Dollar is trading is a mildly firmer tone while Gold inches closer to the key 3000 psychological level after US President Donald Trump officially raised tariffs on aluminum and steel imports. However, the broader market reaction has been relatively subdued. Major US equity indexes managed to post modest gains overnight, and 10-year Treasury yield also recovered. Investor sensitivity to trade war escalations has somewhat diminished. The next test will be whether Trump’s upcoming reciprocal tariff announcement will trigger a similar lackluster response.

In his proclamation on Monday, Trump lifted tariff rate on aluminum to 25% from the previous 10% and eliminating previous country-specific exemptions, including quota agreements and product-specific exclusions for both metals. The measures are set to take effect on March 4.

Although Trump insisted there would be “no exceptions,” he later softened the tone and indicated the possibility of an exemption for Australia, citing that nation’s trade deficit with the US. As a result, uncertainty remains over how many countries or products may ultimately be exempt from the higher tariffs.

Markets are now awaiting further details on Trump’s reciprocal tariff plan, expected to be unveiled between Tuesday and Wednesday. The plan could impose new duties on a range of imports to match tariffs levied by trading partners, with the EU particularly at risk due to its 10% tariff on American cars—much higher than the US’s 2.5% tariff on imported vehicles.

In addition to trade policy developments, the focus is also on Fed Chair Jerome Powell’s Congressional testimony later today, followed by release of key US CPI data tomorrow. Powell’s remarks could provide further insight into the Fed’s rate outlook, particularly whether policymakers are shifting toward an even longer pause in monetary easing given recent strength in the labor market and lingering inflation risks.

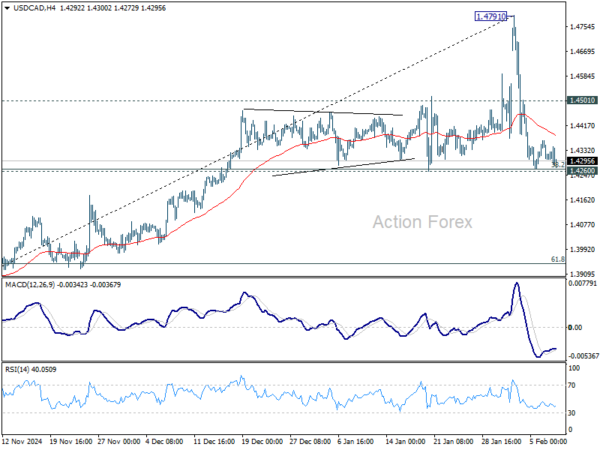

On the currency front, Dollar is currently the strongest major currency so far this week, followed by Aussie and then Swiss franc. Kiwi is the worst performer, trailed by Sterling and then Yen. Euro and Loonie are trading in the middle.

