Investor sentiment in Europe is exceptionally upbeat today, with German stocks leading the rally as DAX surges over 3%, breaking above the 23k mark. Euro also rallies across the board with solid momentum, with help from rise in Germany’s benchmark yield, the overall positive sentiment, as well as a struggling Dollar.

The boost to European sentiment was driven by the announcement that Germany’s two biggest parties, CDU/CSU and SPD, have agreed to overhaul borrowing rules to expand defense and infrastructure spending. More importantly, they are accelerating these investment plans rather than waiting out a lengthy coalition-building process. This commitment to boosting government spending is seen as a significant stimulus for the German economy, which has been struggling with recession.

The prospect of higher public investment in Europe stands in stark contrast to the growing uncertainty surrounding the US economy. The latest ADP jobs report significantly missed expectations. The report cited policy uncertainty and slowing consumer spending as key factors behind the hiring slowdown. Focuses are now on Friday’s non-farm payrolls report, which could further cement concerns over a softening U.S. labor market.

At the same time, the tariff situation remains highly fluid, with reports indicating that the Trump administration is considering exemptions for Canadian and Mexican products that comply with USMCA trade rules. However, no official confirmation has been made, leaving uncertainty over trade policy still hanging over the markets.

In the currency markets, Euro is leading the pack as the strongest performer of the day, followed by Japanese Yen and New Zealand Dollar. Dollar remains the weakest, with Canadian Dollar also underperforming, followed by Swiss Franc. British Pound and Australian Dollar are positioned in the middle of the pack.

