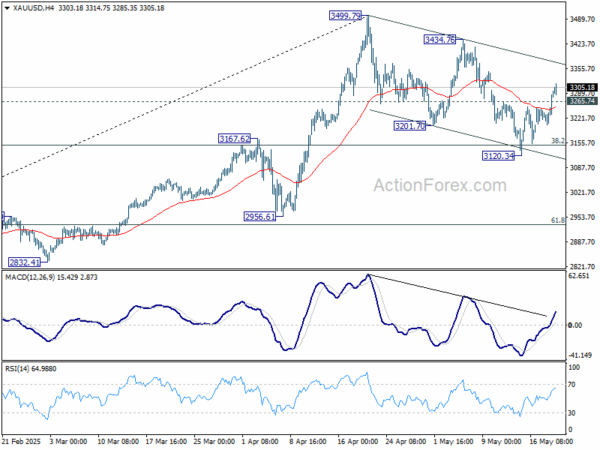

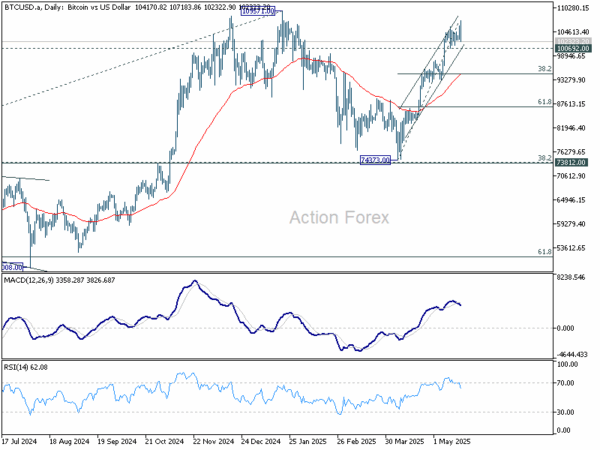

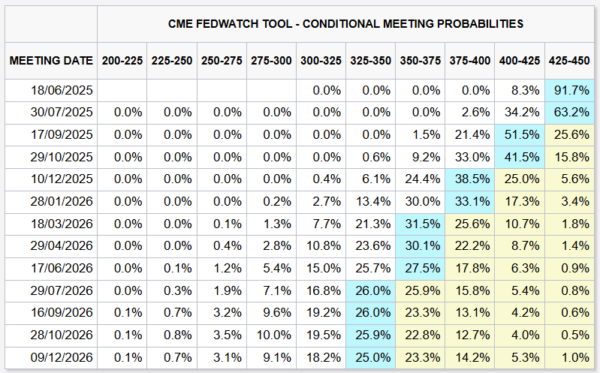

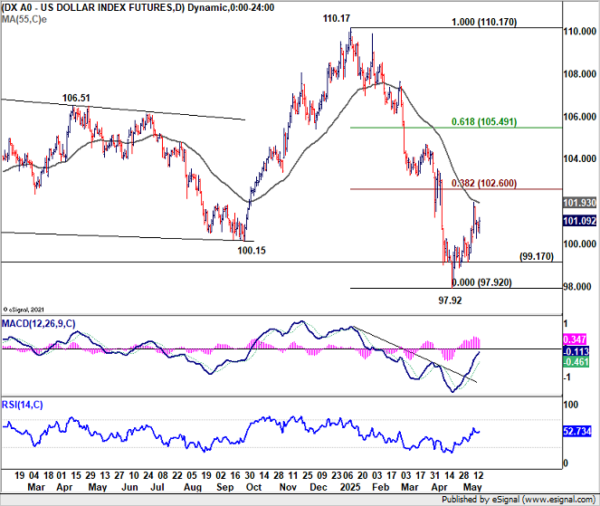

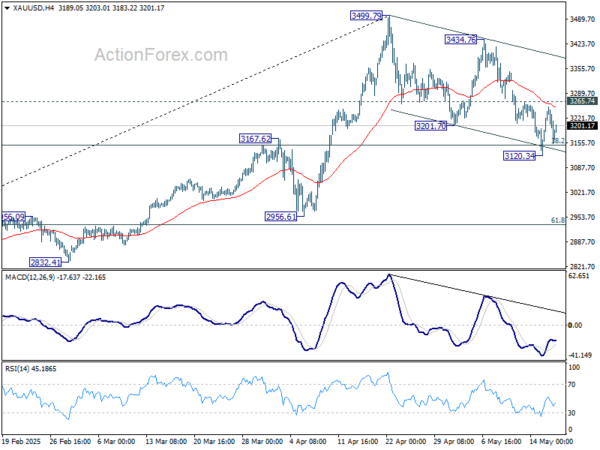

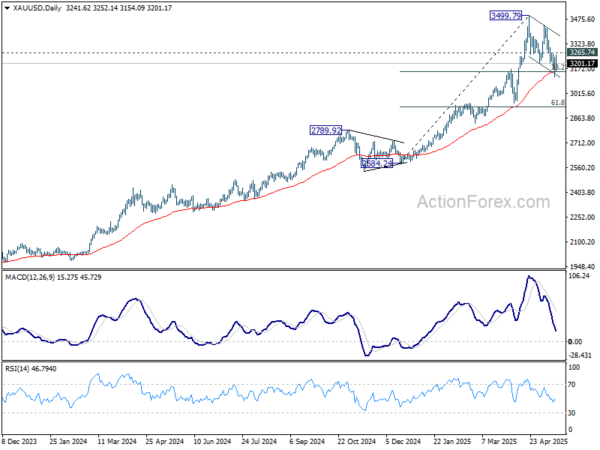

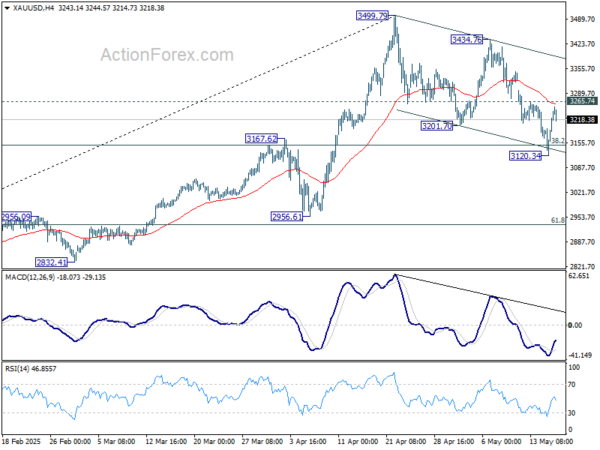

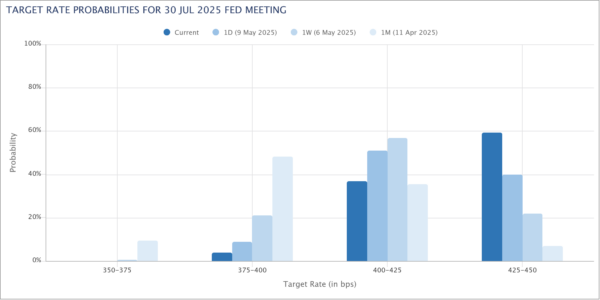

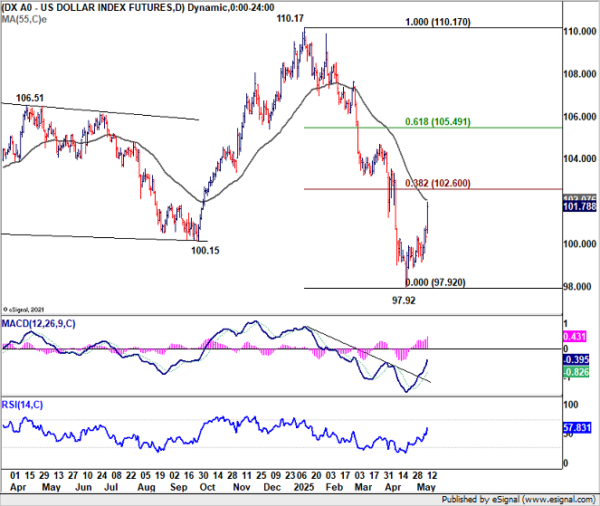

The dominant driver in global markets at the moment is rising concern over the US fiscal deficit. 30-year yield surged toward 5.1% overnight, its highest level since October 2023. 