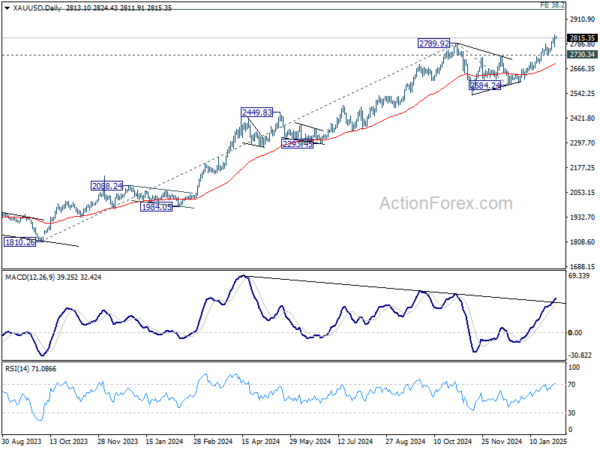

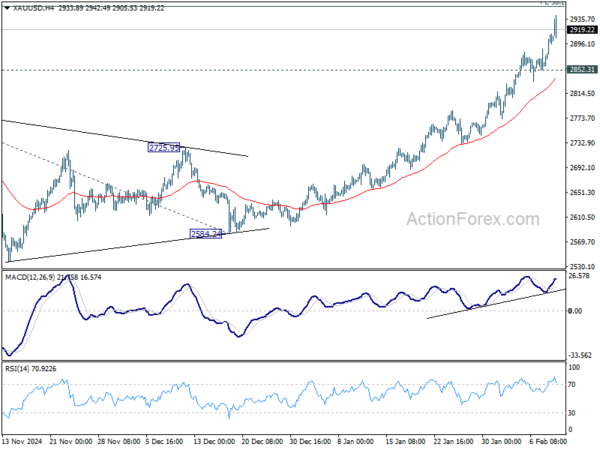

Technically, immediate focus in on Gold’s reaction from 3000 psychological level, as well as 38.2% projection of 1810.26 to 2789.92 from 2584.24 at 2958.47. Strong resistance could be seen from there to limit upside on first attempt. Break of 2852.31 support would indicate that pullback is underway back to 2789.92 resistance turned support and possibly below. However, sustained break of 3000 would pave the way to next target at 61.8% projection at 3189.66 before topping.

In Asia, Japan is on holiday. Hong Kong HSI is down -0.72%. China Shanghai SSE is down -0.16%. Singapore Strait Times is down -0.41%. Overnight, DOW rose 0.38% S&P 500 rose 0.67%. NASDAQ rose 0.98%. 10-year yield rose 0.006 to 4.493.

Australia’s Westpac consumer sentiment ticks up, RBA to start cutting this month

Australia’s Westpac Consumer Sentiment Index rose slightly by 0.1% mom to 92.2 in February. While consumer mood improved significantly in the second half of 2024, the past three months have shown stagnation.

Westpac noted that financial pressures on households persist and a more uncertain global economic climate has also played a role in dampening optimism.

RBA is likely to begin policy easing at its next meeting on February 17–18. Westpac highlighted that recent economic data on core inflation, wage growth, and household consumption indicate that inflation is “returning to target faster” than previously expected.

These factors provide RBA with the confidence to initiate a 25bps rate cut this month, marking the first step in what is expected to be a “moderate” easing cycle through 2025.

Australian NAB business confidence rebounds to 4, but conditions remain weak

Australia’s NAB Business Confidence index made a strong recovery in January, rising from -2 to 4 and returning to positive territory. However, despite this uptick in sentiment, underlying business conditions deteriorated.

Business Conditions index dropped from 6 to 3, marking a notable slowdown. Within this, trading conditions slipped from 10 to 6, while profitability conditions turned negative, falling from 4 to -2. On a more positive note, employment conditions edged up slightly from 4 to 5.

Cost pressures remained a key concern for businesses. Purchase cost growth eased to 1.1% on a quarterly equivalent basis, down from 1.4%. Labor cost growth picked up slightly to 1.8%. Meanwhile, final product price growth held steady at 0.8%, while retail price inflation inched up to 0.9%. Businesses are struggling to fully pass on rising costs to consumers.

NAB Chief Economist Alan Oster noted that while confidence improved, it is uncertain whether this momentum will be sustained. Elevated cost pressures, particularly on wages and input costs, continue to weigh on overall business conditions.

BoE’s Mann: Larger rate cut needed to send clear market signal

BoE MPC member Catherine Mann explained her unexpected vote for a 50bps rate cut last week. Speaking to the Financial Times, she emphasized that “Demand conditions are quite a bit weaker than has been the case”, prompting a reassessment of her stance on inflation risks.

She now sees inflationary pressures easing faster, with pricing trends aligning closely to 2% target in the year ahead. This marks a notable shift from her previously hawkish position, which had consistently supported maintaining restrictive monetary policy.

A key reason for her preference for a larger cut was the need to deliver a stronger signal to financial markets. She argued that a half-point move would help “cut through the noise” and provide clearer guidance on the need for looser financial conditions in the UK.

“To the extent that we can communicate what we think are the appropriate financial conditions for the UK economy, a larger move is a superior communication device,” she noted.

Mann’s stance aligns her with Swati Dhingra, the most dovish member of the MPC, who also advocated for a 50bps cut to 4.25% at last week’s meeting. The final decision was a more measured 25bps reduction to 4.50%.

