- The Canadian Dollar shed 0.3% against the Greenback on Tuesday.

- Bank of Canada (BoC) rate call looms large during the midweek session.

- US President Trump’s trade war against Canada has hit a new gear.

The Canadian Dollar roiled on Tuesday, falling roughly six-tenths of one percent against the Greenback at its lowest as markets weigh the latest evolution in US President Donald Trump’s self-styled trade war against Canada. The Canadian Dollar is still testing within familiar technical territory against the US Dollar, however, the Loonie is poised for further losses after shedding weight for three straight sessions against the USD, all on rising trade war fears.

The Bank of Canada (BoC) is slated to deliver its latest rate call on Wednesday, however markets are getting thrown for a loop on whether the BoC will be able to deliver its expected quarter-point rate trim as trade war rhetoric from team Trump ramps up. Donald Trump took to his favorite social media app to declare that he’s instructed his Secretary of Commerce to double tariffs on all steel and aluminum imported from Canada to 50%, also to begin on Wednesday.

Daily digest market movers: Canadian Dollar withers again on new tariff threats

- US President Donald Trump vowed via social media to impose an additional tariff on Canadian steel and aluminum, bringing the total to 50% and declaring the tariff to go into effect on Wednesday.

- Ontario Prime Minister Doug Ford was quick to retaliate against the US with a flat export tax of 25% on all electricity sent to the US, which sent Donald Trump into a further tailspin on social media.

- Ontario PM Ford followed up with an additional warning that Ontario could shut up energy exports to the US entirely, which would see 1.5M Americans without power.

- White House officials followed up with an announcement that the “paperwork” on additional steel and aluminum tariffs targeted at Canada hasn’t been “signed” in an effort to cross the moat that President Trump continues to dig for the US.

- President Trump reiterated his misunderstanding of Canadian cap-trade tariffs on US dairy products that are baked into the USMCA trade agreement, which Donald Trump himself spearheaded during his first term in the White House.

- The BoC is slated to cut interest rates by another quarter of a point to 2.75% on Wednesday, but rising tariff concerns could throw a wrench in the works.

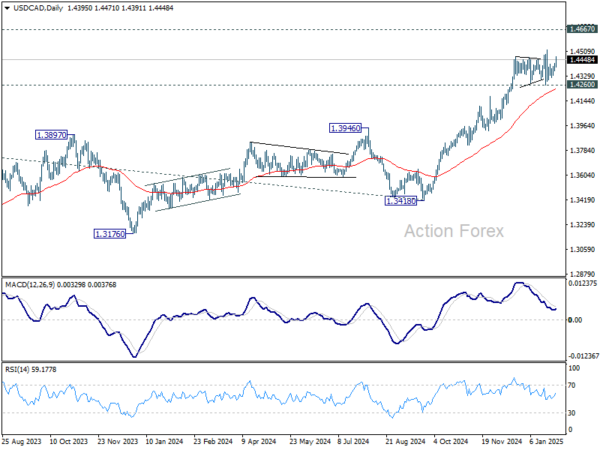

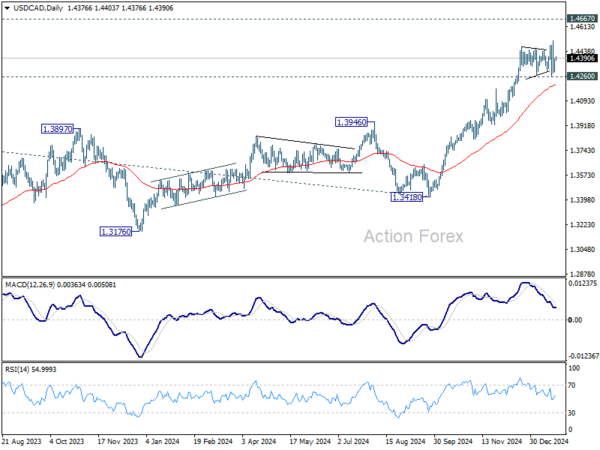

Canadian Dollar price forecast

The Canadian Dollar whipsawed against the Greenback on Tuesday, falling 0.9% top-to-bottom at its absolute lowest as markets churn on geopolitical headlines. The Loonie has somewhat recovered its footing, but still remains down for a third straight session against the US Dollar. USD/CAD has risen around 2% in three straight trading days as the Loonie backslides against the Greenback.