10-year yield also breached the 4.6% mark for the first time in months. Equity markets responded accordingly, with major US indexes closing sharply lower. Gold has broken above 3330, supported additionally by geopolitical uncertainty. Bitcoin hit a new all-time high. Both reflected risk-hedging demand and a search for alternatives.

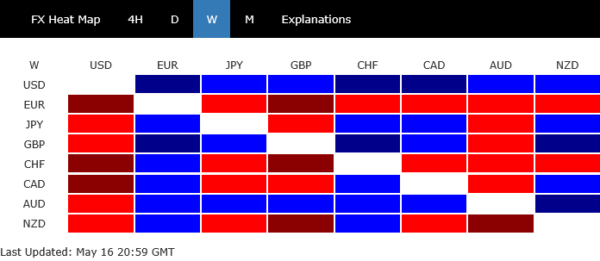

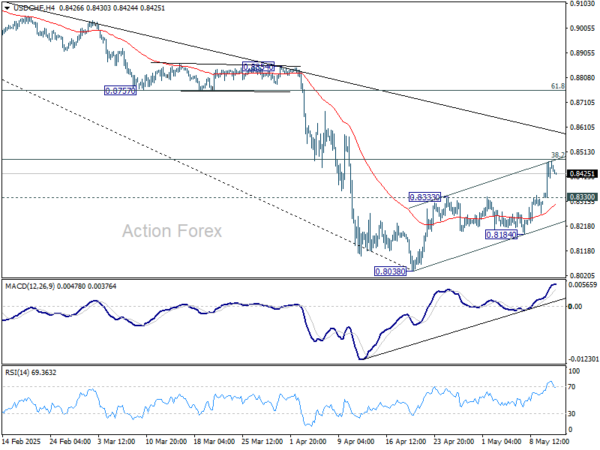

In the currency markets, Dollar is suffering, now the worst performer among majors for the week. Meanwhile, commodity currencies like Aussie, Kiwi, and Loonie are struggling near the bottom of the FX board, a reflection of broader risk aversion. Yen leads the pack, joined by Swiss Franc and Euro, as investors seek safety outside the US. Sterling is trading in the middle.

This spike in long-dated yields has sent a clear signal: investors are becoming increasingly uneasy about the US’s worsening debt profile and its implications for long-term stability. A poorly received 20-year bond auction only amplified these fears, fueling speculation that appetite for US debt is waning just as supply pressures are set to increase.