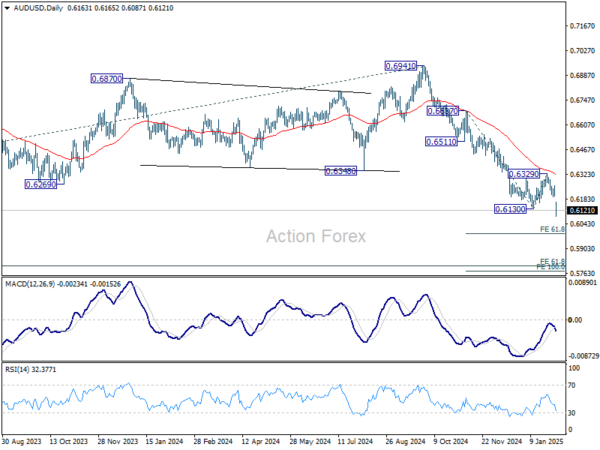

AUD/USD Daily Report

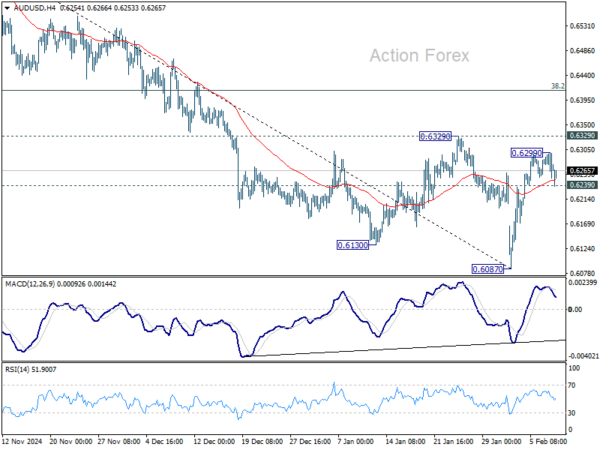

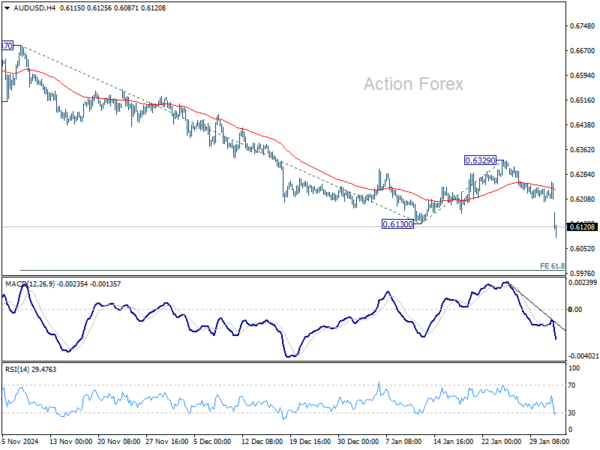

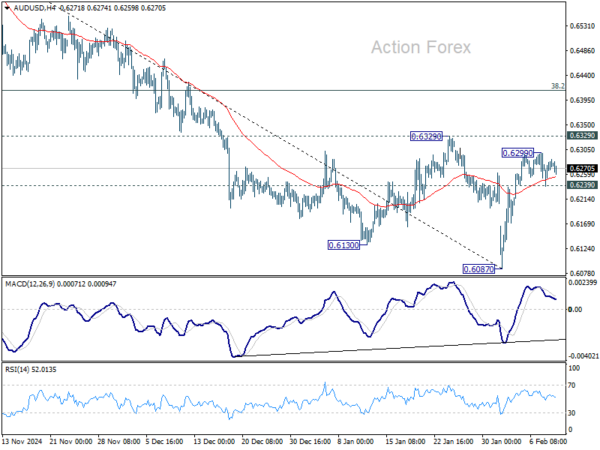

Daily Pivots: (S1) 0.6245; (P) 0.6267; (R1) 0.6299; More…

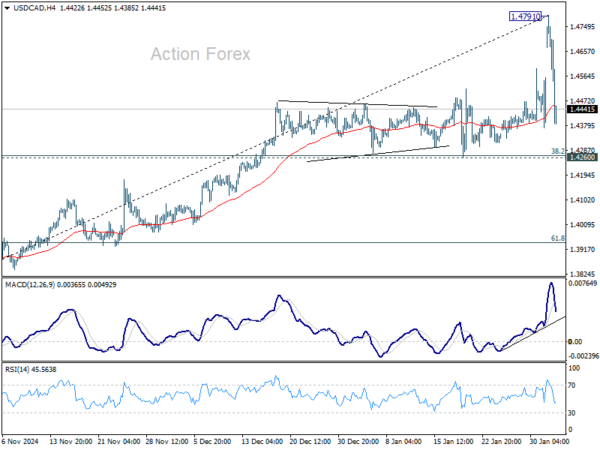

AUD/USD is bounded in sideway trading in tight range and intraday bias remains neutral. With 0.6329 resistance intact, outlook will stay bearish. On the downside, break of 0.6239 minor support will turn bias back to the downside for retesting 0.6087 low. However, firm break of 0.6329 will bring stronger rebound to 38.2% retracement of 0.6941 to 0.6087 at 0.6413, even just as a corrective move.

