Forex markets are trading quietly in the Asian session, remaining within Friday’s range and showing little impetus to move decisively in either direction. Dollar is staying on the back foot, with a lack of substantial buying interest to sustain a meaningful rebound. While last week’s non-farm payroll data helped calm fears of a rapid labor market slowdown, market sentiment remains cautious in the face of escalating uncertainties.

Late last Friday, Morgan Stanley lowered its 2025 economic growth forecast for the US and highlighted mounting concerns about trade tensions. The bank noted that “earlier and broader tariffs should translate into softer growth this year.” In contrast to its previous assumption that any tariff-related drag on growth would be more pronounced in 2026. Morgan Stanley now projects Q4/Q4 2025 growth at 1.5% (down from 1.9%), and 2026 growth at 1.2% (down from 1.3%).

Goldman Sachs also joined the wave of downward revisions, cutting its 2025 Q4/Q4 GDP growth forecast from 2.2% to 1.7%. Moreover, it raised its 12-month recession probability to 20%. While the odd is still low, it’s a noticeable shift from the previously estimated 15%.

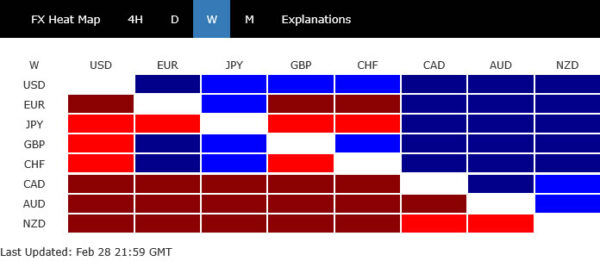

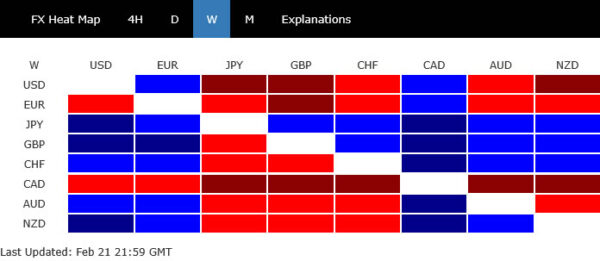

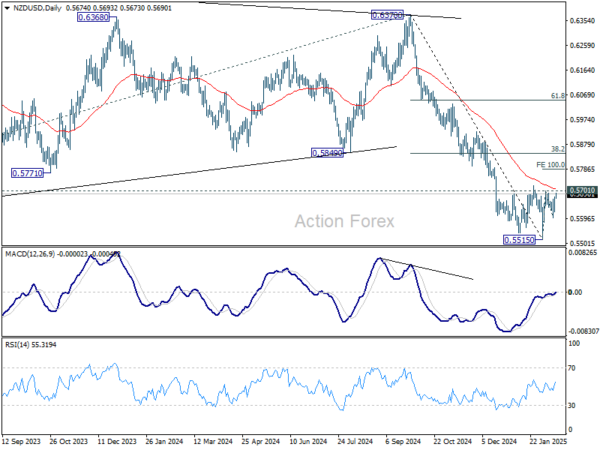

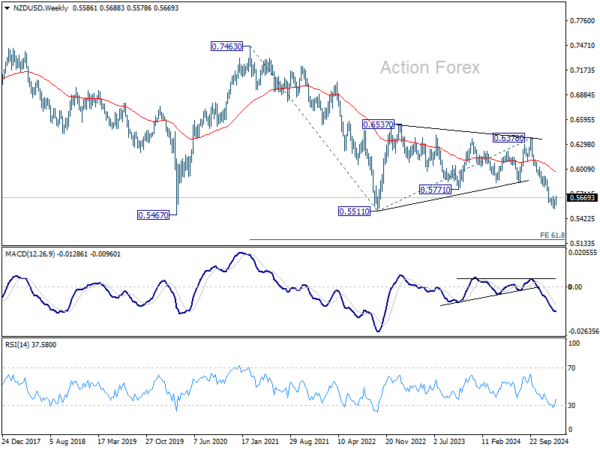

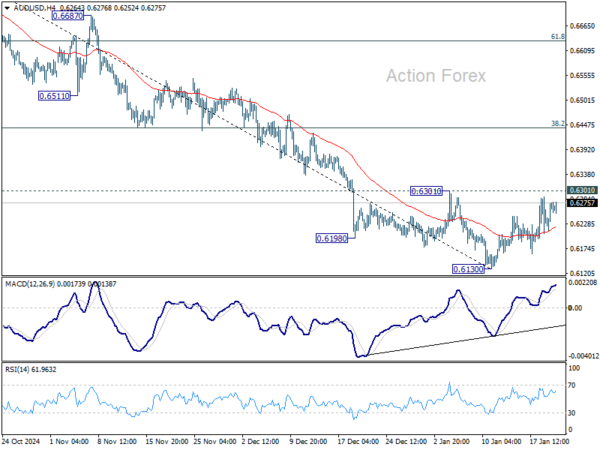

So far this month, Dollar is the weakest performer among the major currencies. It is trailed by Canadian Dollar and then Australian Dollar. On the other end, Euro leads the pack, followed by Swiss Franc and then British Pound, indicating broad European strength in the current environment. Both Yen and New Zealand Dollar hold the middle ground.

Looking ahead, the upcoming US CPI release will be the major data focal point this week Meanwhile, BoC is widely expected to deliver another rate cut. UK GDP data will also be a feature.