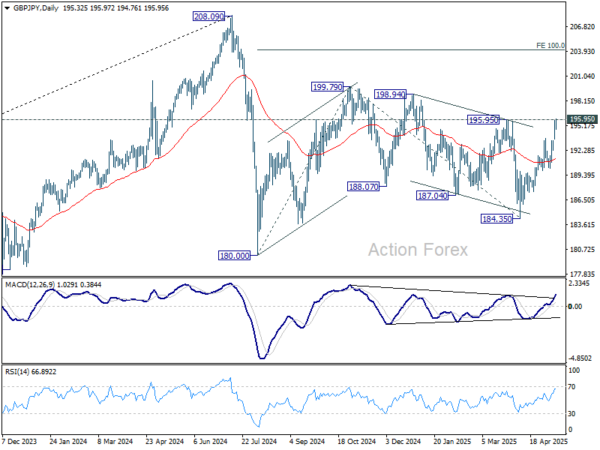

On the trade front, tensions remain high. Japan’s Finance Minister Katsunobu Kato labeled recent US tariffs as “regrettable” and reiterated Tokyo’s position that no trade deal would be worthwhile unless automobile duties are scrapped. At the G7 meeting in Banff, Kato and US Treasury Secretary Scott Bessent agreed that the dollar-yen exchange rate should reflect market fundamentals. However, the lack of concrete progress raises doubts over any near-term breakthrough in US-Japan trade talks.

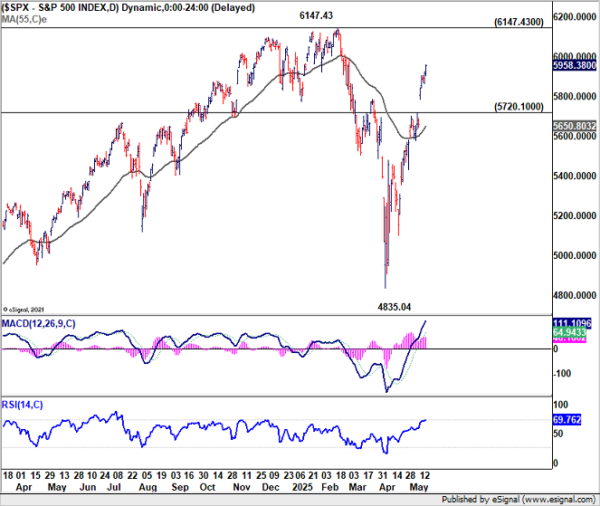

Technically, US 10-year yield’s break of 4.592 resistance confirms resumption of whole rally from 3.886. Near term outlook will stay bullish as long as 4.388 support holds. Further rally should be seen to 100% projection of 3.886 to 4.592 from 4.124 at 4.830. Further selloff in US treasuries could keep US stocks and Dollar pressured.

In Asia, at the time of writing, Nikkei is down -0.94%. Hong Kong HSI is down -1.05%. China Shanghai SSE is down -0.13%. Singapore Strait Times is down -0.42%. Japan 10-year JGB yield is up 0.031 at 1.552. Overnight, DOW fell -1.91%. S&P 500 fell -1.61%. NASDAQ fell -1.41%. 10-year yield rose 0.115 to 4.596.

Looking ahead, Eurozone PMI flash, Germany Ifo business climate, and UK PMI flash will be the main focus in European session. ECB will also release monetary policy meeting accounts. Later in the day, US jobless claims and PMI flash will be the main feature.

BoJ’s Noguchi: Must tread carefully with step-by-step policy normalization

BoJ board member Asahi Noguchi emphasized the importance of a “measured, step-by-step” pace in raising interest rates, stressing the need to carefully assess the economic impact of each hike before proceeding further.

Noguchi also addressed the upcoming interim review of BoJ’s bond tapering strategy, indicating that he sees no need for any major adjustments to the current plan, which runs through March 2026.

He noted that the central bank should approach its long-term reduction in the balance sheet with flexibility, taking the time needed to ensure stability while maintaining the capacity to respond to “sudden market swings”.

Any emergency increase in bond purchases, he noted, would be strictly conditional and “only be implemented during times of severe market disruption.”

Japan’s PMI composite falls to 49.8, private sector contracts again

Japan’s private sector activity fell back into contraction in May, with PMI Composite declining from 51.2 to 49.8. Manufacturing output edged higher from 48.7 to 49.0, but remained below the neutral 50 mark. The services sector, however, lost more momentum, with its PMI falling from 52.4 to 50.8.

The decline in composite output reflects weakening domestic and external demand, as new business volumes fell for the first time in nearly a year.

S&P Global’s Annabel Fiddes noted that elevated uncertainty around trade policy and foreign demand weighed heavily on business confidence, which sank to its second-lowest level since the pandemic’s onset.

