The sharp selloff in equities sparked by AI competition concerns appears to have run its course for now. While NASDAQ dropped more than -3% yesterday, the selling pressure did not intensify as the session progressed. DOW, on the other hand, demonstrated resilience, closing up 0.65%. This relatively stable market sentiment has led to reversal in safe-haven flows, with both Swiss Franc and Japanese Yen giving up most of their earlier gains and showing signs of returning to weakness.

Meanwhile, Dollar found fresh support from reports of new tariff measures. According to the Financial Times, Treasury Secretary Scott Bessant is pushing for a universal 2.5% tariff that would increase incrementally each month, potentially reaching as high as 20%.

US President Donald Trump hinted at an even more aggressive rate, emphasizing that higher tariffs on imports would be balanced by lower taxes for American workers and businesses. Trump also renewed his push for a corporate tax rate cut to 15%—down from 21%—for companies producing goods domestically.

In the currency markets, Yen continues to lead as the strongest performer this week, followed by Swiss Franc and Dollar. On the other end, commodity-linked currencies have come under significant pressure, with Aussie leading the declines, followed by Kiwi and Loonie. Euro and British Pound are trading in the middle of the pack.

While this still reflects a broadly risk-off sentiment, the picture could shift quickly albeit another swift in sentiment. U.S. durable goods orders and consumer confidence data are in focus today. But the spotlight will soon turn to key central bank decisions from BoC and FOMC tomorrow, and ECB on Thursday.

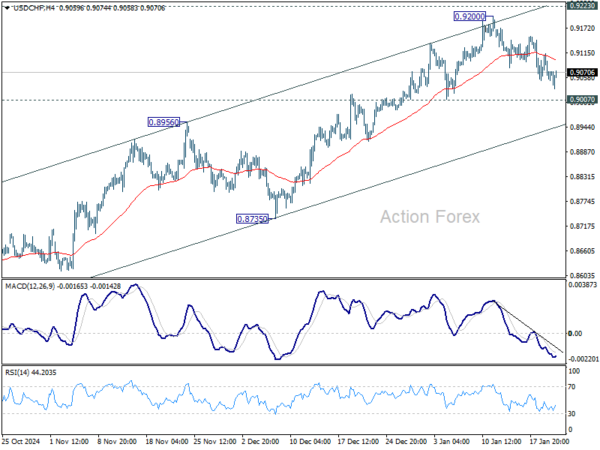

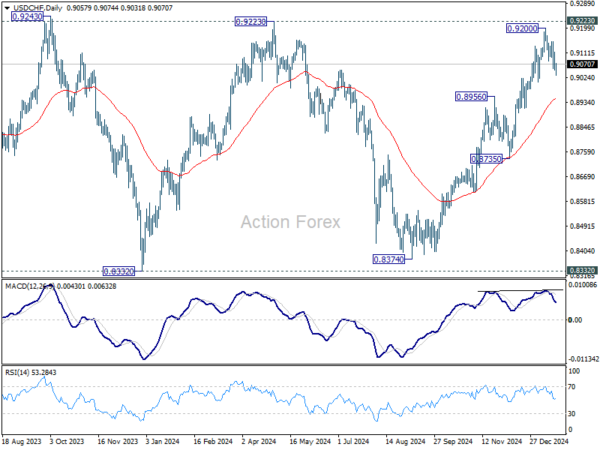

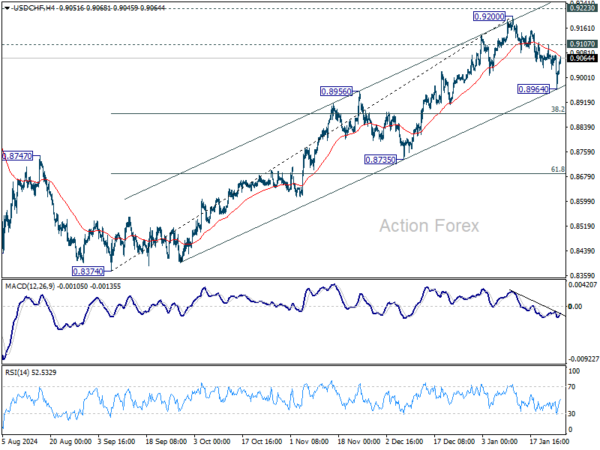

Technically, USD/CHF is well supported by the near term rising channel so far, as rally from 0.8374 remains intact. Break of 0.9107 minor resistance should bring rise resumption to through 0.9200 high to 0.9223 key medium term resistance. Reaction from there will decide whether the pair is already in larger bullish trend reversal.

