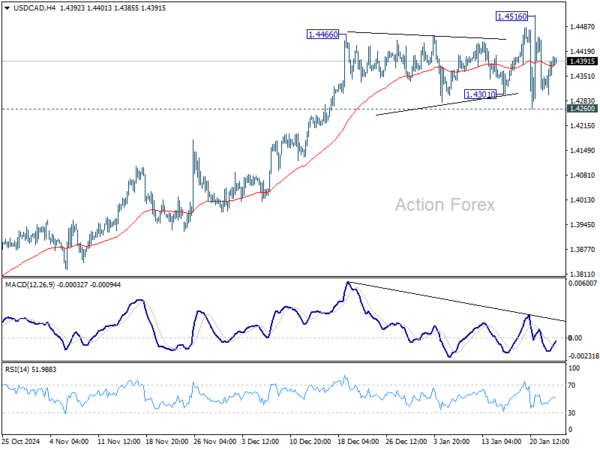

Forex markets remain largely subdued today, with Canadian Dollar being the exception as volatility rises ahead of the implementation of US tariffs tomorrow. Canada is reportedly well prepared to respond with retaliatory measures on US imports worth up to CAD 150B. This comes at a time when Canada’s economy is already under pressure, with November’s GDP data showing a larger-than-expected contraction. However, despite the looming economic strain, Loonie’s selloff remains contained for now, as traders assess the full impact of trade retaliation.

Meanwhile, Dollar shrugged off the latest PCE inflation data, which showed an uptick in the headline rate while core inflation remained at elevated levels. Fed Governor Michelle Bowman noted at an event that while rate cuts are still expected, their timing will depend on incoming data, given persistent inflation risks. The latest data reinforces Fed’s cautious approach, suggesting that policymakers are unlikely to act at least until Q2.

For the week, the broader currency market picture remains unchanged. Yen continues to lead as the strongest performer, followed by Dollar and Swiss Franc. Aussie remains the weakest, followed by Kiwi and Euro. British Pound and Loonie sit in the middle.

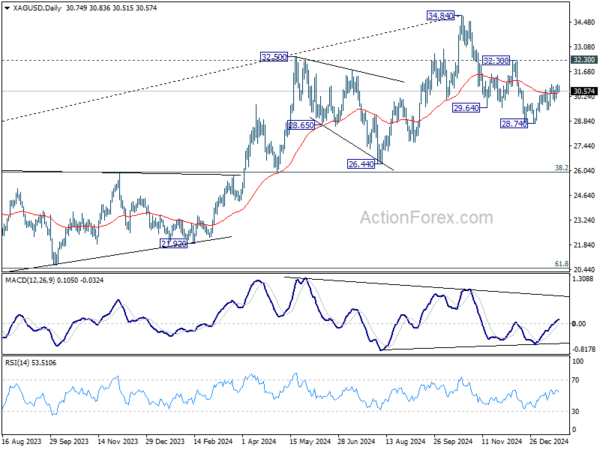

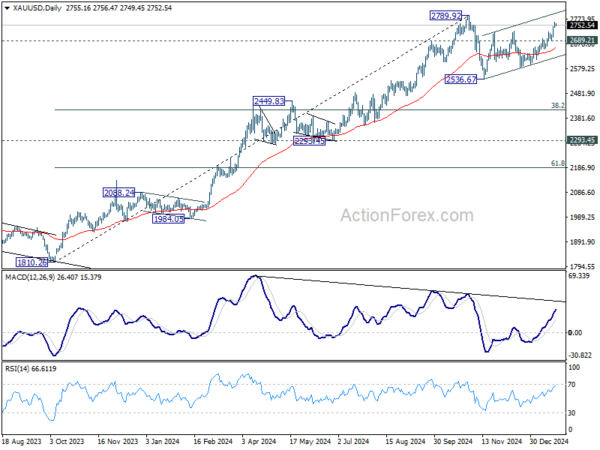

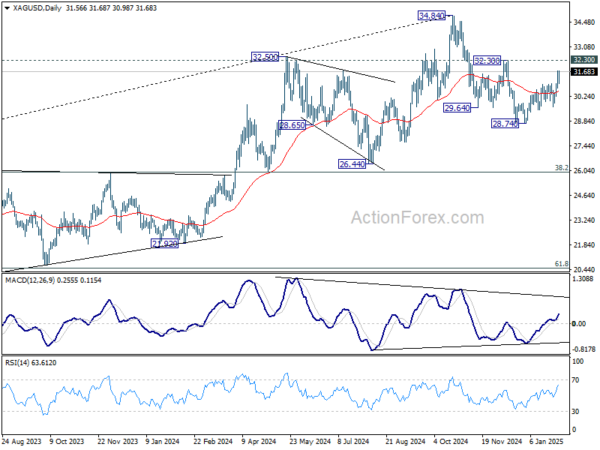

Technically, as Gold is extending its record run, Silver is also picking up momentum. Immediate focus is now on 32.30 resistance in Silver. Firm break there should confirm that corrective fall from 34.84 has completed with three waves down to 28.74. While it may be early to confirm larger up trend resumption, in this case, further rally should at least be seen to retest 34.84 high.

US PCE inflation rises to 2.6% in Dec, core PCE unchanged at 2.8%

In December in the US, headline PCE price index rose 0.3% mom while core PCE price index rose 0.2% mom, both matched expectations.

In the 12-month period, PCE price index accelerated from 2.4% yoy to 2.6% yoy. Core PCE price index (Excluding food and energy) was unchanged at 2.8% yoy. Both matched expectations.