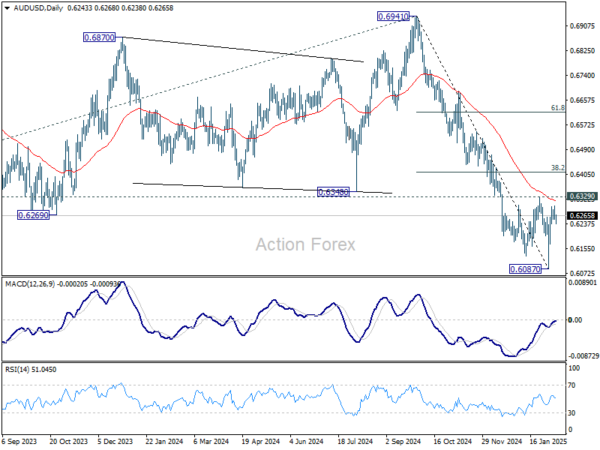

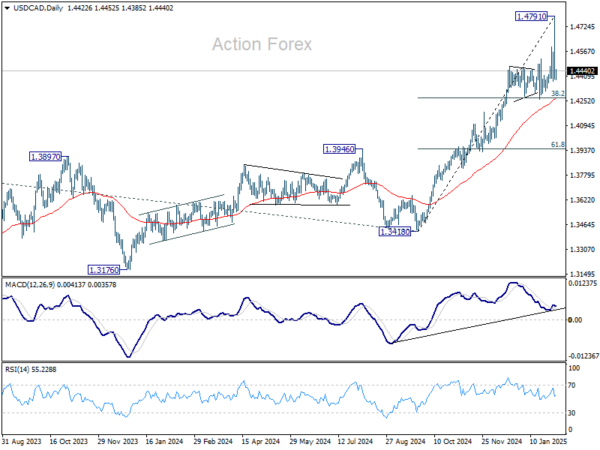

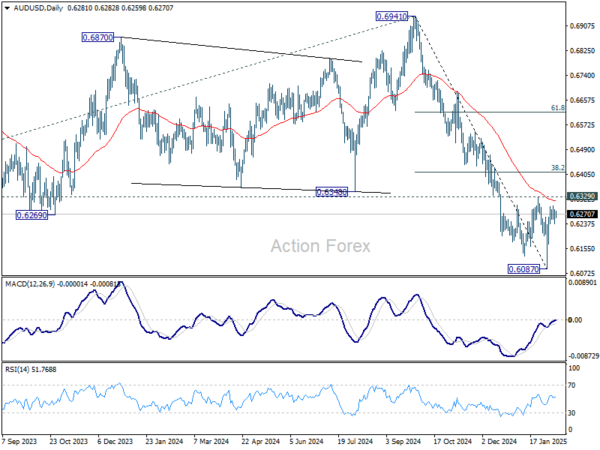

In the bigger picture, fall from 0.6941 (2024 high) is seen as part of the down trend from 0.8006 (2021 high). Next medium term target is 61.8% projection of 0.8006 to 0.6169 from 0.6941 at 0.5806. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.6516) holds.

Looking ahead, markets will keep a close watch on Fed Chair Jerome Powell’s upcoming Congressional testimonies, particularly any remarks concerning inflation and labor market conditions. Major data releases this week include US CPI, UK GDP, Swiss CPI, and key confidence reports from Australia and New Zealand.

Looking ahead, markets will keep a close watch on Fed Chair Jerome Powell’s upcoming Congressional testimonies, particularly any remarks concerning inflation and labor market conditions. Major data releases this week include US CPI, UK GDP, Swiss CPI, and key confidence reports from Australia and New Zealand.