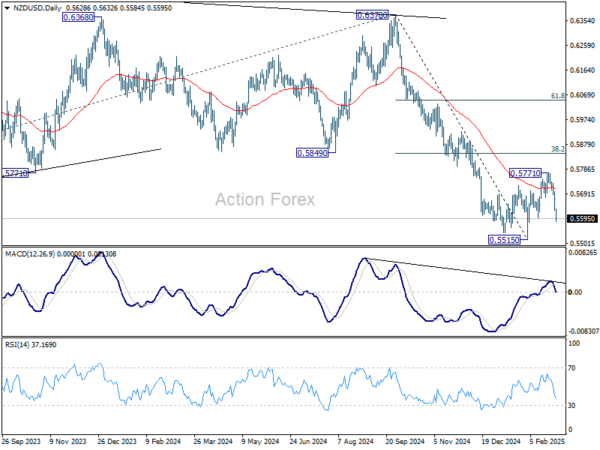

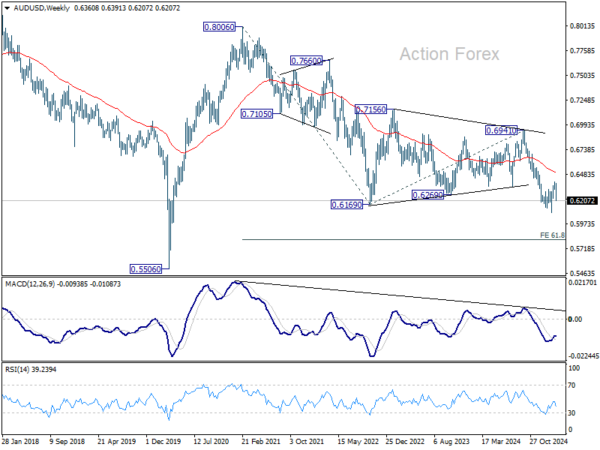

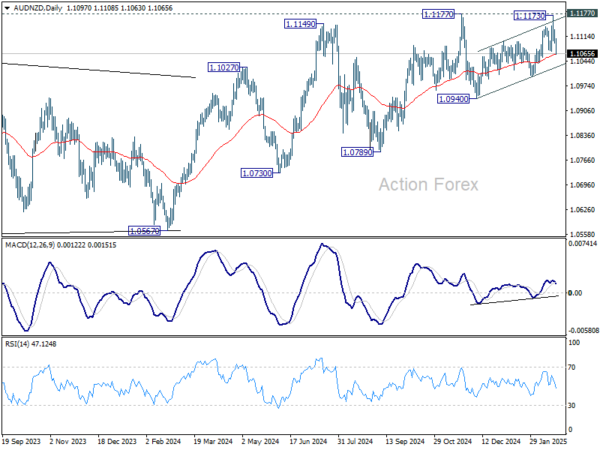

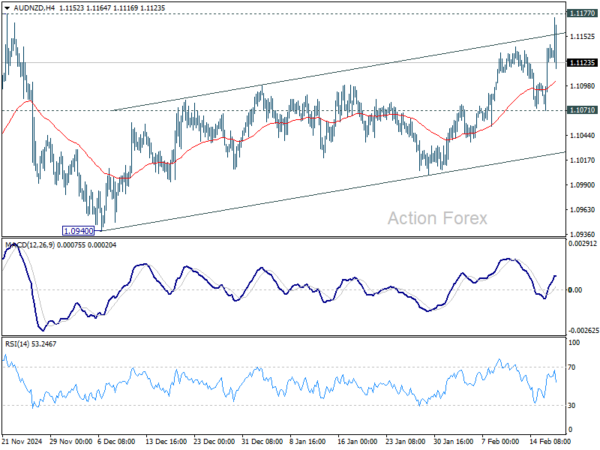

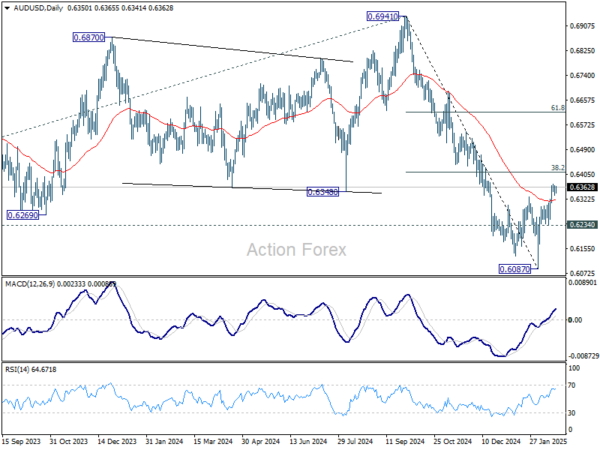

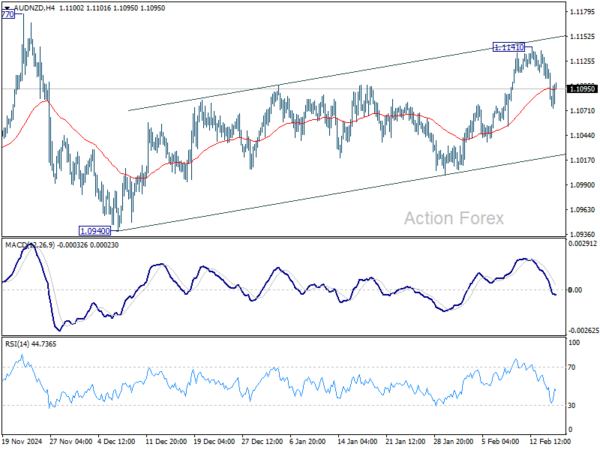

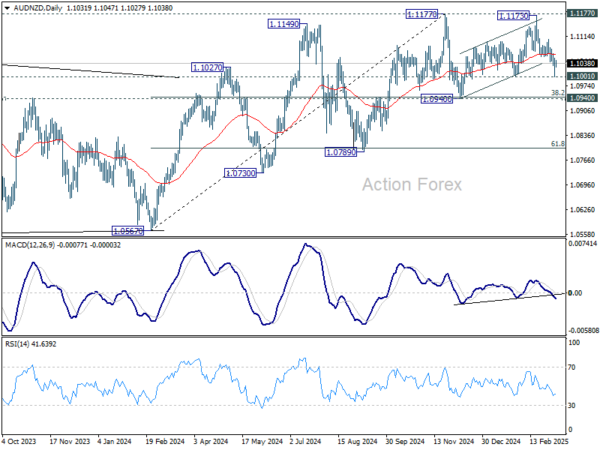

Technically, AUD/NZD appears to be building up downside momentum as seen in D MACD. Break of 1.1001 support will pace the way to 1.0940 cluster support zone (38.2% retracement of 1.0567 to 1.1177 at 1.0944). Such development would give Aussie some additional pressure elsewhere.

