Global Financial markets have endured months of turmoil, with overlapping concerns over the US debt downgrade, recession fears, and an intensifying global trade war. The sharp escalation in Middle East conflict last week has only deepened the anxiety, as Israel and Iran exchanged strikes, raising the specter of prolonged regional instability.

With the 90-day reciprocal tariff truce also nearing its expiration, the weeks ahead look increasingly fraught. For investors, the challenge is no longer just about navigating volatility, but about reassessing whether the overstretch rebound in US equities since April has run its course.

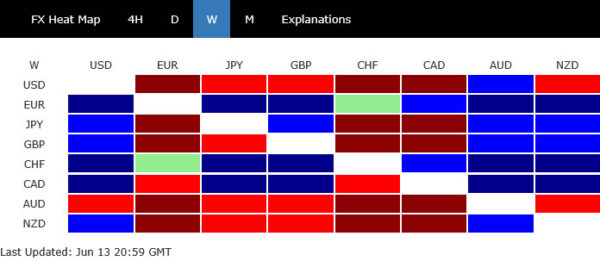

In the currency markets, the week’s performance map clearly reflected a risk-off tone. Swiss Franc stood out as the top performer, benefiting from its traditional safe haven appeal.

Euro also gained significantly, supported not only by its status as the most liquid and stable Dollar alternative, but also by growing sentiment that ECB is near the end of its easing cycle. While a recalibration cut might still be delivered later in the year, markets increasingly believe that the bulk of rate reductions is behind us.

Canadian Dollar rounded out the top three, supported not by domestic strength but by a sharp rally in oil prices amid fears of supply disruption in the Middle East.

On the flip side, Aussie was the week’s worst performer, weighed by its sensitivity to global risk sentiment. Dollar fared little better, finishing second worst despite a bounce late in the week as traders tentatively reconsidered its geopolitical hedge appeal. Kiwi also landed among the bottom performers.

Sterling ended in the middle of the pack but underperformed its European peers, dragged down by weak UK jobs and GDP data that reinforced expectations for BoE rate cut in August (not the upcoming meeting.. Meanwhile, the Japanese Yen also finished mid-table, with markets becoming less convinced that BoJ will tighten policy again this year.

Middle East Escalation Overshadows Market Worries

The sharp escalation in the Middle East conflict has rapidly overtaken other key market concerns—including trade war, US fiscal uncertainty, and recession risks—and is now the dominant driver of global sentiment.

Israel’s largest-ever airstrike on Iranian ballistic missile infrastructure and senior military leaders, followed by Iran’s retaliatory attacks on Israeli cities, marks a dangerous turning point in the regional conflict. What was initially feared as a one-off strike now could quickly become the start of a drawn-out military campaign.

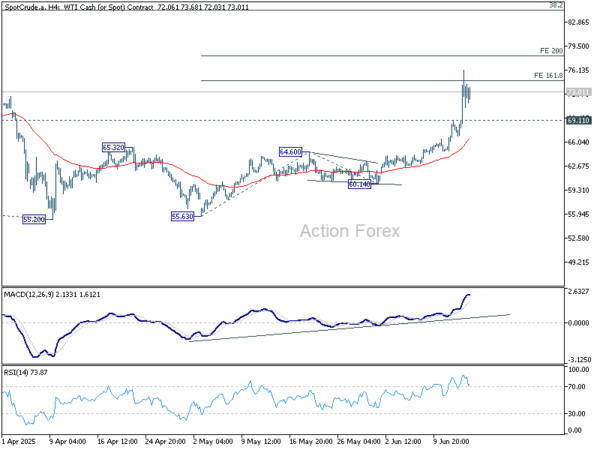

The geopolitical risk premium surged in tandem with crude oil prices, which on Friday posted their largest intraday gains since Russia’s invasion of Ukraine in 2022. Traders began pricing in the risks of serious supply disruptions. Markets are growing increasingly concerned that the conflict could evolve into a broader regional war, possibly threatening key energy infrastructure and shipping routes. The nuclear talks previously scheduled between the US and Iran in Oman now seem moot, with diplomacy giving way to open confrontation.