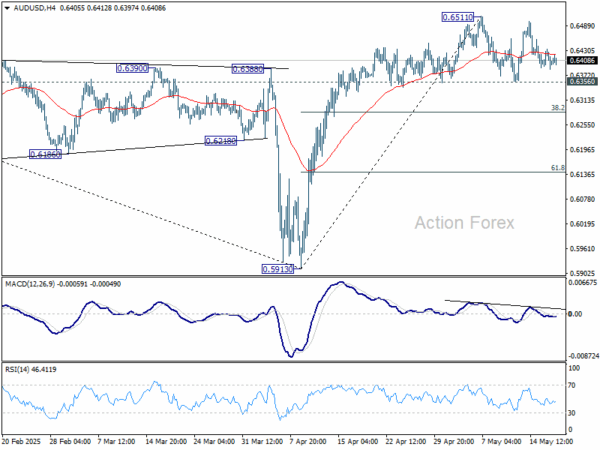

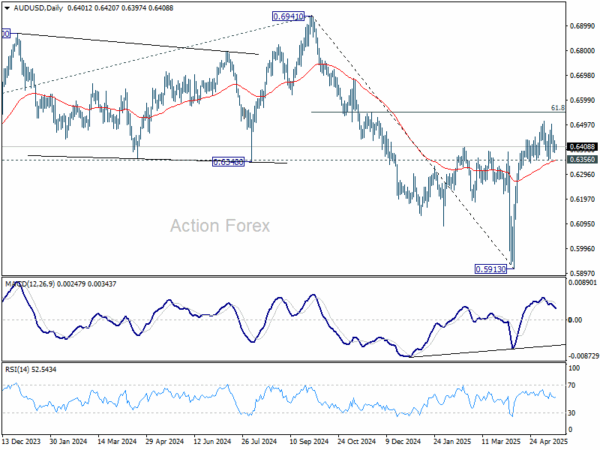

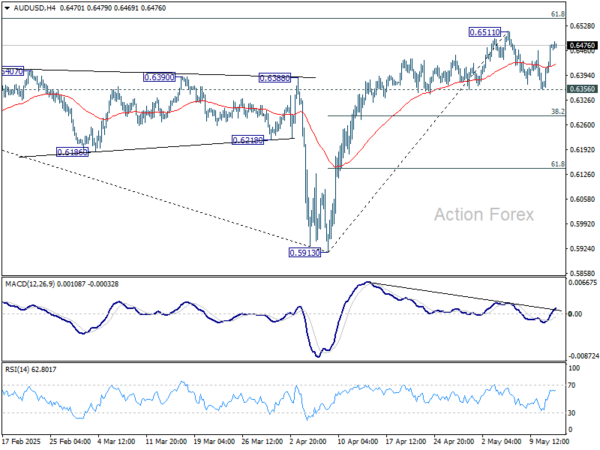

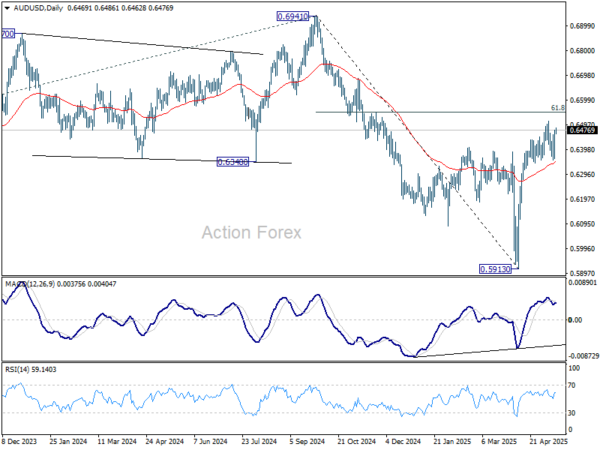

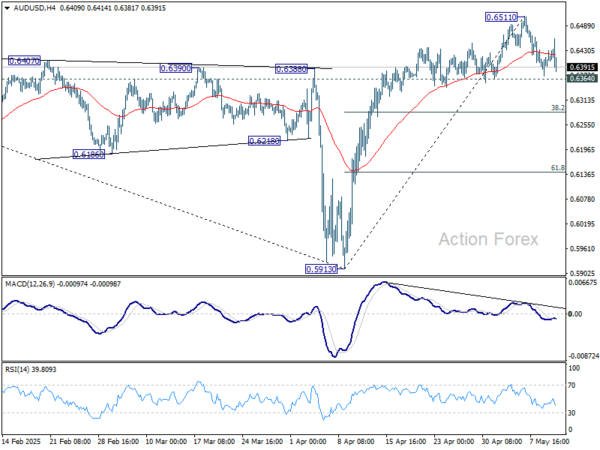

Australia’s PMI Composite slips to 50.6; firms cite election drag on demand

Australia’s private sector showed signs of slowing in May, with PMI Composite falling from 51.0 to a 3-month low of 50.6. Manufacturing index held steady at 51.7. But services weakened from 51.0 to 50.5, its lowest level in six months.

According to S&P Global’s Andrew Harker, the sluggishness may be tied in part to election-related uncertainty, which “contributed to slower growth of new orders”. Still, firms remained cautiously optimistic, continuing to hire at a “solid pace”. With the political noise expected to ease, attention will turn to whether demand picks up in the months ahead.