In Asia, at the time of writing, Nikkei is up 0.47%. Hong Kong HSI is down -1.53%. China Shanghai SSE is down -0.37%. Singapore Strait Times is down -0.52.

Japan’s nominal wages rises 2.8% yoy in Jan, real wages fall -1.8% yoy

Japan’s labor cash earnings rose 2.8% yoy in January, falling short of market expectations of 3.2% yoy. Nominal wage growth remained positive for the 37th month.

Real wages, adjusted for inflation, fell -1.8% yoy, reversing two months of slight gains. The decline was largely driven by a sharp rise in consumer inflation.

The inflation rate used by the Ministry of Health, Labor and Welfare to calculate real wages—which includes fresh food prices but excludes rent—accelerated to 4.7% yoy, its highest level since January 2023.

Regular pay, or base salary, rose 3.1% yoy, the largest gain since 1992. This was overshadowed by a sharp -3.7% yoy decline in special payments, which consist largely of one-off bonuses.

China’s inflation turns negative, but seasonal factors skew the picture

Released over the weekend, China’s consumer inflation dipped into negative territory for the first time in over a year, with February’s CPI coming in at -0.7% yoy, weaker than the expected -0.5% yoy, and a sharp reversal from January’s 0.5% yoy gain.

Core CPI, which strips out food and energy prices, also slipped by -0.1% yoy—its first decline since January 2021—signaling weak underlying demand.

On a month-over-month basis, consumer prices fell -0.2%, more than the expected -0.1%, reversing some of January’s 0.7% increase.

While the decline may raise concerns about deflationary pressures, NBS attributed much of the drop to seasonal distortions tied to the timing of the Lunar New Year. Stripping out this factor, NBS estimates that CPI actually rose 0.1% yoy.

Given these distortions, a clearer picture of China’s inflation trajectory will likely emerge in March when seasonal effects fade.

Meanwhile, producer prices remained in contraction for the 29th consecutive month, with PPU declining -2.2% yoy, slightly better than January’s -2.3% yoy but still below expectations of -2.1% yoy.

BoC rate cut, US inflation and consumer sentiment

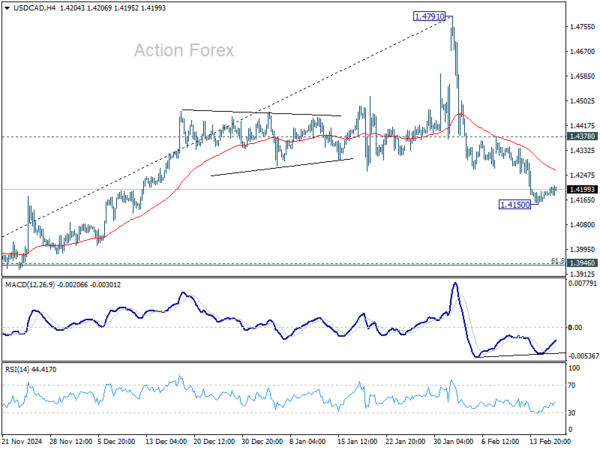

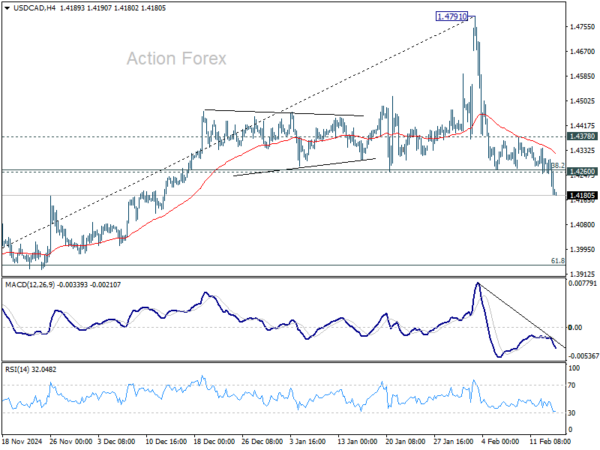

Expectations for BoC to continue easing policy have surged following weak February job data, which showed that tariff-related uncertainty is already taking a toll on employment. Markets now widely expect BoC to lower its policy rate by another 25bps this week to to 2.75%, This would serve as an insurance move against further trade disruptions. With inflation well-contained, some analysts believe the central bank would continue cutting at this pace in upcoming meetings until rates reach 2%.

