- The USD/CAD forecast shows a weaker dollar.

- Data in the previous session revealed softer-than-expected US consumer inflation.

- The Bank of Canada cut interest rates by 25-bps on Wednesday, as expected.

The USD/CAD forecast shows increased bearish momentum after downbeat US inflation data. At the same time, the Canadian dollar strengthened after a cautious tone during the BoC policy meeting. Moreover, support came from reports of Canada’s counter-tariffs on Trump’s steel and aluminum duties.

Data in the previous session revealed softer-than-expected consumer inflation in the US in February. The CPI increased by 0.2%, a significant drop from the previous reading of 0.5%. Moreover, it was smaller than the forecast of 0.3%. Meanwhile, the annual figure increased by 2.8%, missing estimates of 2.9%.

The downbeat numbers increase pressure on the Fed to lower borrowing costs. A slowdown in the economy plus softer inflation is enough motivation for policymakers to cut interest rates. As a result, rate cut expectations rose, hurting the dollar.

Meanwhile, the Bank of Canada cut interest rates by 25-bps on Wednesday, as expected. However, the governor said the central bank would proceed with caution due to the uncertainty regarding Trump’s tariffs. Consequently, the loonie gained.

Elsewhere, Trump’s tariff on steel and aluminum imports ignited a trade war with Canada and Europe. Canada is a major exporter of steel and aluminum to the US.

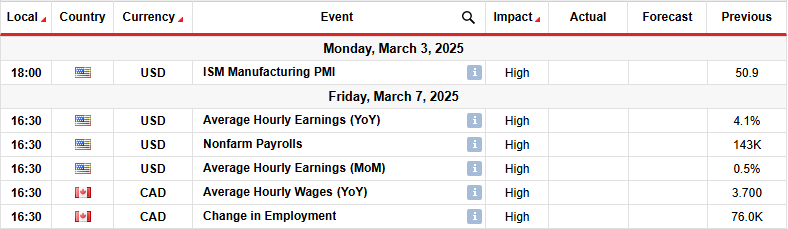

USD/CAD key events today

- US core PPI m/m

- US PPI m/m

- US unemployment claims

USD/CAD technical forecast: Oscillating in the 1.4301-1.4501 range

On the technical side, the USD/CAD price is oscillating between the 1.4301 support and the 1.4501 resistance levels. Bears and bulls are battling for control, with each showing strength in this range area.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Currently, the price trades in the middle of the range. It has broken below the SMA and the RSI has dropped below 50. This is a sign that bears are trying to retest the range support. However, bulls are threatening to push the price back above the SMA.

If bears maintain control, the price will soon reach the 1.4301 support level. A break below this level will indicate a bearish win, starting a downtrend. On the other hand, if the price goes back above the SMA, it will revisit the 1.4501 resistance. A break above this level will signal the start of a bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.