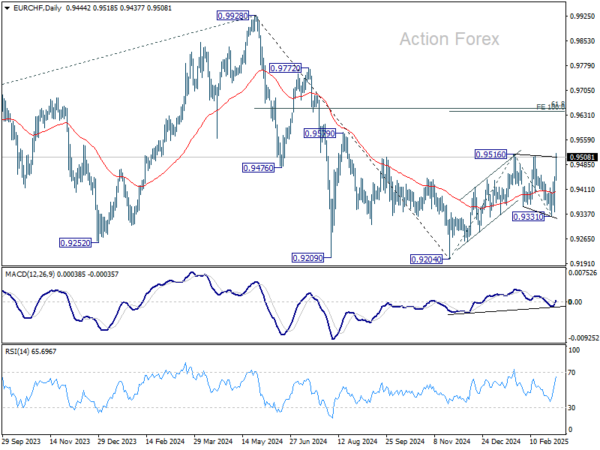

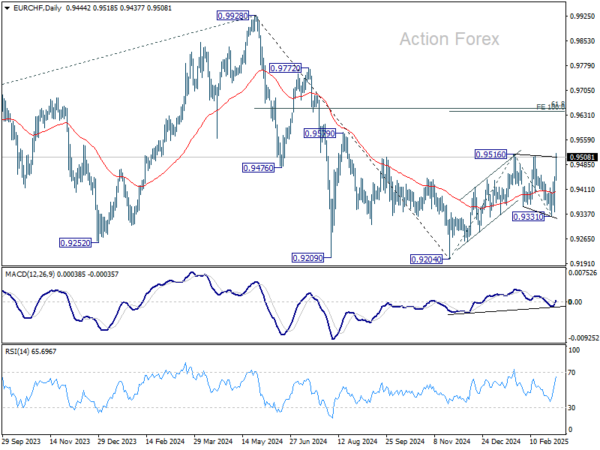

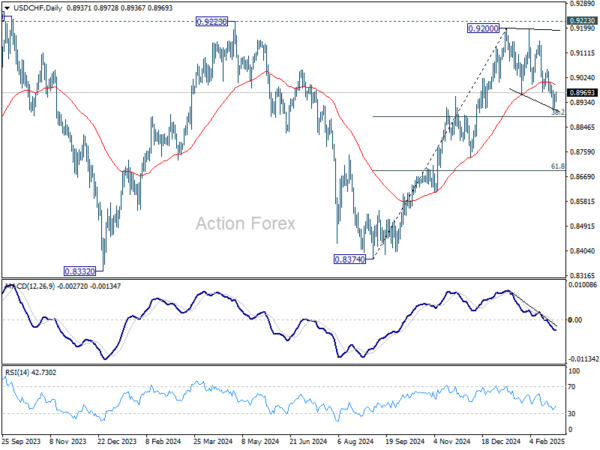

Technically, an immediate focus is on 0.9516 resistance in EUR/CHF. Firm break above this level would confirm resumption of rebound from 0.9204. More significantly, it would also strengthen the case that the downtrend from 0.9928 (2024 high) is reversing. In this case, EUR/CHF should target 100% projection of 0.8204 to 0.9516 from 0.9331 at 0.9643 next.

In Europe, at the time of writing, FTSE is up 0.37%. DAX is up 3.42%. CAC is up 2.05%. UK 10-year yield is up 0.118 at 4.619. Germany 10-year yield is up 0.219 at 2.713. Earlier in Asia, Nikkei rose 0.23%. Hong Kong HSI rose 2.84%. China Shanghai SSE rose 0.53%. Singapore Strait Times rose 0.20%. Japan 10-year JGB yield rose 0.020 to 1.446.

US ADP jobs grow only 77, hiring slowdown

US private sector employment growth slowed sharply in February, with ADP reporting an increase of just 77k jobs, far below market expectations of 140k.

The breakdown showed that goods-producing sectors contributed 42k jobs, while service-providing sectors added only 36k. By company size, small businesses shed -12k jobs, while medium-sized firms led hiring with a 46k gain, followed by large businesses with a 37k increase.

Wage growth showed little change, with job-changers seeing annual pay gains slow slightly from 6.8% to 6.7%, while job-stayers remained steady at 4.7%.

ADP’s chief economist Nela Richardson attributed the hiring slowdown to “policy uncertainty and a slowdown in consumer spending,” which may have prompted layoffs or cautious hiring.

Eurozone PPI up 0.8% mom 1.8% yoy in Jan, above expectations.

Eurozone producer prices rose sharply by 0.8% mom and 1.8% yoy in January, exceeding expectations of 0.3% mom and 1.4% yoy, respectively.

The monthly increase in Eurozone PPI was primarily driven by a 1.7% mom jump in energy prices, while capital goods and durable consumer goods also saw notable gains of 0.7% mom and 0.6%, respectively. Intermediate goods prices edged up by 0.3% mom, while non-durable consumer goods saw a modest 0.2% mom rise.

The broader EU also recorded a 0.8% mom, 1.8% yoy in producer prices. Among individual member states, Ireland saw the largest monthly price jump at 6.2%, followed by Bulgaria (+5.4%) and Sweden (+2.3%).

However, not all countries experienced inflationary pressures, as Portugal (-2.2%), Austria (-0.6%), Slovenia (-0.5%), and Cyprus (-0.3%) registered price declines.

Eurozone PMI composite finalized at 50.2, barely grow for two months

Eurozone economy showed little momentum in February, with PMI Services finalizing at 50.6, down from 51.3 in January, while PMI Composite was unchanged at 50.2.

The picture was mixed across the region with Spain, Ireland, and Italy showing signs of expansion, while Germany’s services sector slowed and France’s continued its sharp contraction, posting its lowest reading in 13 months at 45.1.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that services growth is barely offsetting the prolonged slump in manufacturing. He pointed to rising input costs, particularly wage pressures, as a growing concern for ECB.

Political uncertainty in key economies is also weighing on sentiment. France’s services sector is deteriorating at a much faster pace, likely influenced by unresolved political instability. In contrast, Germany’s services sector, though slowing, remains in expansion, with hopes that post-election stability could support economic recovery.

However, with external risks from trade tensions and weak consumer spending, a decisive rebound in Eurozone remains uncertain.