BoC’s rhetoric will be closely scrutinized to gauge how policymakers assess the risks posed by tariffs and trade disputes. If the central bank signals greater concern over the economic fallout, expectations for a sustained easing cycle will strengthen. The stance will be critical in shaping near-term movements in Canadian Dollar, which has just had a roller-coaster ride last week on tariff news.

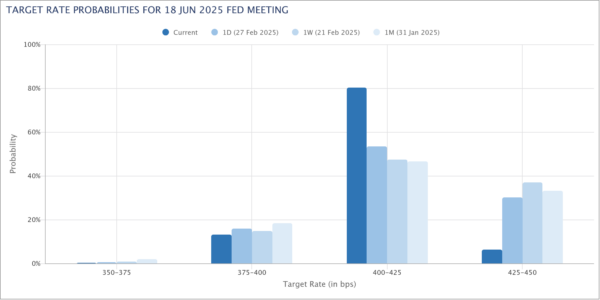

Looking south, US inflation data are another pivot point for global markets. Both headline and core CPI rates are expected to edge lower, from 3.0% to 2.9% and from 3.3% to 3.2%, respectively. Yet the outcome remains uncertain due to possible tariff-induced price hikes—or, conversely, weaker consumption dampening inflation. With a surprise in either direction, Fed’s near-term policy path could be thrown into disarray. March is still widely expected to be a hold, but May is increasingly up in the air.

Adding to the US economic picture is the University of Michigan consumer sentiment survey, which carries added significance. The recent stock market selloff was closely tied to poor January consumer sentiment. Any notable deterioration in confidence could drive renewed risk aversion, compounding existing concerns about trade and growth.

Elsewhere, other key data, including UK GDP, Japan cash earnings, and household spending, will round out a relatively less busy week for global markets.

Here are some highlights for the week:

- Monday: Japan average cash earnings; Germany industrial production, trade balance; Swiss SECO consumer climate; Eurozone Sentix investor confidence.

- Tuesday: New Zealand manufacturing sales; Australia Westpac consumer sentiment, NAB business sentiment; Japan household spending, GDP final.

- Wednesday: Japan BSI manufacturing, PPI; US CPI, BoC rate decision.

- Thursday: Swiss PPI; Eurozone industrial production; US PPI, jobless claims.

- Friday: New Zealand BNZ manufacturing; Germany GDP final; UK GDP, production, goods trade balance; Canada manufacturing sales, wholesale sales; US U of Michigan consumer sentiment.

