.0183 (2022 low) at least.

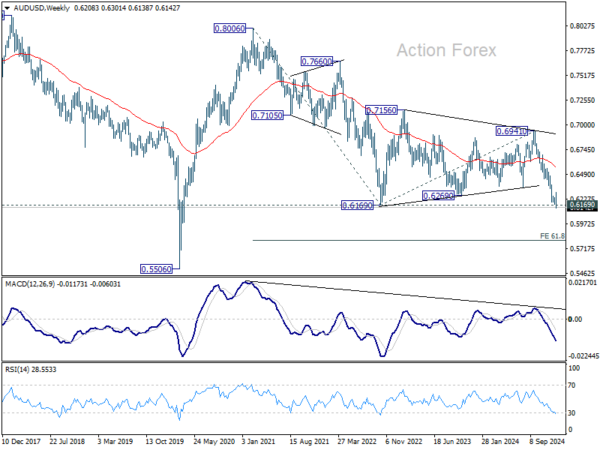

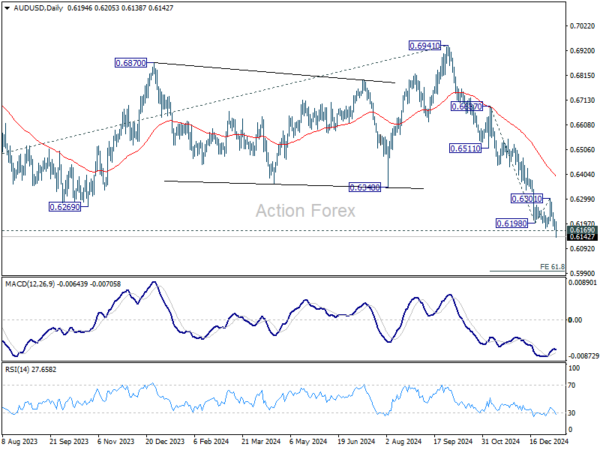

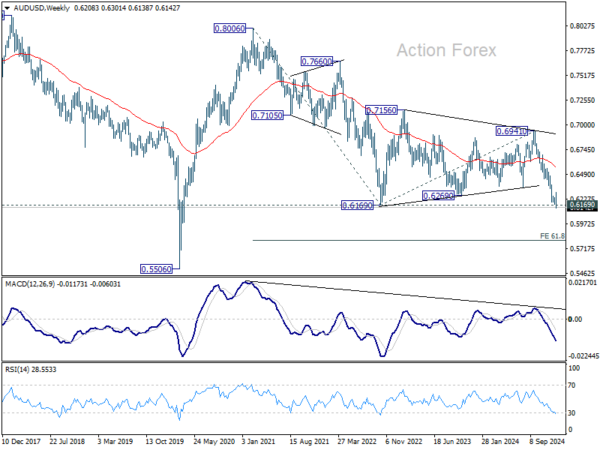

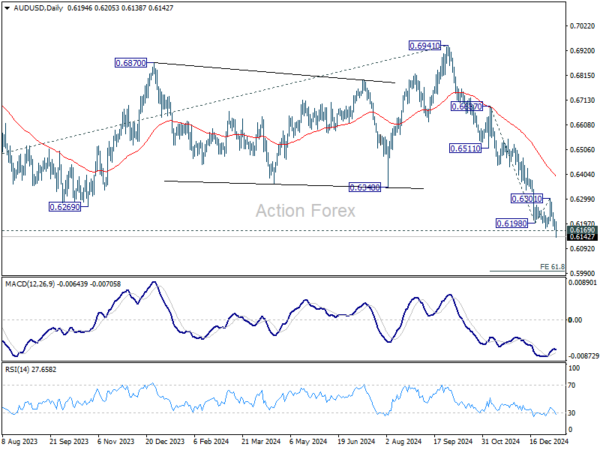

AUD/USD Weekly Report

AUD/USD’s break of 0.6169 key support level last week confirms larger down trend resumption. Initial bias stays on the downside this week for 61.8% projection of 0.6687 to 0.6198 from 0.6301 at 0.5999. For now, outlook will stay bearish as long as 0.6301 resistance holds, in case of recovery.

In the bigger picture, down trend from 0.8006 (2021 high) is resuming with break of 0.6169 (2022 low). Next medium term target is 61.8% projection of 0.8006 to 0.6169 from 0.6941 at 0.5806, In any case, outlook will stay bearish as long as 55 W EMA (now at 0.6587) holds.

In the long term picture, prior rejection by 55 M EMA (now at 0.6846) is taken as a bearish signal. But for now, fall from 0.8006 is still seen as the second leg of the corrective pattern from 0.5506 long term bottom (2020 low). Hence, in case of deeper fall, strong support should emerge above 0.5506 to contain downside to bring reversal. However, this view is subject to adjustment if current decline accelerates further.