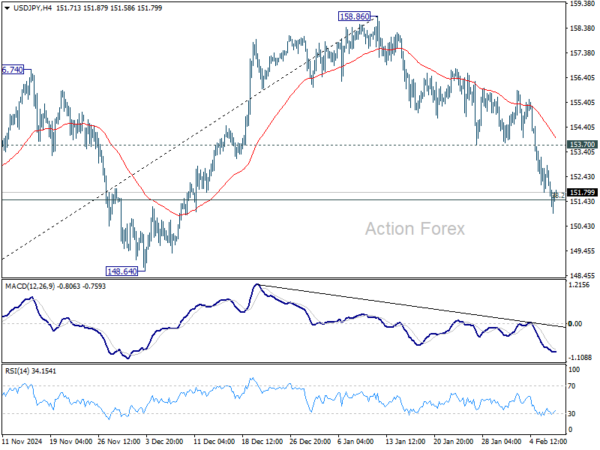

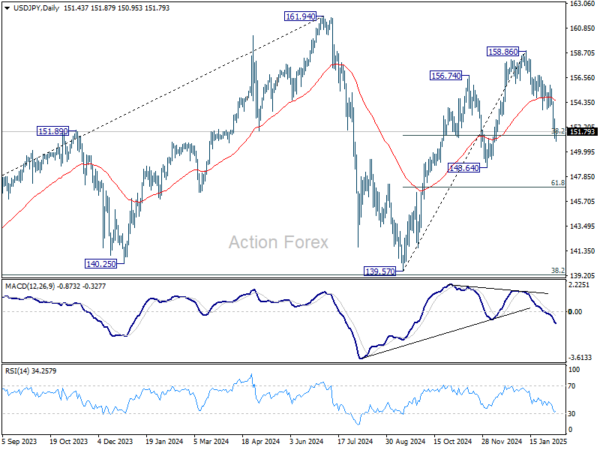

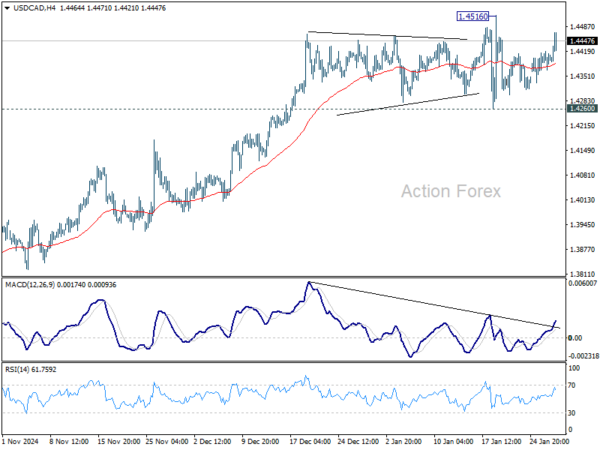

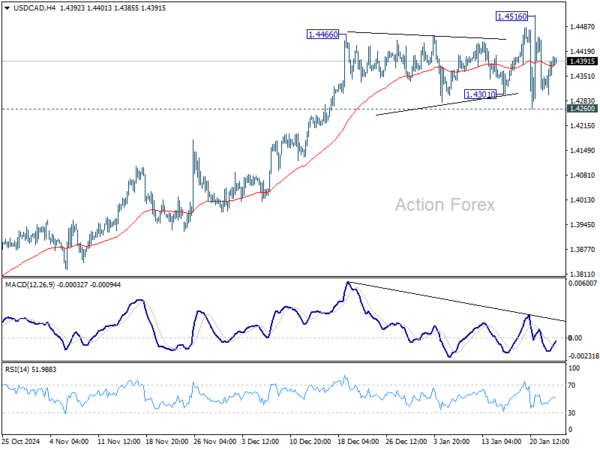

USD/CAD 4-hour chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.