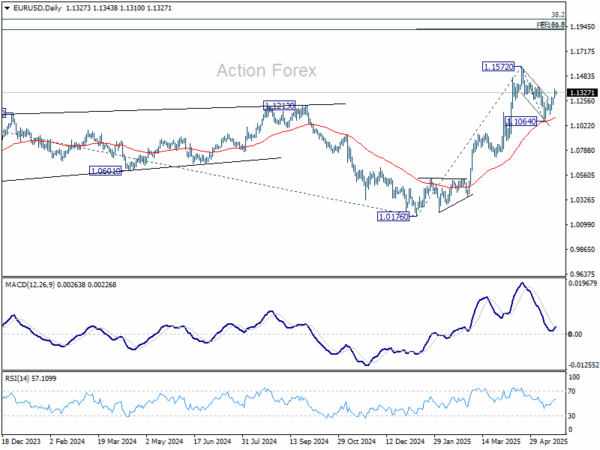

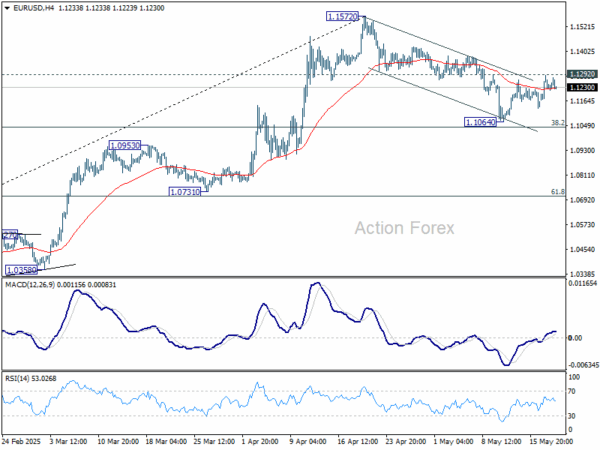

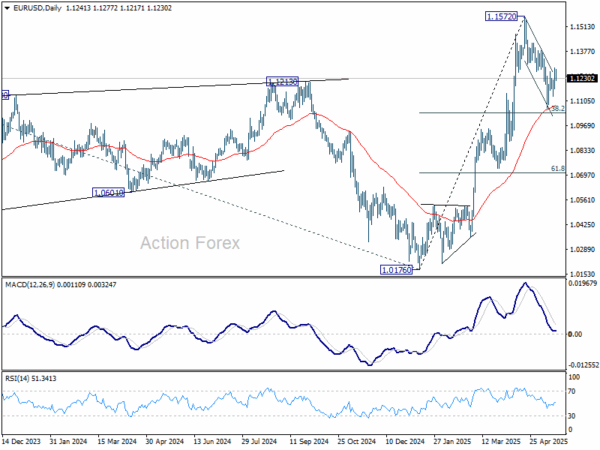

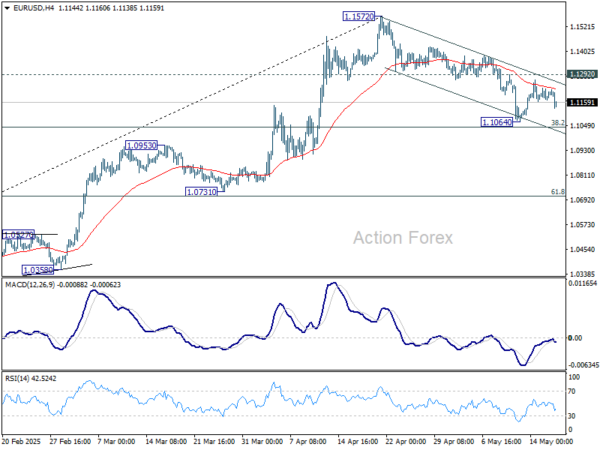

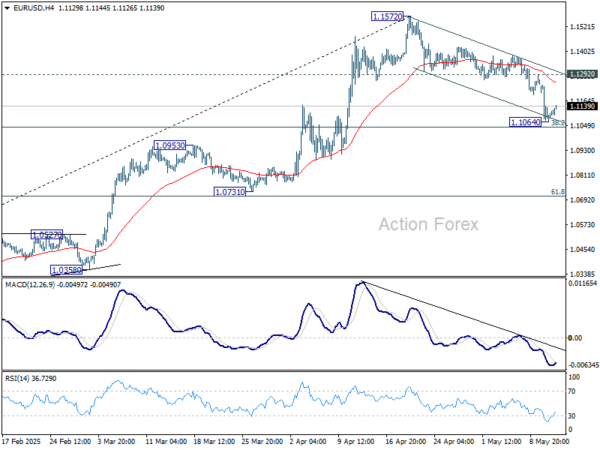

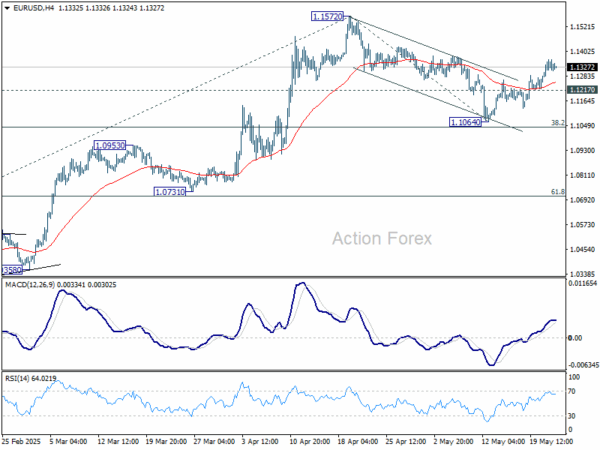

EUR/USD Daily Outlook

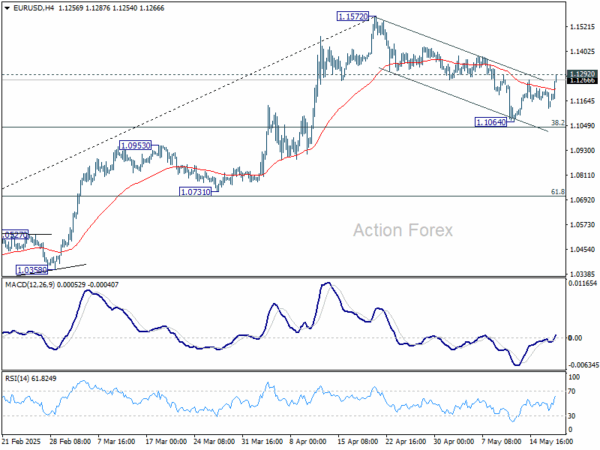

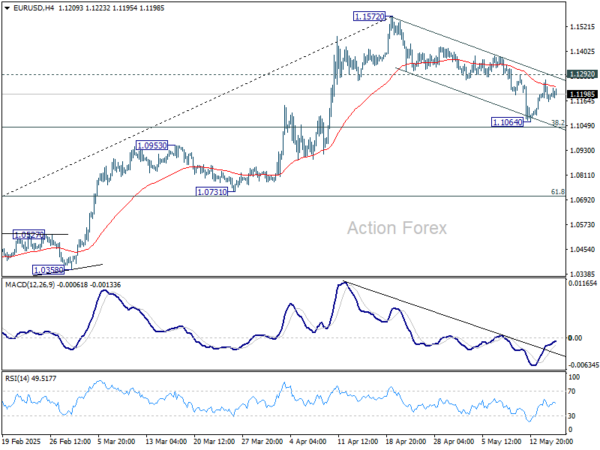