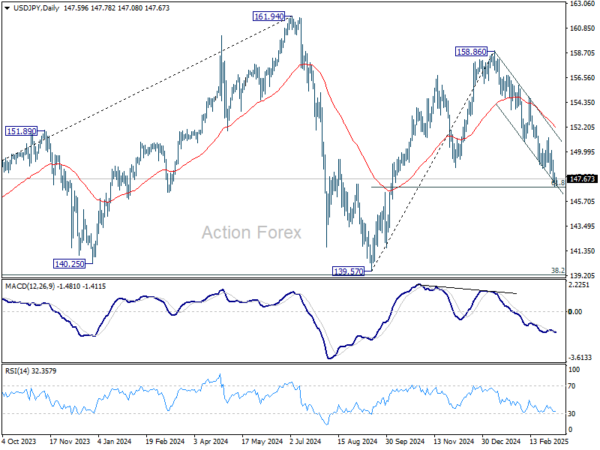

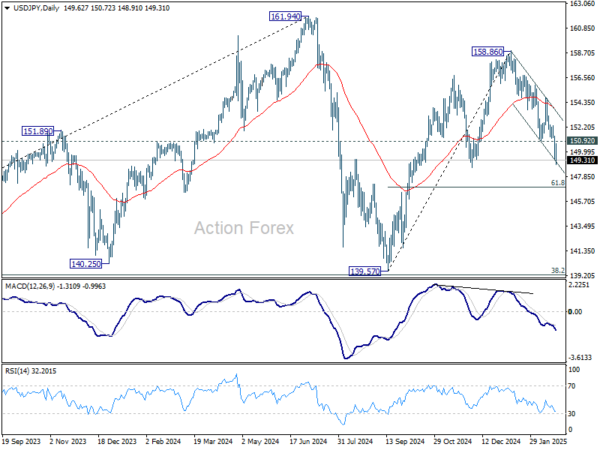

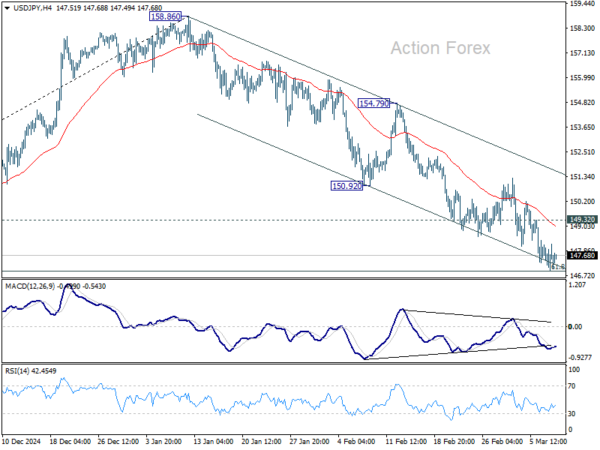

USD/JPY Daily Outlook

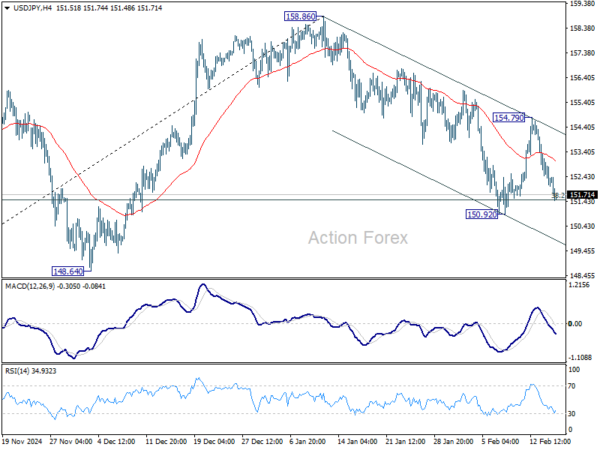

Daily Pivots: (S1) 147.26; (P) 147.73; (R1) 148.51; More…

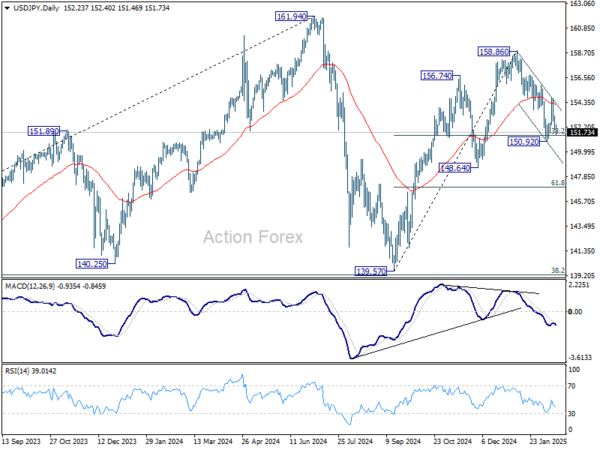

Intraday bias in USD/JPY stays on the downside at this point. Sustained trading below 61.8% retracement of 139.57 to 158.86 at 146.32 will pave the way to 139.57 support. On the upside, 149.32 minor resistance will turn intraday bias neutral and bring consolidations again, before staging another fall.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low), with fall from 158.86 as the third leg. Strong support should be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.