Oil markets are particularly sensitive to any disruption in Iranian supply. Iran currently produces around 3.3 million barrels per day and exports over 2 million bpd of crude and refined products. Any damage to this output would not only tighten global supply but also stretch the remaining spare capacity from other producers, capacity that might be insufficient to cushion further geopolitical or natural shocks.

A worst-case scenario would involve Iran targeting the Strait of Hormuz, neighboring oil-producing states, or even US military installations. The implications of such actions would be severe. While the US has publicly stated it is not involved in the current Israeli operation, any direct attack on American assets could force a shift in US posture.

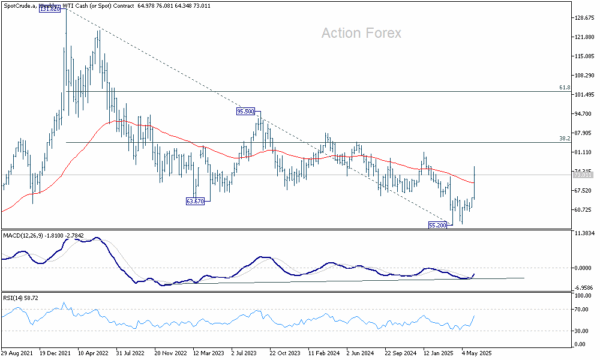

Technically, for the near term, 74.65/78.08 resistance zone (161.8% projection of 55.63 to 64.60 from 60.14. at 74.65 and 200% projection at 78.08) is still likely to limit WTI oil price, with help from overbought condition in 4H MACD.

However, decisive break of 78.08 will add to the case that 55.20 was already a long term bottom. Rebound from there would target 38.2% retracement of 131.81 (2022 high) to 55.20 (2025 low) at 84.46, even still as a corrective move.

Oil Shock Threatens Fed Cut Bets as Inflation Risks Return and Tariff Clock Ticks

The surge in oil prices somewhat revived fears of energy-driven inflation—just as investors were gaining confidence that the Fed could begin cutting rates later this year.

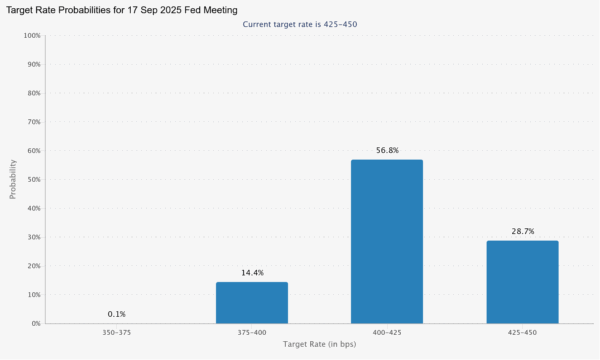

Last week’s downside surprises in both US CPI and PPI reports had strengthened that belief, suggesting that new tariffs imposed earlier this year had yet to filter into upstream or downstream prices. Fed fund futures quickly priced in a more than 70% probability of a September rate cut.

However, the oil shock complicates this narrative, If headline inflation picks up again on energy. In this context, monetary policy may be forced to stay tighter for longer than markets currently anticipate.

Adding to the uncertainty is the looming expiration of the 90-day reciprocal tariff truce in early July. While Treasury Secretary Scott Bessent floated the idea of extending negotiations for “good faith” trading partners, President Donald Trump took a more aggressive stance. He dismissed the need for any delay and signaled that countries would soon receive formal notice of new tariff arrangements—implying a return to unilateral trade policy. The conflicting signals within the administration only amplify the sense of unpredictability for businesses and markets alike.

The intersection of a hawkish tariff stance and resurgent oil prices represents a twin risk scenario that could destabilize expectations across bonds, equities, and currencies. With Fed facing conflicting signals—cooling core inflation versus rising headline risks—the central bank’s room to maneuver may shrink in the months ahead. Investors hoping for a smooth transition to rate cuts may find the coming period more volatile than hoped.