UK PMI services finalized at 51, stagflation risks grow

The UK services sector showed little improvement in February, with PMI Services finalized at 51.0, slightly up from January’s 50.8 but still well below its long-run average of 54.3. Meanwhile, PMI Composite edged lower from 50.6 to 50.5, signaling stagnant overall economic activity as demand conditions continue to weaken both domestically and in export markets.

Tim Moore, Economics Director at S&P Global Market Intelligence, warned of “elevated risk of stagflation on the horizon”. New orders falling at their sharpest rate in over two years. Rising payroll costs and economic uncertainty have eroded business confidence, bringing sentiment to its lowest level since December 2022.

Concerns over slowing growth and persistent inflation pressures have also led to continued job losses, with employment in the services sector contracting for a fifth straight month—the longest period of decline outside of the pandemic since early 2011.

Swiss annual CPI ticks down to 0.3% yoy, remains weak

Swiss inflation accelerated on a monthly basis in February, with CPI rising 0.6% mom, slightly above the expected 0.5%. Core CPI, which excludes fresh and seasonal products, energy, and fuel, increased by 0.7% mom. The rise was driven by both domestic and imported product prices, which climbed 0.5% mom and 0.9% mom, respectively.

However, the broader inflation trend remains subdued. On a year-over-year basis, headline CPI slowed to 0.3% yoy from 0.4% yoy, though it was still slightly above expectations of 0.2% yoy. Core CPI remained steady at 0.9% yoy. While domestic product price inflation eased from 1.0% yoy to 0.9% yoy, imported prices continued to contract, staying at -1.5% yoy.

BoJ’s Uchida: Interest rate to gradually approach neutral by late FY 2025 to FY 2026

BoJ Deputy Governor Shinichi Uchida reinforced today that interest rates will continue to rise if the bank’s economic projections hold. He highlighted in a speech that BoJ expects inflation to stabilize around the 2% target in the second half of fiscal 2025 to fiscal 2026, with “effects of the cost-push wane” while underlying inflation strengthens with wages growth.

“The policy interest rate at that time is considered to approach an interest rate level that is neutral to economic activity and prices,” he added.

However, Uchida acknowledged that determining the “neutral” interest rate level remains uncertain. While in theory, it should be around 2% plus Japan’s natural rate of interest, estimates for the latter vary significantly from -1% to +0.5%.

Given this wide range and estimation errors, BoJ will avoid relying solely on theoretical models and instead “examine the response of economic activity and prices as it raises the policy interest rate”

Japan’s PMI service finalized at 53.7, sector strengthens but confidence wanes on labor shortages and trade risks

Japan’s PMI Services was finalized at 53.7 in February, up from January’s 53.0, marking a six-month high. PMI Composite also improved from 51.1 to 52.0, the strongest reading since September 2024.

According to Usamah Bhatti, Economist at S&P Global Market Intelligence, service sector businesses saw higher sales volumes, with export demand contributing to the expansion. Meanwhile, the broader private sector recorded its steepest rise in activity in five months, supported by a milder contraction in manufacturing.

Despite the growth, overall business confidence showed signs of softening. Bhatti noted Firms expressed concerns over labor shortages and uncertainty stemming from US trade policies, leading to the weakest sentiment since January 2021.