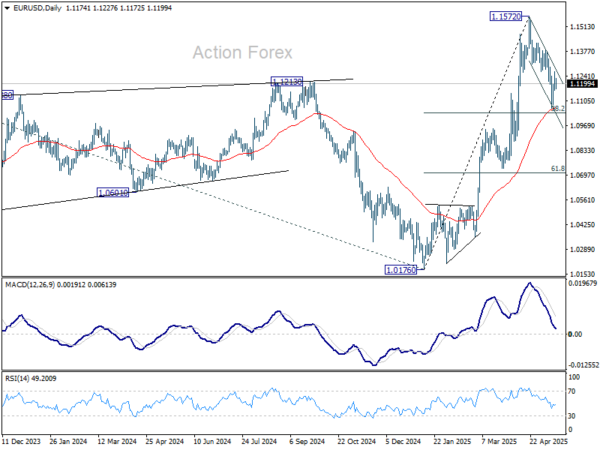

Daily Pivots: (S1) 1.1286; (P) 1.1324; (R1) 1.1369; More…

EUR/USD’s rally from 1.1064 is in progress and intraday bias stays on the upside. Correction from 1.1572 could have completed at 1.1064 already. Further rise should be seen to retest 1.1572 high first. Firm break there will resume larger up trend. Next near term target will be 61.8% projection of 1.0176 to 1.1572 from 1.1064 at 1.1927. On the downside, break of 1.1217 minor support will delay the bullish case and turn intraday bias neutral again.

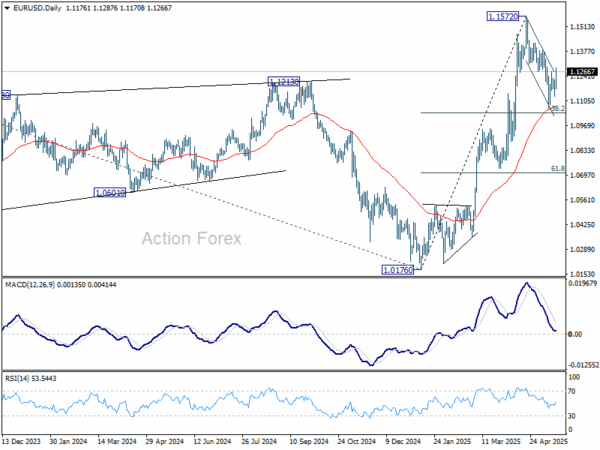

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 55 W EMA (now at 1.0818) holds.