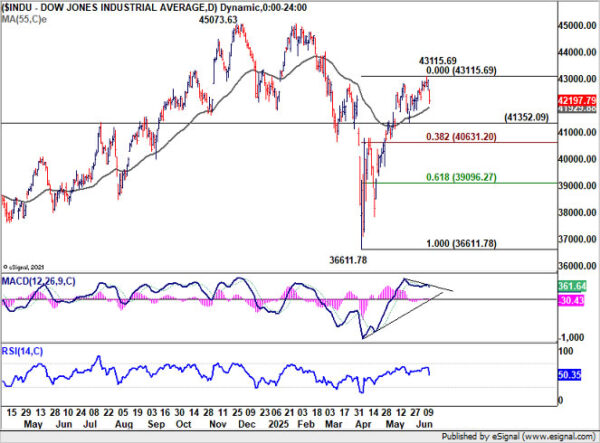

Technically, warning signs are already flashing in equity markets. A bearish divergence is starting to emerge in the D MACD of DOW. Friday’s steep -769 point decline strongly suggests that a short-term top may have formed at 43115.69.

Firm break of 41352.09 will bring deeper fall to 38.2% retracement of 36611.78 to 43115.69 at 40631.20 at least, even still as a corrective move.

Looking ahead, if 40631.20 fails to hold, it would raise the likelihood that the broader medium-term corrective pattern from 45073.63 (2024 high) is still unfolding. In such a case, the index could be at risk of revisiting the bottom of that range near 36611.78.

Dollar Finds a Lifeline in Geopolitical Risk, But Downtrend Still in Play

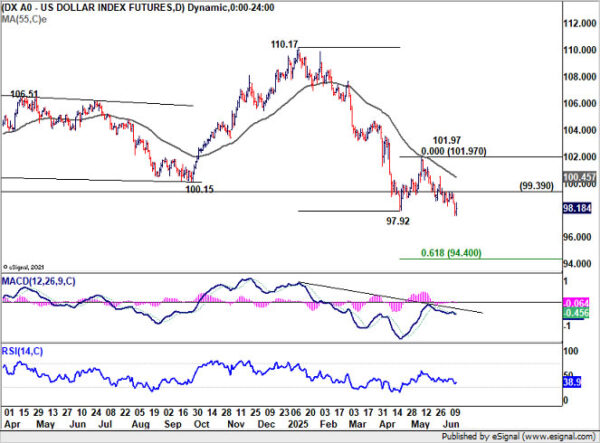

Dollar Index saw a volatile week, initially plunging as softer-than-expected US CPI and PPI data solidified market expectations for a Fed rate cut in September. While the inflation-driven downside pressure dominated early in the week, risk aversion linked to escalating geopolitical tensions between Israel and Iran helped the greenback stage a late recovery. Even so, Dollar still ended as the second worst-performing major, only narrowly outperforming Aussie.

For months, Dollar struggled to find consistent support. Tariff developments, rising inflation, and even climbing Treasury yields failed to lift the greenback, as each came with offsetting factors. In particular, bond selloffs triggered concerns about global diversification away from US assets. Recession-driven risk aversion didn’t help either. But the current geopolitical flare-up in the Middle East, particularly the potential for a drawn-out Israel-Iran conflict, may finally offer Dollar a clearer haven bid—at least in the short term.

Technically, however, Dollar Index remains under pressure. As long 99.39 resistance holds, further decline is favored. That said, downside momentum might start to slow as it approaches 61.8% projection of 110.17 to 97.92 from 101.97 at 94.40. On the upside, break of 99.39 resistance will suggest short term bottoming, and bring stronger rebound back to 55 D EMA (now at 100.45), and possibly further to 101.97 resistance.