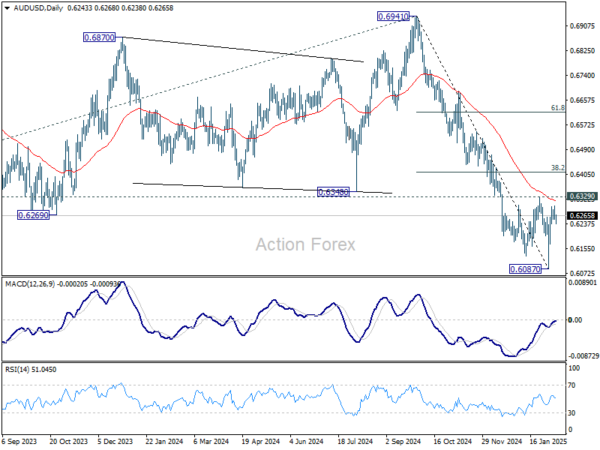

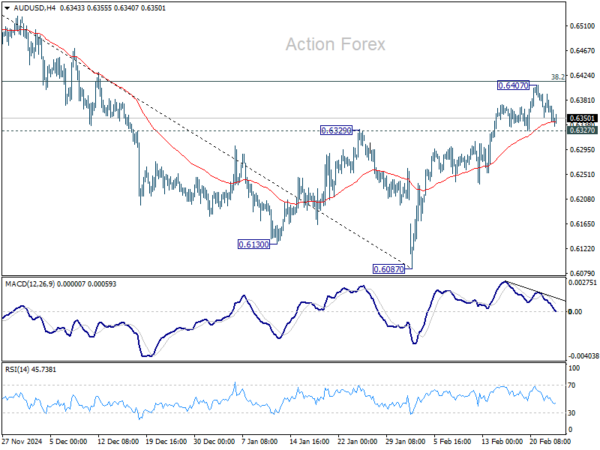

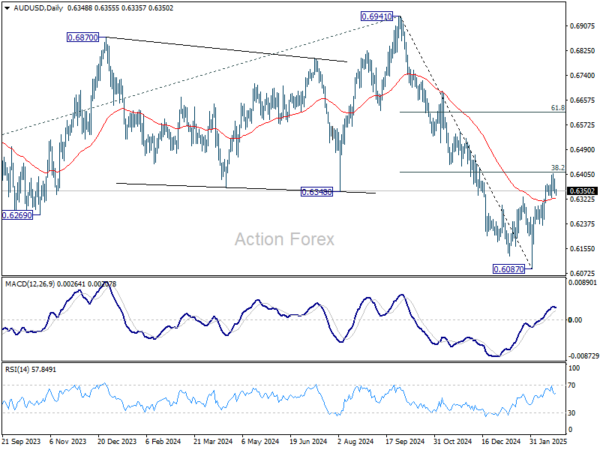

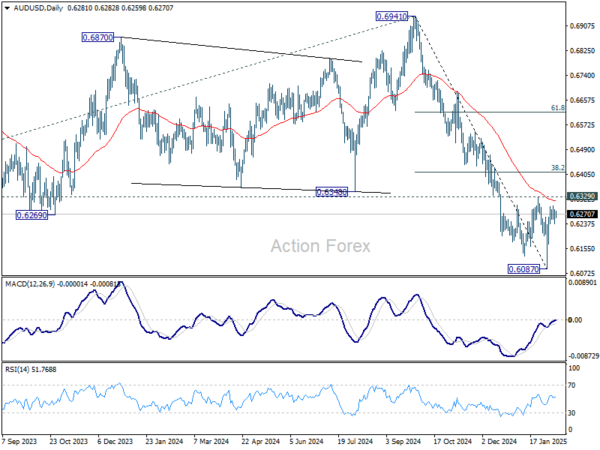

RBA’s Hauser: Uncertain on further easing disputes market’s rate-cut outlook

RBA Deputy Governor Andrew Hauser emphasized in a speech today that monetary policy is set to ensure inflation returns to the midpoint of the target range, which is crucial for maintaining price stability over the long run.

He justified the February rate cut, stating that it “reduces the risks of inflation undershooting that midpoint.”

However, Hauser pushed back against market expectations of a sustained easing cycle, saying the “Board does not currently share the market’s confidence that a sequence of further cuts will be required”.

While Hauser acknowledged that interest rates will go where they need to go to balance inflation control with full employment, he made it clear that progress so far does not warrant complacency.

He stressed that RBA will continue to assess economic developments on a “meeting by meeting” basis.