Australia NAB business confidence rises to -2, price pressures persist

Australia’s NAB Business Confidence showed slight improvement in December, rising from -3 to -2, but remains below the long-term average since early 2023. Business Conditions, on the other hand, posted a stronger gain, climbing from 3 to 6.

Breaking down the details, trading conditions improved from 6 to 9, profitability rose from 0 to 4, and employment conditions ticked up from 3 to 4.

Price pressures continue to persist, with purchase cost growth rising slightly to 1.5% in quarterly equivalent terms. Labour cost growth edged lower to 1.4%, but output price growth increased by 0.3 percentage points to 0.9%. Retail prices also ticked up to 0.7%.

According to NAB Chief Economist Alan Oster, “The uptick in purchase cost growth and final product prices reminds us that businesses continue to face some price pressures.”

SNB’s Schlegel: Negative rates won’t be taken lightly

SNB Chair Martin Schlegel said on Monday that while the central bank is reluctant to reintroduce negative interest rates, it cannot rule them out entirely.

He stated, “negative interest rates have served their purpose, but it is not something the SNB would do lightly,” .

Schlegel also downplayed the risks of deflation, noting that occasional months of negative inflation “is not a problem”.

“Our concept is price stability over the mid term,” he emphasized.

Markets currently see 64% chance of SNB cutting rates from 0.5% to 0.25% in March, with a 27% likelihood of a further cut to 0% by June.

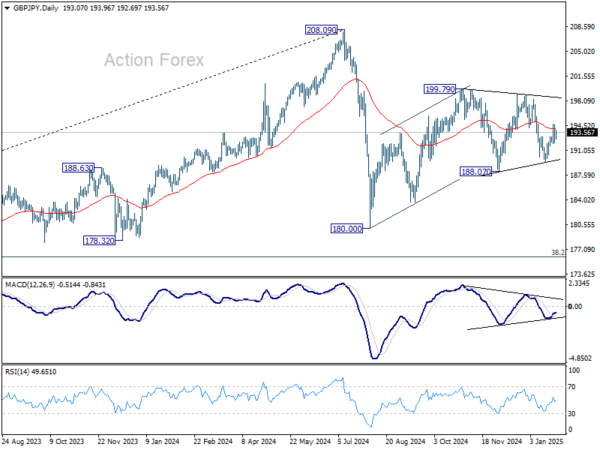

GBP/JPY Daily Outlook

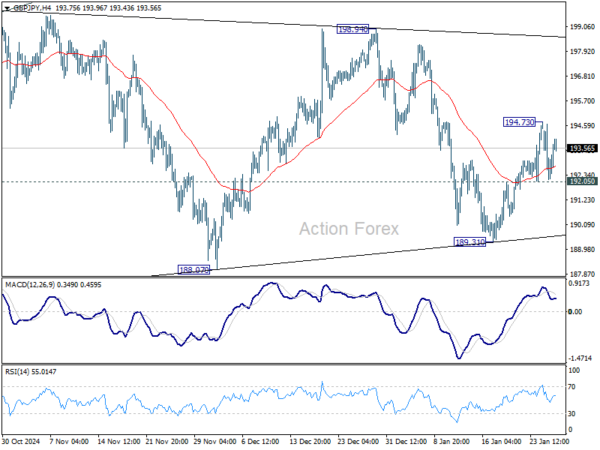

Daily Pivots: (S1) 191.98; (P) 193.31; (R1) 194.47; More…

GBP/JPY recovered above 192.05 minor support and intraday bias stays neutral for the moment. Overall outlook is unchanged that corrective pattern from 180.00 might extend. On the upside above 194.73 will target 198.94/197.79 resistance zone. On the downside, however, break of 192.05 minor support will turn bias back to the downside for 189.31 support instead.

In the bigger picture, price actions from 208.09 are seen as a correction to whole rally from 123.94 (2020 low). The range of consolidation should be set between 38.2% retracement of 123.94 to 208.09 at 175.94 and 208.09. However, decisive break of 175.94 will argue that deeper correction is underway.