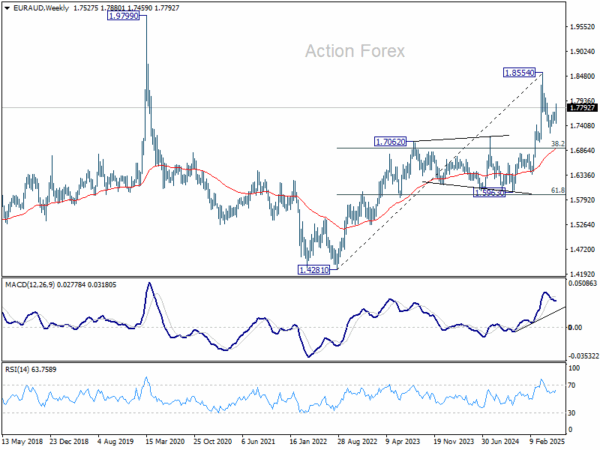

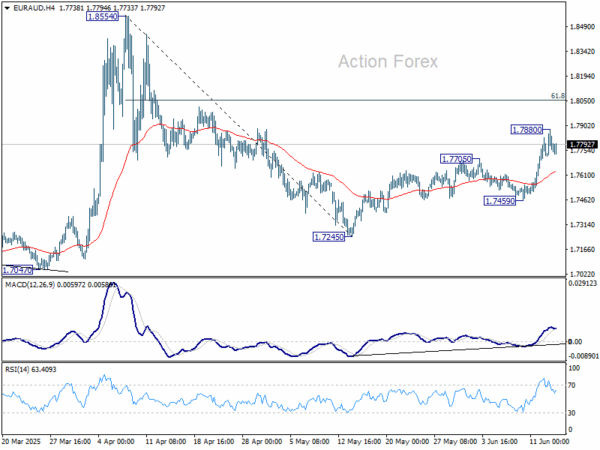

EUR/AUD Weekly Outlook

EUR/AUD’s rebound from 1.7245 resumed last week but lost some momentum after hitting 1.7880. Initial bias is turned neutral this week first. Overall development suggests that fall from 1.8554 has completed as a corrective move. Further rise is expected as long as 1.7459 support holds. Above 1.7880 will target 61.8% retracement of 1.8554 to 1.7245 at 1.8054. Firm break there will pave the way to 1.8554.

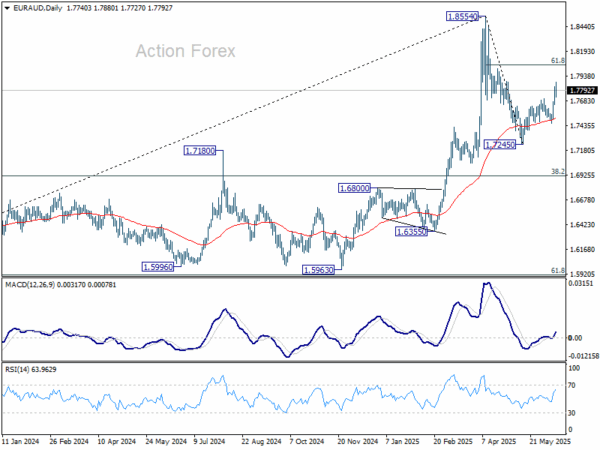

In the bigger picture, with 55 W MACD staying well below signal line, 1.8554 is likely a medium term top already. Price actions from there are seen as a corrective pattern only. While deeper pullback might be seen, downside should be contained by 38.2% retracement of 1.4281 (2022 low) to 1.8554 at 1.6922 to bring rebound. Up trend from 1.4281 is still expected to resume at a later stage.

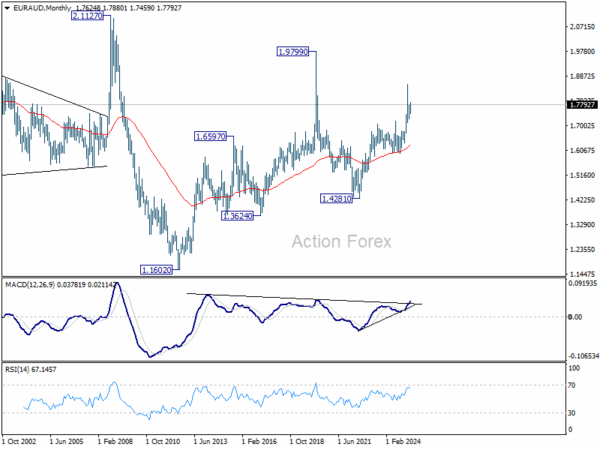

In the longer term picture, rise from 1.4281 is seen as the second leg of the pattern from 1.9799 (2020 high), which is part of the pattern from 2.1127 (2008 high). As long as 55 M EMA (now at 1.6303) holds, this second leg could still extend higher.