Australia’s GDP grows 0.6% qoq in Q4, ending per capita contraction streak

Australia’s GDP grew by 0.6% qoq in Q4, exceeding expectations of 0.5% qoq, while annual growth stood at 1.3% yoy. A key highlight was the 0.1% qoq per capita GDP growth, marking the first increase after seven consecutive quarters of contraction.

According to Katherine Keenan, head of national accounts at the ABS, “Modest growth was seen broadly across the economy this quarter.” She noted that both public and private spending contributed positively, alongside a rise in exports of goods and services.

China’s Caixin PMI services rises to 5.14, but uncertainties rising in employment and income

China’s Caixin Services PMI climbed to 51.4 in February, up from 51.0, beating market expectations of 50.8. Composite PMI also improved slightly to 51.5, signaling steady expansion across both manufacturing and services for the 16th consecutive month.

According to Wang Zhe, Senior Economist at Caixin Insight Group, supply and demand showed improvement in both sectors, supported by robust consumption during the Chinese New Year holiday and technological innovations in select industries. However, “employment saw a slight contraction”, mainly due to weakness in the manufacturing sector.

Concerns remain over China’s broader economic recovery. Wang noted that overall price levels “remained subdued”, with declining sales prices in both manufacturing and services. “Rising uncertainties in employment and household income constraining efforts to boost domestic demand and stabilize the economy,” he added.

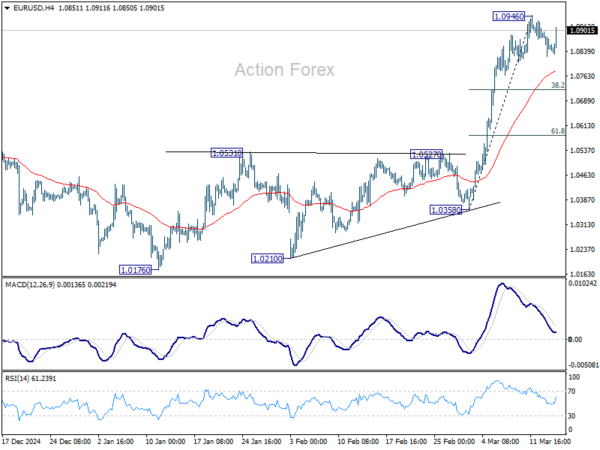

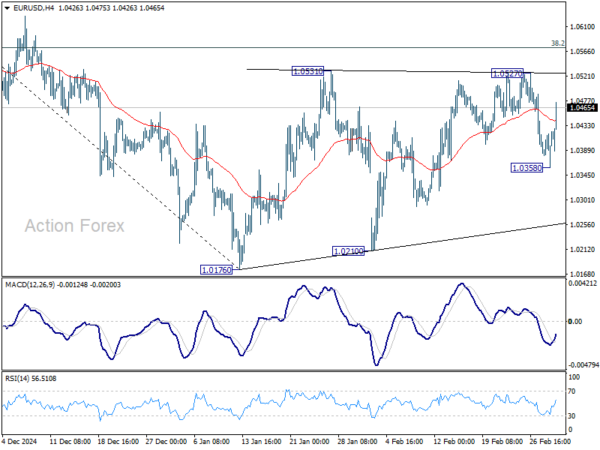

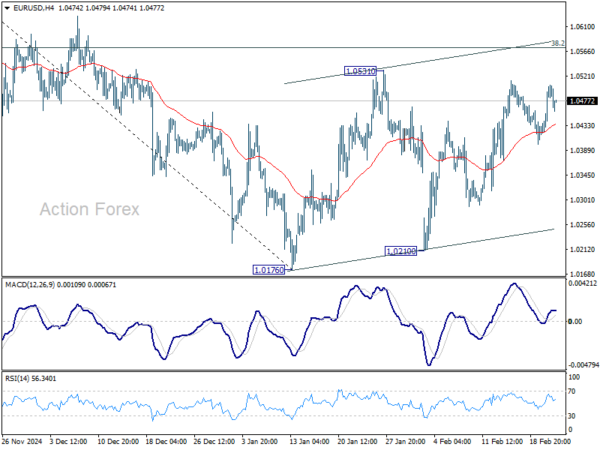

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0522; (P) 1.0575; (R1) 1.0679; More…