Personal income rose 0.4% mom or USD 92.0B, matched expectations. Personal spending rose 0.7% mom or USD 133.6B, stronger than expected 0.5% mom.

Canada’s GDP contracts -0.2% mom in Nov, but Dec outlook improves

Canada’s economy shrank by -0.2% mom in November, marking the largest contraction since December 2023 and coming in weaker than expectations of -0.1% mom decline. The downturn was broad-based, with 13 of 20 sectors reporting declines, underscoring underlying weakness across multiple industries.

Goods-producing industries led the slowdown, contracting by -0.6% after a strong 0.9% expansion in October. Services sector, which had posted steady gains in previous months, also slipped by -0.1%, marking its first decline in six months.

Advance estimates suggest that real GDP expanded by 0.2% mom in December, pointing to a rebound. Growth was driven by gains in retail trade, manufacturing, and construction, though this was partially offset by weakness in transportation, real estate, and wholesale trade.

Tokyo inflation accelerates, keeping BoJ hikes alive

Japan’s inflationary pressures picked up in January, with Tokyo’s core CPI (excluding fresh food) rising to 2.5% yoy from 2.4%, marking its fastest pace in nearly a year. Core-core measure (excluding food and energy) also edged higher to 1.9% from 1.8%. Meanwhile, headline CPI surged to 3.4% from 3.0%, its highest level in nearly two years, largely driven by rising prices for vegetables and rice.

The data reinforces expectations that inflation in Japan could continue rising toward 3% in the coming months, as persistently weak yen drives up import costs. Some analysts see room for one or two more rate hikes by BoJ this year, particularly if inflation remains sticky and real wage growth improves. However, with Tokyo services inflation slowing to 0.6% yoy from 1.0% yoy, concerns remain about the sustainability of domestic price pressures.

On the production side, industrial output rose 0.3% mom in December, matching forecasts. The Ministry of Economy retained its cautious assessment, stating that production “fluctuates indecisively,” though manufacturers expect a 1.0% rise in January and a further 1.2% increase in February.

Retail sales, however, showed resilience, climbing 3.7% yoy, exceeding expectations of 2.9%. This suggests that consumer demand remains strong despite higher living costs.

BoJ’s Ueda reaffirms support for economy while keeping rate hikes on the table

BoJ Governor Kazuo Ueda reiterated the central bank’s is aiming for “gradual pickup” in prices, supported by a “solid increase in wages.” He emphasized that maintaining easy monetary conditions remains necessary to “support economic activity” and ensure that underlying inflation continues rising toward the 2% target.

However, he also made it clear that BoJ’s stance remains unchanged, noting that it will “continue raising interest rates” and adjust monetary support if the economy and prices “move in line with our forecasts.”

At the same parliamentary session, Prime Minister Shigeru reinforced the government’s priority of achieving sustainable inflation alongside wage growth. He highlighted that while stable price increases are important, “we must aim for wage growth higher than inflation while prices rise stably.” He also warned against the perception that falling prices are beneficial, arguing that such views prolonged Japan’s deflationary struggles in the past.

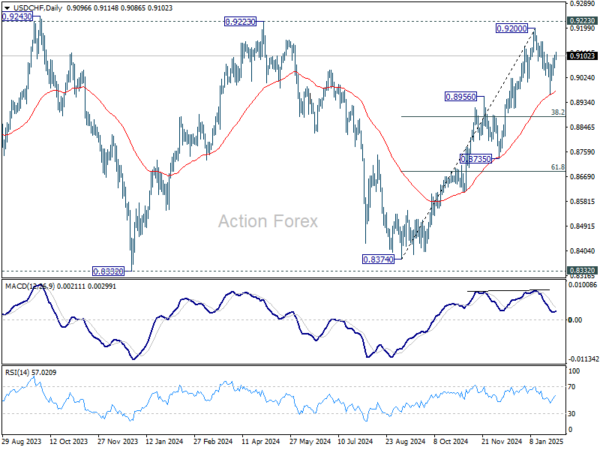

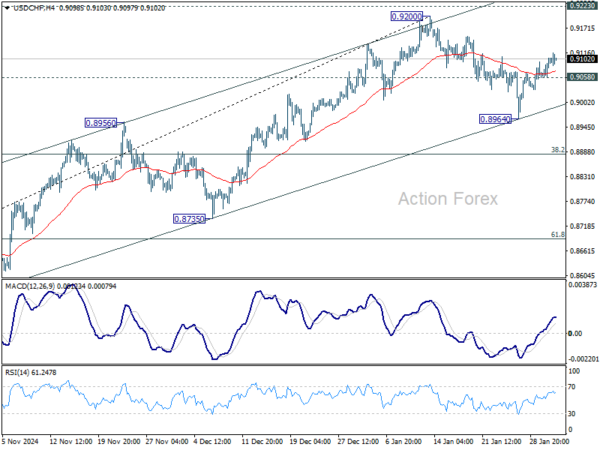

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9069; (P) 0.9087; (R1) 0.9114; More…

Intraday bias in USD/CHF stays mildly on the upside for the moment. Correction from 0.9200 could have completed at 0.8964 already. Further rise should be seen to retest 0.9200 and then 0.9223 key resistance. On the downside, below 0.9058 minor support will turn intraday bias neutral first. Further break of 0.8964 will resume the fall from 0.9200 to 38.2% retracement of 0.8374 to 0.9200 at 0.8884 next.

In the bigger picture, as long as 0.9223 resistance holds, price actions from 0.8332 (2023 low) are seen as a medium term corrective pattern. That is, long term down trend is in favor to resume through 0.8332 at a later stage. However, sustained break of 0.9223 will be an important sign of bullish trend reversal.