EUR/USD accelerates further higher today and met 100% projection of 1.0176 to 1.0531 from 1.0358 at 1.0173 already. There is no sign of topping yet. Intraday bias stays on the upside for 161.8% projection at 1.0932 next. On the downside, below 1.0636 minor support will turn intraday bias neutral again first.

In the bigger picture, the strong rebound from 61.8 retracement of 0.9534 (2022 low) to 1.1274 (2024 high) at 1.0199 argues that fall from 1.1274 might be a correction only. Sustained trading above 55 W EMA (now at 1.0668) should indicate that this correction has already completed with three waves down to 1.0176. Rise from 0.9534 (2022 low) might then be ready to resume through 1.1274. Nevertheless, rejection by 55 W EMA would keep outlook bearish for another fall through 1.0176 at a later stage.

Economic Indicators Update

| GMT |

CCY |

EVENTS |

ACT |

F/C |

PP |

REV |

| 00:30 |

AUD |

GDP Q/Q Q4 |

0.60% |

0.50% |

0.30% |

|

| 00:30 |

JPY |

Services PMI Feb F |

53.7 |

53.1 |

53.1 |

|

| 01:45 |

CNY |

Caixin Services PMI Feb |

51.4 |

50.8 |

51 |

|

| 07:30 |

CHF |

CPI M/M Feb |

0.60% |

0.50% |

-0.10% |

|

| 07:30 |

CHF |

CPI Y/Y Feb |

0.30% |

0.20% |

0.40% |

|

| 08:50 |

EUR |

France Services PMI Feb F |

45.3 |

44.5 |

44.5 |

|

| 08:55 |

EUR |

Germany Services PMI Feb F |

51.1 |

52.2 |

52.2 |

|

| 09:00 |

EUR |

Eurozone Services PMI Feb F |

50.6 |

50.7 |

50.7 |

|

| 09:30 |

GBP |

Services PMI Feb F |

51 |

51.1 |

51.1 |

|

| 10:00 |

EUR |

Eurozone PPI M/M Jan |

0.80% |

0.30% |

0.40% |

0.50% |

| 10:00 |

EUR |

Eurozone PPI Y/Y Jan |

1.80% |

1.40% |

0% |

0.10% |

| 13:15 |

USD |

ADP Employment Change Feb |

77K |

140K |

183K |

186K |

| 13:30 |

CAD |

Labor Productivity Q/Q Q4 |

0.60% |

0.30% |

-0.40% |

0.10% |

| 14:45 |

USD |

Services PMI Feb F |

|

49.7 |

49.7 |

|

| 15:00 |

USD |

ISM Services PMI Feb |

|

53 |

52.8 |

|

| 15:00 |

USD |

Factory Orders M/M Jan |

|

1.50% |

-0.90% |

|

| 15:30 |

USD |

Crude Oil Inventories |

|

0.6M |

-2.3M |

|

| 19:00 |

USD |

Fed’s Beige Book |

|

|

|

|

Looking ahead, markets will keep a close watch on Fed Chair Jerome Powell’s upcoming Congressional testimonies, particularly any remarks concerning inflation and labor market conditions. Major data releases this week include US CPI, UK GDP, Swiss CPI, and key confidence reports from Australia and New Zealand.

Looking ahead, markets will keep a close watch on Fed Chair Jerome Powell’s upcoming Congressional testimonies, particularly any remarks concerning inflation and labor market conditions. Major data releases this week include US CPI, UK GDP, Swiss CPI, and key confidence reports from Australia and New Zealand.